| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3924901050 | Doc | 33.3% | CN | US | 2025-05-12 |

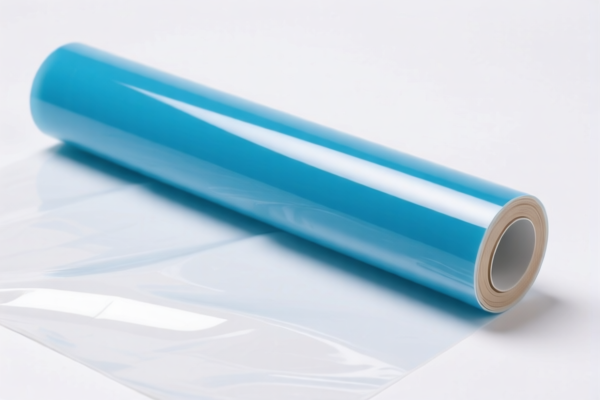

Here is the structured classification and tax information for "Other plastic self adhesive shading film" based on the provided HS codes and tariff details:

✅ HS CODE: 3921905050

Product Description: Other plastic sheets, plates, films, foils, and strips

Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- Special Notes: This code is for general plastic films, which may include self-adhesive shading films depending on specific product features.

✅ HS CODE: 3921904090

Product Description: Flexible plastic sheets, plates, films, foils, and strips

Total Tax Rate: 34.2%

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- Special Notes: This code is for flexible plastic films, which may be suitable for self-adhesive shading films.

✅ HS CODE: 3925900000

Product Description: Plastic building hardware products, and other unspecified plastic products

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- Special Notes: This code is for building-related plastic products, which may not be the best fit unless the shading film is specifically used in construction.

✅ HS CODE: 3926909989

Product Description: Other plastic products and products of chapters 3901 to 3914

Total Tax Rate: 42.8%

- Base Tariff Rate: 5.3%

- Additional Tariff (before April 11, 2025): 7.5%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- Special Notes: This is a general category for other plastic products, which may include self-adhesive shading films if not classified elsewhere.

✅ HS CODE: 3924901050

Product Description: Curtains, drapes, including curtain rods and fringes; tablecloths, napkins, mats, etc.

Total Tax Rate: 33.3%

- Base Tariff Rate: 3.3%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- Special Notes: This code is for home textile products, which may not be the correct classification for a plastic shading film.

📌 Proactive Advice:

- Verify Material and Unit Price: Ensure the product is indeed a plastic self-adhesive shading film and not a textile or construction product.

- Check Certifications: Confirm if any certifications (e.g., fire resistance, environmental compliance) are required for import.

- Consult Customs Authority: For precise classification, it is recommended to consult local customs or a customs broker for confirmation.

- Monitor Tariff Changes: Be aware that additional tariffs of 30.0% apply after April 11, 2025, which could significantly increase the total cost.

Let me know if you need help determining the most accurate HS code for your specific product. Here is the structured classification and tax information for "Other plastic self adhesive shading film" based on the provided HS codes and tariff details:

✅ HS CODE: 3921905050

Product Description: Other plastic sheets, plates, films, foils, and strips

Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- Special Notes: This code is for general plastic films, which may include self-adhesive shading films depending on specific product features.

✅ HS CODE: 3921904090

Product Description: Flexible plastic sheets, plates, films, foils, and strips

Total Tax Rate: 34.2%

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- Special Notes: This code is for flexible plastic films, which may be suitable for self-adhesive shading films.

✅ HS CODE: 3925900000

Product Description: Plastic building hardware products, and other unspecified plastic products

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- Special Notes: This code is for building-related plastic products, which may not be the best fit unless the shading film is specifically used in construction.

✅ HS CODE: 3926909989

Product Description: Other plastic products and products of chapters 3901 to 3914

Total Tax Rate: 42.8%

- Base Tariff Rate: 5.3%

- Additional Tariff (before April 11, 2025): 7.5%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- Special Notes: This is a general category for other plastic products, which may include self-adhesive shading films if not classified elsewhere.

✅ HS CODE: 3924901050

Product Description: Curtains, drapes, including curtain rods and fringes; tablecloths, napkins, mats, etc.

Total Tax Rate: 33.3%

- Base Tariff Rate: 3.3%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- Special Notes: This code is for home textile products, which may not be the correct classification for a plastic shading film.

📌 Proactive Advice:

- Verify Material and Unit Price: Ensure the product is indeed a plastic self-adhesive shading film and not a textile or construction product.

- Check Certifications: Confirm if any certifications (e.g., fire resistance, environmental compliance) are required for import.

- Consult Customs Authority: For precise classification, it is recommended to consult local customs or a customs broker for confirmation.

- Monitor Tariff Changes: Be aware that additional tariffs of 30.0% apply after April 11, 2025, which could significantly increase the total cost.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.