| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919905060 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919102055 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

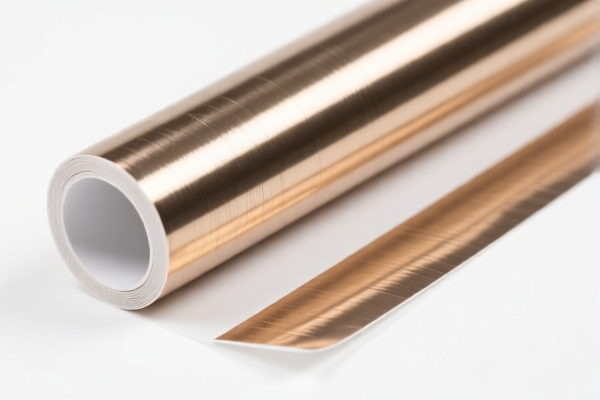

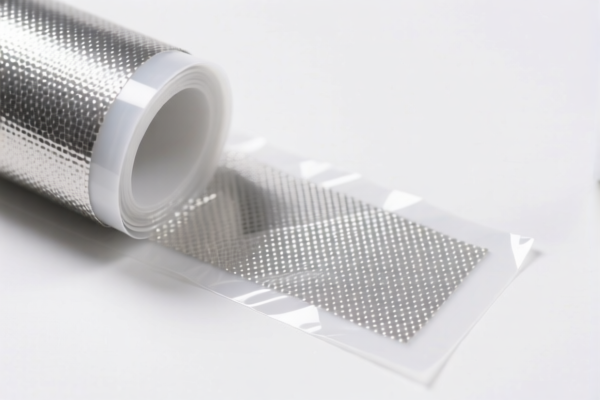

Here is the structured classification and tax information for "Other plastic self adhesive conductive film" based on the provided HS codes and tariff details:

🔍 HS Code Classification Overview

- HS Code 3919905060

- Description: Other plastic self adhesive conductive film

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: This is the highest tax rate among the listed options.

-

HS Code 3919102055

- Description: Other plastic self adhesive conductive film

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: Same total tax rate as 3919905060.

-

HS Code 3920992000

- Description: Other plastic self adhesive conductive film

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: Slightly lower base tariff than the previous two.

-

HS Code 3921905050

- Description: Other plastic self adhesive conductive film

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

-

Note: Lower overall tax rate due to no additional tariff.

-

HS Code 3921904090

- Description: Other plastic self adhesive conductive film

- Total Tax Rate: 34.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

- Note: The lowest tax rate among the listed options.

⚠️ Important Notes and Alerts

-

April 11, 2025 Tariff Increase:

All listed HS codes will face an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and should be considered in your import planning. -

No Anti-Dumping Duties Mentioned:

Based on the provided data, no specific anti-dumping duties on iron or aluminum are listed for these HS codes.

📌 Proactive Advice for Importers

-

Verify Material Composition:

Ensure the product is indeed classified as "plastic self adhesive conductive film" and not a different material (e.g., metal-based or composite). -

Check Unit Price and Tax Calculation:

The total tax rate will vary depending on the HS code and product value. Use the correct HS code for accurate customs clearance. -

Review Required Certifications:

Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country. -

Plan for Tariff Increases:

If importing after April 11, 2025, budget for the 30.0% additional tariff to avoid unexpected costs.

Let me know if you need help selecting the most appropriate HS code for your specific product. Here is the structured classification and tax information for "Other plastic self adhesive conductive film" based on the provided HS codes and tariff details:

🔍 HS Code Classification Overview

- HS Code 3919905060

- Description: Other plastic self adhesive conductive film

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: This is the highest tax rate among the listed options.

-

HS Code 3919102055

- Description: Other plastic self adhesive conductive film

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: Same total tax rate as 3919905060.

-

HS Code 3920992000

- Description: Other plastic self adhesive conductive film

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: Slightly lower base tariff than the previous two.

-

HS Code 3921905050

- Description: Other plastic self adhesive conductive film

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

-

Note: Lower overall tax rate due to no additional tariff.

-

HS Code 3921904090

- Description: Other plastic self adhesive conductive film

- Total Tax Rate: 34.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

- Note: The lowest tax rate among the listed options.

⚠️ Important Notes and Alerts

-

April 11, 2025 Tariff Increase:

All listed HS codes will face an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and should be considered in your import planning. -

No Anti-Dumping Duties Mentioned:

Based on the provided data, no specific anti-dumping duties on iron or aluminum are listed for these HS codes.

📌 Proactive Advice for Importers

-

Verify Material Composition:

Ensure the product is indeed classified as "plastic self adhesive conductive film" and not a different material (e.g., metal-based or composite). -

Check Unit Price and Tax Calculation:

The total tax rate will vary depending on the HS code and product value. Use the correct HS code for accurate customs clearance. -

Review Required Certifications:

Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country. -

Plan for Tariff Increases:

If importing after April 11, 2025, budget for the 30.0% additional tariff to avoid unexpected costs.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.