| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919102040 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919905060 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919102055 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919905040 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919101050 | Doc | 61.5% | CN | US | 2025-05-12 |

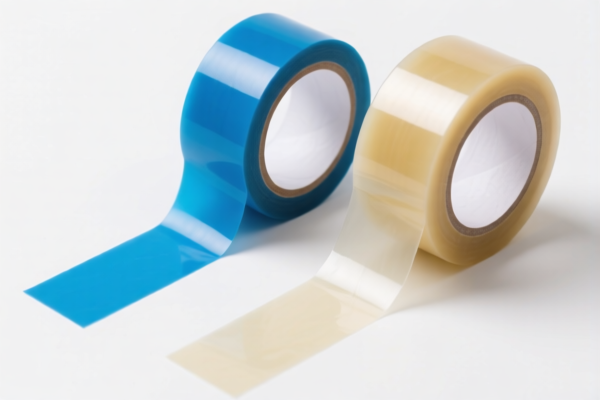

Here is the structured classification and tax information for "Other plastic self adhesive tape" based on the provided HS codes and tariff details:

📦 Product Classification Overview: Other Plastic Self Adhesive Tape

✅ HS CODE: 3919102040

- Description: Non-special-purpose plastic self-adhesive tape

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to general-purpose plastic self-adhesive tapes not used for specialized applications.

✅ HS CODE: 3919905060

- Description: Plastic self-adhesive tape material

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for raw or semi-finished materials used in the production of self-adhesive tapes.

✅ HS CODE: 3919102055

- Description: Plastic self-adhesive roll tape

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to self-adhesive tape in roll form, typically used for packaging or sealing.

✅ HS CODE: 3919905040

- Description: Plastic transparent self-adhesive tape

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for transparent plastic self-adhesive tapes, often used in office or packaging applications.

✅ HS CODE: 3919101050

- Description: Self-adhesive reflective plastic tape

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to reflective or safety-related self-adhesive plastic tapes, which may have higher base tariffs due to specialized use.

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. Ensure your import timeline is aligned with this policy change. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for these HS codes, but always verify with the latest customs updates or consult a customs broker for confirmation. -

Certifications and Documentation:

- Confirm the material composition (e.g., PVC, PE, etc.) and unit price to ensure correct classification.

-

Check if certifications (e.g., RoHS, REACH, or safety standards) are required for your product type and destination market.

-

Customs Clearance:

Provide detailed product descriptions, including usage, dimensions, and intended application, to avoid misclassification and potential delays.

📌 Proactive Advice:

- Verify HS Code Accuracy: Double-check the HS code with the product's exact description and specifications.

- Monitor Tariff Updates: Stay informed about any changes in tariffs or trade policies, especially around the April 11, 2025 deadline.

- Consult a Customs Expert: For high-value or complex shipments, consider engaging a customs compliance expert or broker.

Let me know if you need help with HS code verification or customs documentation! Here is the structured classification and tax information for "Other plastic self adhesive tape" based on the provided HS codes and tariff details:

📦 Product Classification Overview: Other Plastic Self Adhesive Tape

✅ HS CODE: 3919102040

- Description: Non-special-purpose plastic self-adhesive tape

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to general-purpose plastic self-adhesive tapes not used for specialized applications.

✅ HS CODE: 3919905060

- Description: Plastic self-adhesive tape material

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for raw or semi-finished materials used in the production of self-adhesive tapes.

✅ HS CODE: 3919102055

- Description: Plastic self-adhesive roll tape

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to self-adhesive tape in roll form, typically used for packaging or sealing.

✅ HS CODE: 3919905040

- Description: Plastic transparent self-adhesive tape

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for transparent plastic self-adhesive tapes, often used in office or packaging applications.

✅ HS CODE: 3919101050

- Description: Self-adhesive reflective plastic tape

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to reflective or safety-related self-adhesive plastic tapes, which may have higher base tariffs due to specialized use.

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. Ensure your import timeline is aligned with this policy change. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for these HS codes, but always verify with the latest customs updates or consult a customs broker for confirmation. -

Certifications and Documentation:

- Confirm the material composition (e.g., PVC, PE, etc.) and unit price to ensure correct classification.

-

Check if certifications (e.g., RoHS, REACH, or safety standards) are required for your product type and destination market.

-

Customs Clearance:

Provide detailed product descriptions, including usage, dimensions, and intended application, to avoid misclassification and potential delays.

📌 Proactive Advice:

- Verify HS Code Accuracy: Double-check the HS code with the product's exact description and specifications.

- Monitor Tariff Updates: Stay informed about any changes in tariffs or trade policies, especially around the April 11, 2025 deadline.

- Consult a Customs Expert: For high-value or complex shipments, consider engaging a customs compliance expert or broker.

Let me know if you need help with HS code verification or customs documentation!

Customer Reviews

No reviews yet.