| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

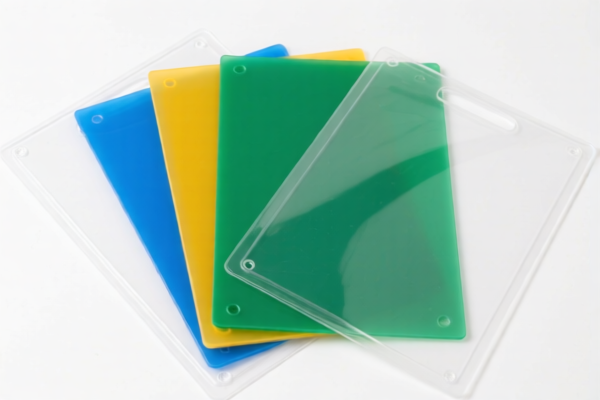

Here is the structured classification and tariff information for "Other plastic protective boards" based on the provided HS codes and tax details:

✅ HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils, and strips

Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable for this category

- Note: This is a lower tax rate compared to other HS codes for similar products.

✅ HS CODE: 3920995000

Description: Various plastic sheets

Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable

- Note: This is a high tax rate due to the additional 25% tariff.

✅ HS CODE: 3925900000

Description: Plastic building hardware products, or other unspecified plastic products

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable

- Note: This code is for more specialized or unspecified plastic products, with a high total tax rate.

✅ HS CODE: 3921904090

Description: Other plastic sheets, films, foils, and strips

Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable

- Note: Similar to 3921905050, but with a slightly lower base tariff.

📌 Proactive Advice for Users:

- Verify the exact product description and material composition to ensure the correct HS code is applied.

- Check the unit price to determine if the product falls under a different tariff category (e.g., based on value or thickness).

- Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- Be aware of the April 11, 2025, tariff increase (30.0%) which will apply to all listed codes. This could significantly impact your import costs.

- Consider consulting a customs broker or tax expert for complex or high-value shipments.

Let me know if you need help determining the most appropriate HS code for your specific product. Here is the structured classification and tariff information for "Other plastic protective boards" based on the provided HS codes and tax details:

✅ HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils, and strips

Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable for this category

- Note: This is a lower tax rate compared to other HS codes for similar products.

✅ HS CODE: 3920995000

Description: Various plastic sheets

Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable

- Note: This is a high tax rate due to the additional 25% tariff.

✅ HS CODE: 3925900000

Description: Plastic building hardware products, or other unspecified plastic products

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable

- Note: This code is for more specialized or unspecified plastic products, with a high total tax rate.

✅ HS CODE: 3921904090

Description: Other plastic sheets, films, foils, and strips

Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Anti-dumping duties: Not applicable

- Note: Similar to 3921905050, but with a slightly lower base tariff.

📌 Proactive Advice for Users:

- Verify the exact product description and material composition to ensure the correct HS code is applied.

- Check the unit price to determine if the product falls under a different tariff category (e.g., based on value or thickness).

- Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- Be aware of the April 11, 2025, tariff increase (30.0%) which will apply to all listed codes. This could significantly impact your import costs.

- Consider consulting a customs broker or tax expert for complex or high-value shipments.

Let me know if you need help determining the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.