| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919905060 | Doc | 60.8% | CN | US | 2025-05-12 |

| 8532250060 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3919102055 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919101050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

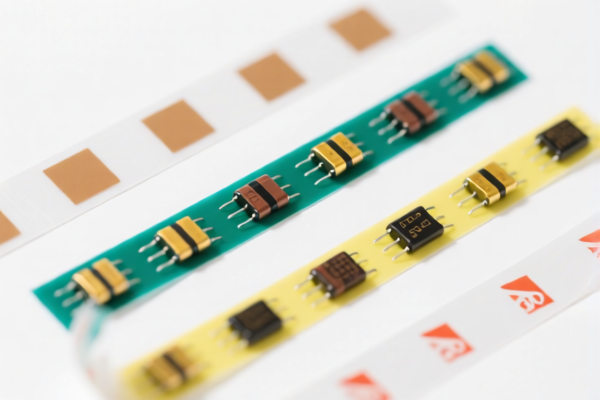

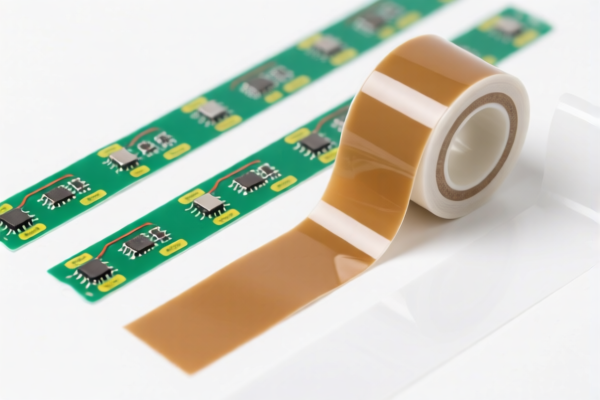

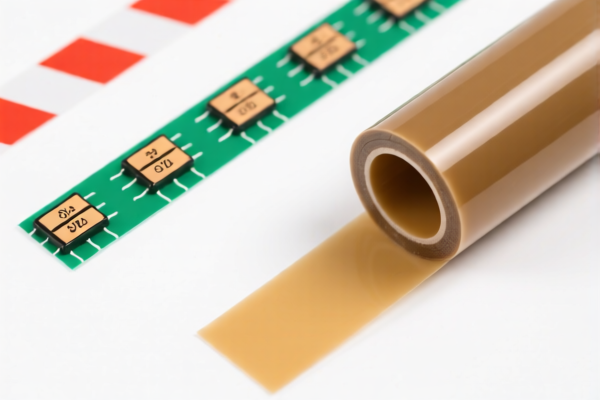

Product Classification: Other Plastic Self-Adhesive Capacitor Film

Based on your declaration, the product is a plastic self-adhesive capacitor film, which is a type of plastic film used in electronic components. Below is the detailed classification and tariff information for the relevant HS codes.

✅ HS CODE: 3919905060

Description: Plastic self-adhesive films, foils, sheets, etc.

Total Tax Rate: 60.8%

Breakdown of Tariff Rates:

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

- April 11 Special Tariff: Applies after April 11, 2025 (30.0% increase)

✅ HS CODE: 8532250060

Description: Self-healing plastic dielectric capacitors, plastic dielectric film capacitors, etc.

Total Tax Rate: 55.0%

Breakdown of Tariff Rates:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

- April 11 Special Tariff: Applies after April 11, 2025 (30.0% increase)

✅ HS CODE: 3919102055

Description: Self-adhesive plastic adhesive film sheets

Total Tax Rate: 60.8%

Breakdown of Tariff Rates:

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

- April 11 Special Tariff: Applies after April 11, 2025 (30.0% increase)

✅ HS CODE: 3919101050

Description: Self-adhesive reflective plastic films, etc.

Total Tax Rate: 61.5%

Breakdown of Tariff Rates:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

- April 11 Special Tariff: Applies after April 11, 2025 (30.0% increase)

✅ HS CODE: 3920690000

Description: Other polyester plastic foils

Total Tax Rate: 59.2%

Breakdown of Tariff Rates:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

- April 11 Special Tariff: Applies after April 11, 2025 (30.0% increase)

📌 Proactive Advice for Importers:

- Verify Material and Unit Price: Ensure the product is indeed a self-adhesive capacitor film and not a general-purpose plastic film, as this can affect classification.

- Check Required Certifications: Some HS codes may require specific certifications (e.g., RoHS, REACH, or customs declarations).

- Monitor April 11, 2025, Tariff Changes: If your import is scheduled after this date, the 30.0% additional tariff will apply, significantly increasing the total cost.

- Consider HS Code 8532250060 for Capacitors: If the product is used in capacitors, this code may be more appropriate and has a lower base tariff rate (0.0%).

Let me know if you need help determining the most accurate HS code based on product specifications or documentation.

Product Classification: Other Plastic Self-Adhesive Capacitor Film

Based on your declaration, the product is a plastic self-adhesive capacitor film, which is a type of plastic film used in electronic components. Below is the detailed classification and tariff information for the relevant HS codes.

✅ HS CODE: 3919905060

Description: Plastic self-adhesive films, foils, sheets, etc.

Total Tax Rate: 60.8%

Breakdown of Tariff Rates:

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

- April 11 Special Tariff: Applies after April 11, 2025 (30.0% increase)

✅ HS CODE: 8532250060

Description: Self-healing plastic dielectric capacitors, plastic dielectric film capacitors, etc.

Total Tax Rate: 55.0%

Breakdown of Tariff Rates:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

- April 11 Special Tariff: Applies after April 11, 2025 (30.0% increase)

✅ HS CODE: 3919102055

Description: Self-adhesive plastic adhesive film sheets

Total Tax Rate: 60.8%

Breakdown of Tariff Rates:

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

- April 11 Special Tariff: Applies after April 11, 2025 (30.0% increase)

✅ HS CODE: 3919101050

Description: Self-adhesive reflective plastic films, etc.

Total Tax Rate: 61.5%

Breakdown of Tariff Rates:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

- April 11 Special Tariff: Applies after April 11, 2025 (30.0% increase)

✅ HS CODE: 3920690000

Description: Other polyester plastic foils

Total Tax Rate: 59.2%

Breakdown of Tariff Rates:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

- April 11 Special Tariff: Applies after April 11, 2025 (30.0% increase)

📌 Proactive Advice for Importers:

- Verify Material and Unit Price: Ensure the product is indeed a self-adhesive capacitor film and not a general-purpose plastic film, as this can affect classification.

- Check Required Certifications: Some HS codes may require specific certifications (e.g., RoHS, REACH, or customs declarations).

- Monitor April 11, 2025, Tariff Changes: If your import is scheduled after this date, the 30.0% additional tariff will apply, significantly increasing the total cost.

- Consider HS Code 8532250060 for Capacitors: If the product is used in capacitors, this code may be more appropriate and has a lower base tariff rate (0.0%).

Let me know if you need help determining the most accurate HS code based on product specifications or documentation.

Customer Reviews

No reviews yet.