Found 4 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921190090 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921135000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921110000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

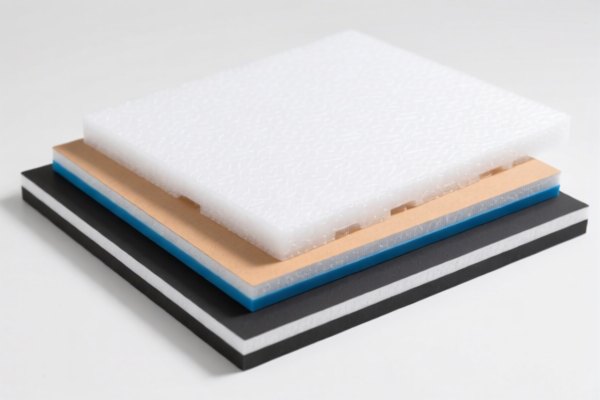

Product Classification: Other Plastic Rigid Foam Boards

HS CODE: 3921190090

🔍 Classification Summary

- Product: Other plastic rigid foam boards (not specifically categorized under other more specific HS codes like polyurethane or PVC).

- HS CODE: 3921190090

- Description: Other plates, sheets, film, foil, and strip of plastics (excluding more specific categories like polystyrene, PVC, or polyurethane).

📊 Tariff Breakdown

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after this date. Ensure your import timeline is planned accordingly.

- No Anti-Dumping Duties Listed: No specific anti-dumping duties are mentioned for this product category.

- No Specific Tariff for Iron or Aluminum: This product is plastic-based, so iron or aluminum-related duties do not apply.

📌 Proactive Advice for Importers

- Verify Material Composition: Confirm that the product is not classified under more specific HS codes (e.g., 3921135000 for polyurethane or 3921125000 for PVC).

- Check Unit Price and Certification: Ensure that the product meets any required certifications (e.g., REACH, RoHS, or other local regulations).

- Monitor Tariff Updates: Stay informed about any changes in tariff rates, especially after April 11, 2025.

- Consult Customs Broker: For complex classifications or large shipments, consider engaging a customs broker for accurate compliance.

Let me know if you need help with a specific product description or customs documentation!

Product Classification: Other Plastic Rigid Foam Boards

HS CODE: 3921190090

🔍 Classification Summary

- Product: Other plastic rigid foam boards (not specifically categorized under other more specific HS codes like polyurethane or PVC).

- HS CODE: 3921190090

- Description: Other plates, sheets, film, foil, and strip of plastics (excluding more specific categories like polystyrene, PVC, or polyurethane).

📊 Tariff Breakdown

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after this date. Ensure your import timeline is planned accordingly.

- No Anti-Dumping Duties Listed: No specific anti-dumping duties are mentioned for this product category.

- No Specific Tariff for Iron or Aluminum: This product is plastic-based, so iron or aluminum-related duties do not apply.

📌 Proactive Advice for Importers

- Verify Material Composition: Confirm that the product is not classified under more specific HS codes (e.g., 3921135000 for polyurethane or 3921125000 for PVC).

- Check Unit Price and Certification: Ensure that the product meets any required certifications (e.g., REACH, RoHS, or other local regulations).

- Monitor Tariff Updates: Stay informed about any changes in tariff rates, especially after April 11, 2025.

- Consult Customs Broker: For complex classifications or large shipments, consider engaging a customs broker for accurate compliance.

Let me know if you need help with a specific product description or customs documentation!

Customer Reviews

No reviews yet.