| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926305000 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3916903000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

| 9403993080 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3926301000 | Doc | 44.0% | CN | US | 2025-05-12 |

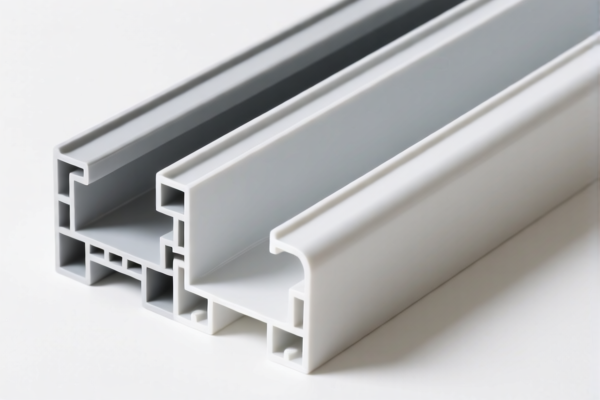

Here is the structured classification and tariff analysis for the product "Other plastic profile shapes for furniture accessories" based on the provided HS codes and tax details:

✅ HS CODE: 3926305000

Description: Other parts for furniture, vehicle bodies, or similar uses

Total Tax Rate: 42.8%

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specifically for other parts used in furniture or similar applications, which may include plastic profiles.

✅ HS CODE: 3916903000

Description: Plastic rods, wires, sticks, and profiles with cross-section over 1 mm, unprocessed

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to raw or unprocessed plastic profiles, which may not be suitable if your product is finished or processed for furniture use.

✅ HS CODE: 3917400095

Description: Plastic pipes, tubes, and fittings, including other fittings

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for plastic pipes and fittings, which may be relevant if your product is used as part of a plumbing or structural system in furniture.

✅ HS CODE: 9403993080

Description: Parts of rubber or plastic

Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general category for rubber or plastic parts, which may be applicable if your product is a component rather than a finished profile.

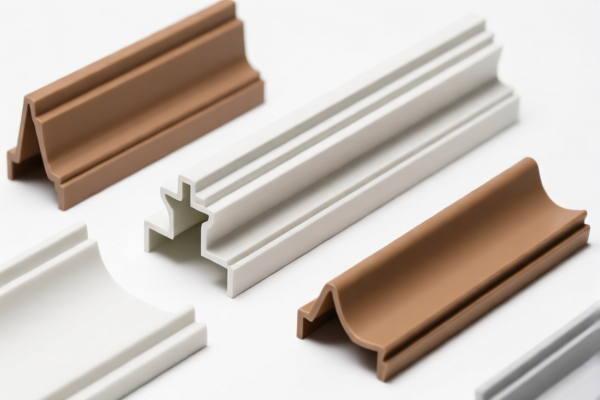

✅ HS CODE: 3926301000

Description: Handles and knobs for furniture, vehicle bodies, etc.

Total Tax Rate: 44.0%

- Base Tariff: 6.5%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for specific parts like handles and knobs, which may not cover general plastic profiles unless they are used as such.

📌 Proactive Advice:

- Verify the product's exact use: Is it a finished part (e.g., handle, knob) or a raw profile used in manufacturing?

- Check material composition: Ensure the product is plastic and not mixed with other materials (e.g., metal), which may change the classification.

- Confirm unit price and quantity: This will affect whether additional tariffs apply based on value thresholds.

- Check for certifications: Some products may require CE, RoHS, or other compliance certifications, especially for EU or international markets.

- Monitor April 11, 2025, deadline: The special tariff of 30% will apply after this date, so plan accordingly for import costs.

Let me know if you need help determining the most accurate HS code for your specific product. Here is the structured classification and tariff analysis for the product "Other plastic profile shapes for furniture accessories" based on the provided HS codes and tax details:

✅ HS CODE: 3926305000

Description: Other parts for furniture, vehicle bodies, or similar uses

Total Tax Rate: 42.8%

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specifically for other parts used in furniture or similar applications, which may include plastic profiles.

✅ HS CODE: 3916903000

Description: Plastic rods, wires, sticks, and profiles with cross-section over 1 mm, unprocessed

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to raw or unprocessed plastic profiles, which may not be suitable if your product is finished or processed for furniture use.

✅ HS CODE: 3917400095

Description: Plastic pipes, tubes, and fittings, including other fittings

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for plastic pipes and fittings, which may be relevant if your product is used as part of a plumbing or structural system in furniture.

✅ HS CODE: 9403993080

Description: Parts of rubber or plastic

Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general category for rubber or plastic parts, which may be applicable if your product is a component rather than a finished profile.

✅ HS CODE: 3926301000

Description: Handles and knobs for furniture, vehicle bodies, etc.

Total Tax Rate: 44.0%

- Base Tariff: 6.5%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for specific parts like handles and knobs, which may not cover general plastic profiles unless they are used as such.

📌 Proactive Advice:

- Verify the product's exact use: Is it a finished part (e.g., handle, knob) or a raw profile used in manufacturing?

- Check material composition: Ensure the product is plastic and not mixed with other materials (e.g., metal), which may change the classification.

- Confirm unit price and quantity: This will affect whether additional tariffs apply based on value thresholds.

- Check for certifications: Some products may require CE, RoHS, or other compliance certifications, especially for EU or international markets.

- Monitor April 11, 2025, deadline: The special tariff of 30% will apply after this date, so plan accordingly for import costs.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.