| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3924901010 | Doc | 33.3% | CN | US | 2025-05-12 |

| 3924901050 | Doc | 33.3% | CN | US | 2025-05-12 |

| 3925301000 | Doc | 40.8% | CN | US | 2025-05-12 |

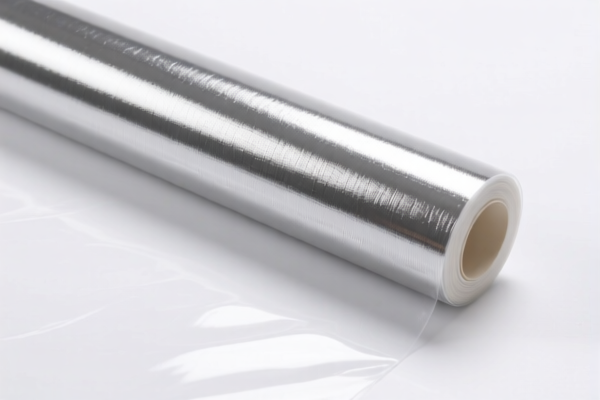

Here is the structured classification and tax information for "Other plastic shading film" based on the provided HS codes and tariff details:

📦 Product Classification: Other Plastic Shading Film

🔍 HS Code Details and Tax Rates

- HS CODE: 3921905050

- Base Tariff Rate: 4.8%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.8%

-

Note: No other additional tariffs apply.

-

HS CODE: 3921904090

- Base Tariff Rate: 4.2%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

-

Note: No other additional tariffs apply.

-

HS CODE: 3924901010

- Base Tariff Rate: 3.3%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 33.3%

-

Note: No other additional tariffs apply.

-

HS CODE: 3924901050

- Base Tariff Rate: 3.3%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 33.3%

-

Note: No other additional tariffs apply.

-

HS CODE: 3925301000

- Base Tariff Rate: 3.3%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping Duty: 7.5%

- Total Tax Rate: 40.8%

- Note: This code includes an anti-dumping duty of 7.5%, which is in addition to the base and April 11 special tariffs.

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff is imposed on all listed HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in your customs planning. -

Anti-dumping Duty (Only for 3925301000):

A 7.5% anti-dumping duty applies to this specific HS code. This is likely due to trade remedy measures and should be verified with customs or a trade compliance expert.

📌 Proactive Advice for Importers

-

Verify Material and Unit Price:

Ensure the product is indeed classified as "other plastic shading film" and not a different type of plastic product (e.g., film for packaging or agricultural use). -

Check Required Certifications:

Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country. -

Consult Customs or Trade Compliance Experts:

Especially for HS code 3925301000, where anti-dumping duties apply, it is crucial to confirm the exact product description and origin to avoid unexpected costs. -

Plan for April 11, 2025 Tariff Increase:

If your shipment is scheduled after this date, budget for the 30.0% additional tariff to avoid unexpected expenses.

Let me know if you need help determining the most appropriate HS code for your specific product or if you need assistance with customs documentation. Here is the structured classification and tax information for "Other plastic shading film" based on the provided HS codes and tariff details:

📦 Product Classification: Other Plastic Shading Film

🔍 HS Code Details and Tax Rates

- HS CODE: 3921905050

- Base Tariff Rate: 4.8%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.8%

-

Note: No other additional tariffs apply.

-

HS CODE: 3921904090

- Base Tariff Rate: 4.2%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

-

Note: No other additional tariffs apply.

-

HS CODE: 3924901010

- Base Tariff Rate: 3.3%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 33.3%

-

Note: No other additional tariffs apply.

-

HS CODE: 3924901050

- Base Tariff Rate: 3.3%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 33.3%

-

Note: No other additional tariffs apply.

-

HS CODE: 3925301000

- Base Tariff Rate: 3.3%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping Duty: 7.5%

- Total Tax Rate: 40.8%

- Note: This code includes an anti-dumping duty of 7.5%, which is in addition to the base and April 11 special tariffs.

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff is imposed on all listed HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in your customs planning. -

Anti-dumping Duty (Only for 3925301000):

A 7.5% anti-dumping duty applies to this specific HS code. This is likely due to trade remedy measures and should be verified with customs or a trade compliance expert.

📌 Proactive Advice for Importers

-

Verify Material and Unit Price:

Ensure the product is indeed classified as "other plastic shading film" and not a different type of plastic product (e.g., film for packaging or agricultural use). -

Check Required Certifications:

Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country. -

Consult Customs or Trade Compliance Experts:

Especially for HS code 3925301000, where anti-dumping duties apply, it is crucial to confirm the exact product description and origin to avoid unexpected costs. -

Plan for April 11, 2025 Tariff Increase:

If your shipment is scheduled after this date, budget for the 30.0% additional tariff to avoid unexpected expenses.

Let me know if you need help determining the most appropriate HS code for your specific product or if you need assistance with customs documentation.

Customer Reviews

No reviews yet.