| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919102040 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919905060 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919102055 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919905040 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919102040 | Doc | 60.8% | CN | US | 2025-05-12 |

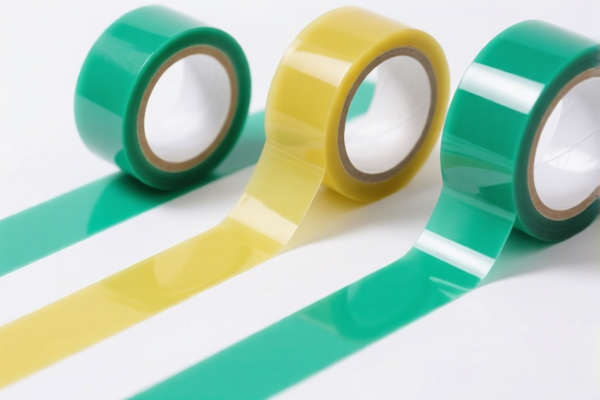

Product Name: Other plastic self adhesive PET tape

Classification: HS Code (Harmonized System Code) for plastic self-adhesive tapes

✅ HS CODES & TAX DETAILS (as of current data):

- HS CODE: 3919102040

- Description: Applicable for non-specialized self-adhesive plastic tape

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3919905060

- Description: Applicable for plastic self-adhesive tape material

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3919102055

- Description: Applicable for plastic self-adhesive roll tape

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3919905040

- Description: Applicable for transparent plastic self-adhesive tape

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3919102040 (repeated)

- Description: Applicable for general-purpose plastic self-adhesive tape

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning and customs declarations. -

No Anti-Dumping Duties Mentioned:

As of now, there are no specific anti-dumping duties reported for this product category (plastic self-adhesive tape), but this may change depending on trade policies.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed made of PET (polyethylene terephthalate) and not another type of plastic, as this can affect classification.

- Check Unit Price and Packaging: Customs may require detailed product specifications, including thickness, width, and packaging type.

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are needed for the product in the destination country.

- Consult Local Customs Authority: For the most up-to-date HS code and tariff information, always cross-check with local customs or a qualified customs broker.

Let me know if you need help with HS code verification or customs documentation!

Product Name: Other plastic self adhesive PET tape

Classification: HS Code (Harmonized System Code) for plastic self-adhesive tapes

✅ HS CODES & TAX DETAILS (as of current data):

- HS CODE: 3919102040

- Description: Applicable for non-specialized self-adhesive plastic tape

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3919905060

- Description: Applicable for plastic self-adhesive tape material

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3919102055

- Description: Applicable for plastic self-adhesive roll tape

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3919905040

- Description: Applicable for transparent plastic self-adhesive tape

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3919102040 (repeated)

- Description: Applicable for general-purpose plastic self-adhesive tape

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning and customs declarations. -

No Anti-Dumping Duties Mentioned:

As of now, there are no specific anti-dumping duties reported for this product category (plastic self-adhesive tape), but this may change depending on trade policies.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed made of PET (polyethylene terephthalate) and not another type of plastic, as this can affect classification.

- Check Unit Price and Packaging: Customs may require detailed product specifications, including thickness, width, and packaging type.

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are needed for the product in the destination country.

- Consult Local Customs Authority: For the most up-to-date HS code and tariff information, always cross-check with local customs or a qualified customs broker.

Let me know if you need help with HS code verification or customs documentation!

Customer Reviews

No reviews yet.