| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920991000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 8708295160 | Doc | 2.5% <u></u>+105.0% | CN | US | 2025-05-12 |

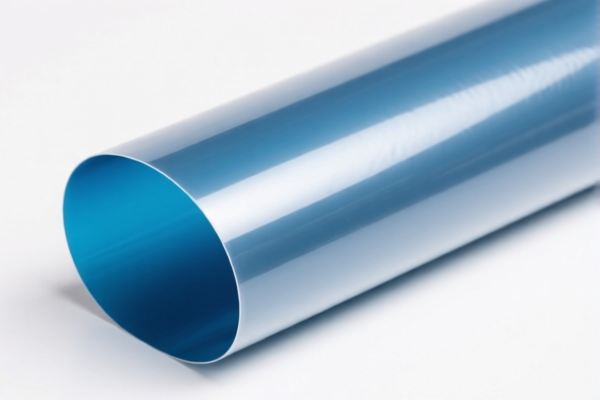

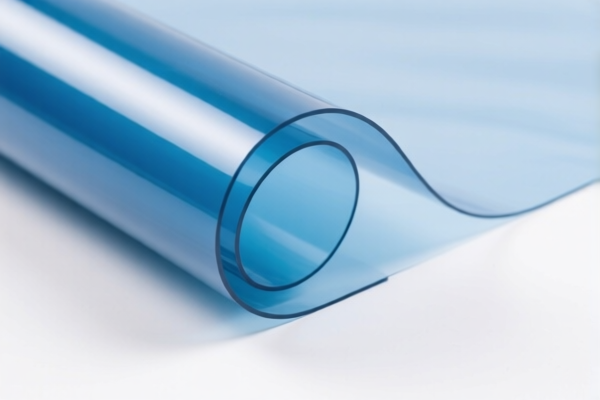

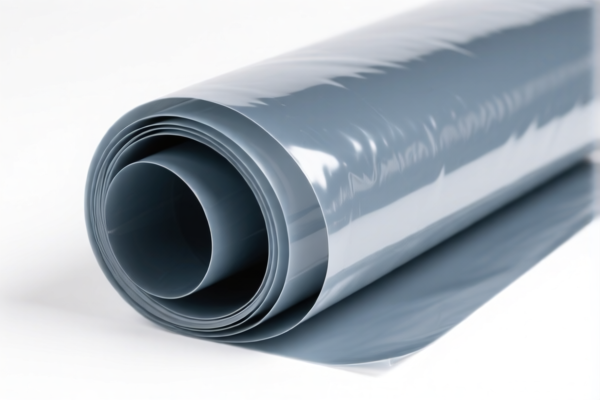

Product Classification: Other Plastic Sheet for Automotive Industry

HS CODEs and Tax Information Overview:

- HS CODE: 3921904010

- Description: Other plates, sheets, film, foil and strip, of plastics

- Total Tax Rate: 34.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

-

Note: No anti-dumping duties or special tariffs on steel, aluminum, or copper.

-

HS CODE: 3920100000

- Description: Other plates, sheets, film, foil and strip, of plastics (8-10 digit explanation)

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: Higher additional tariffs compared to other codes.

-

HS CODE: 3920991000

- Description: Plastic board, sheet, film, foil and strip (classification)

- Total Tax Rate: 61.0%

- Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: Highest base tariff among the plastic sheet options.

-

HS CODE: 3921905050

- Description: Other plates, sheets, film, foil and strip, of plastics

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

-

Note: Slightly higher base tariff than 3921904010.

-

HS CODE: 8708295160

- Description: Automotive parts (e.g., components for vehicles)

- Total Tax Rate: 2.5% + 105.0%

- Breakdown:

- Base Tariff: 2.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Steel, Aluminum, Copper Additional Tariff: 50.0%

- Note: This code is likely for finished automotive parts, not raw plastic sheets. Be cautious of the high additional tariffs on metal components.

✅ Proactive Advice:

- Verify Material and Unit Price: Ensure the product is indeed a "plastic sheet" and not a composite or metal-containing product, which may fall under different HS codes (e.g., 8708295160).

- Check Required Certifications: Some plastic products may require specific certifications (e.g., RoHS, REACH) for automotive use.

- Monitor Tariff Changes: The April 11, 2025 tariff increase applies to all listed codes. If your shipment is scheduled after this date, the total tax rate will increase by 30%.

- Consider Anti-Dumping Duties: If the product contains steel, aluminum, or copper, additional tariffs of 50% may apply (as seen in 8708295160).

Let me know if you need help selecting the most appropriate HS code based on your product's specifications.

Product Classification: Other Plastic Sheet for Automotive Industry

HS CODEs and Tax Information Overview:

- HS CODE: 3921904010

- Description: Other plates, sheets, film, foil and strip, of plastics

- Total Tax Rate: 34.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

-

Note: No anti-dumping duties or special tariffs on steel, aluminum, or copper.

-

HS CODE: 3920100000

- Description: Other plates, sheets, film, foil and strip, of plastics (8-10 digit explanation)

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: Higher additional tariffs compared to other codes.

-

HS CODE: 3920991000

- Description: Plastic board, sheet, film, foil and strip (classification)

- Total Tax Rate: 61.0%

- Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: Highest base tariff among the plastic sheet options.

-

HS CODE: 3921905050

- Description: Other plates, sheets, film, foil and strip, of plastics

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

-

Note: Slightly higher base tariff than 3921904010.

-

HS CODE: 8708295160

- Description: Automotive parts (e.g., components for vehicles)

- Total Tax Rate: 2.5% + 105.0%

- Breakdown:

- Base Tariff: 2.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Steel, Aluminum, Copper Additional Tariff: 50.0%

- Note: This code is likely for finished automotive parts, not raw plastic sheets. Be cautious of the high additional tariffs on metal components.

✅ Proactive Advice:

- Verify Material and Unit Price: Ensure the product is indeed a "plastic sheet" and not a composite or metal-containing product, which may fall under different HS codes (e.g., 8708295160).

- Check Required Certifications: Some plastic products may require specific certifications (e.g., RoHS, REACH) for automotive use.

- Monitor Tariff Changes: The April 11, 2025 tariff increase applies to all listed codes. If your shipment is scheduled after this date, the total tax rate will increase by 30%.

- Consider Anti-Dumping Duties: If the product contains steel, aluminum, or copper, additional tariffs of 50% may apply (as seen in 8708295160).

Let me know if you need help selecting the most appropriate HS code based on your product's specifications.

Customer Reviews

No reviews yet.