| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919905040 | Doc | 60.8% | CN | US | 2025-05-12 |

| 4811413000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3919905060 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919102040 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919102055 | Doc | 60.8% | CN | US | 2025-05-12 |

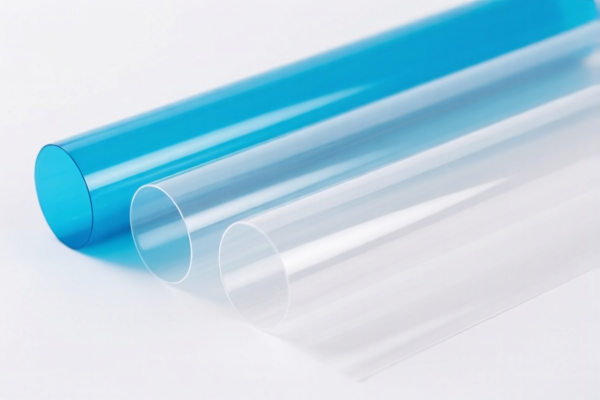

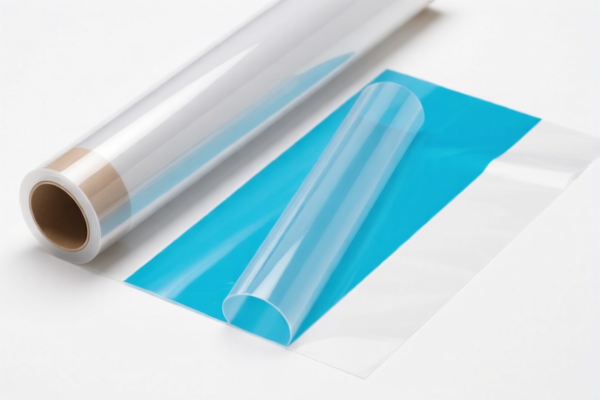

Here is the structured classification and tax information for the product "Other plastic self adhesive transparent film" based on the provided HS codes and tariff details:

✅ HS CODE: 3919905040

Product Description: Other plastic self adhesive transparent film

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies to this product after April 11, 2025

📌 Key Notes and Recommendations:

- Material Verification: Confirm that the product is indeed made of plastic and not paper or paperboard, as this would change the applicable HS code (e.g., 4811413000).

- Unit Price and Certification: Check the unit price and whether any certifications (e.g., RoHS, REACH) are required for import.

- Tariff Changes: Be aware that the special tariff of 30.0% will apply after April 11, 2025, which could significantly increase the total cost.

- Alternative HS Codes: If the product is not transparent, or is used for patching, consider codes like 3919102040 or 3919102055, which also have similar tax structures.

🛑 Proactive Advice:

- Double-check the product description to ensure it matches the HS code used for classification.

- Consult a customs broker or import compliance expert if the product is used in sensitive industries (e.g., electronics, automotive).

- Keep records of product specifications, material composition, and supplier documentation to support customs declarations.

Let me know if you need help with certification requirements or customs documentation for this product. Here is the structured classification and tax information for the product "Other plastic self adhesive transparent film" based on the provided HS codes and tariff details:

✅ HS CODE: 3919905040

Product Description: Other plastic self adhesive transparent film

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies to this product after April 11, 2025

📌 Key Notes and Recommendations:

- Material Verification: Confirm that the product is indeed made of plastic and not paper or paperboard, as this would change the applicable HS code (e.g., 4811413000).

- Unit Price and Certification: Check the unit price and whether any certifications (e.g., RoHS, REACH) are required for import.

- Tariff Changes: Be aware that the special tariff of 30.0% will apply after April 11, 2025, which could significantly increase the total cost.

- Alternative HS Codes: If the product is not transparent, or is used for patching, consider codes like 3919102040 or 3919102055, which also have similar tax structures.

🛑 Proactive Advice:

- Double-check the product description to ensure it matches the HS code used for classification.

- Consult a customs broker or import compliance expert if the product is used in sensitive industries (e.g., electronics, automotive).

- Keep records of product specifications, material composition, and supplier documentation to support customs declarations.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.