| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 8534000070 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8485901000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

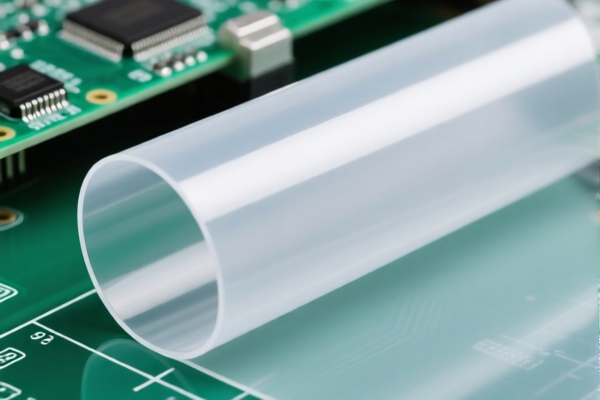

Here is the structured analysis and classification for the declared product "Other plastic sheet for electronics industry" based on the provided HS codes and tax details:

✅ HS CODE: 3921904010

Description: Other plates, sheets, film, foil and strip, of plastics

Total Tax Rate: 34.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- April 11 Special Tariff: 30.0% (applies after April 11, 2025)

Key Notes:

- This is the most suitable code for general-purpose plastic sheets, especially if they are not specifically used in electronics or not classified under more specific categories.

- The 30% additional tariff will apply after April 11, 2025, which is a critical date to note for customs clearance planning.

✅ HS CODE: 8534000070

Description: Printed circuits, impregnated plastic type, non-flexible type, other

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- April 11 Special Tariff: 30.0% (applies after April 11, 2025)

Key Notes:

- This code is for printed circuits made with plastic, typically used in electronics.

- If your product is a printed circuit board or similar, this may be the correct classification.

- The 30% additional tariff will apply after April 11, 2025.

✅ HS CODE: 8485901000

Description: Parts of additive manufacturing machines, specifically those made by depositing plastic or rubber

Total Tax Rate: 58.1%

Tax Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- April 11 Special Tariff: 30.0% (applies after April 11, 2025)

Key Notes:

- This code is for 3D printing parts made from plastic or rubber.

- If your product is a component for 3D printing, this may be the correct classification.

- The 30% additional tariff will apply after April 11, 2025.

✅ HS CODE: 3920992000

Description: Other plastic-made plates, sheets, film, foil and strip

Total Tax Rate: 59.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- April 11 Special Tariff: 30.0% (applies after April 11, 2025)

Key Notes:

- This is a more specific code for plastic sheets that are not covered under 3921904010.

- The 30% additional tariff will apply after April 11, 2025.

✅ HS CODE: 3920690000

Description: Other polyester plastic foil

Total Tax Rate: 59.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- April 11 Special Tariff: 30.0% (applies after April 11, 2025)

Key Notes:

- This code is for polyester plastic foil, which is a specific type of plastic sheet.

- If your product is polyester-based, this may be the correct classification.

- The 30% additional tariff will apply after April 11, 2025.

📌 Proactive Advice for Users:

- Verify the material composition of the plastic sheet (e.g., is it polyester, polyethylene, etc.) to ensure correct classification.

- Check the unit price to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Confirm the intended use (e.g., general-purpose vs. electronics-specific) to select the most accurate HS code.

- Review required certifications (e.g., RoHS, REACH, or other compliance standards) for electronics industry products.

- Plan for the April 11, 2025, tariff increase to avoid unexpected costs during customs clearance.

Let me know if you need help with a specific product description or customs documentation. Here is the structured analysis and classification for the declared product "Other plastic sheet for electronics industry" based on the provided HS codes and tax details:

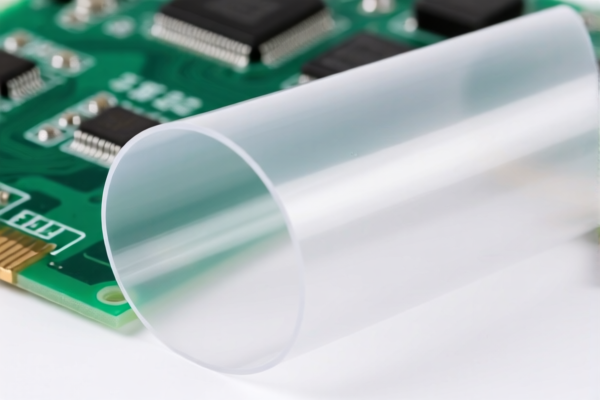

✅ HS CODE: 3921904010

Description: Other plates, sheets, film, foil and strip, of plastics

Total Tax Rate: 34.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- April 11 Special Tariff: 30.0% (applies after April 11, 2025)

Key Notes:

- This is the most suitable code for general-purpose plastic sheets, especially if they are not specifically used in electronics or not classified under more specific categories.

- The 30% additional tariff will apply after April 11, 2025, which is a critical date to note for customs clearance planning.

✅ HS CODE: 8534000070

Description: Printed circuits, impregnated plastic type, non-flexible type, other

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- April 11 Special Tariff: 30.0% (applies after April 11, 2025)

Key Notes:

- This code is for printed circuits made with plastic, typically used in electronics.

- If your product is a printed circuit board or similar, this may be the correct classification.

- The 30% additional tariff will apply after April 11, 2025.

✅ HS CODE: 8485901000

Description: Parts of additive manufacturing machines, specifically those made by depositing plastic or rubber

Total Tax Rate: 58.1%

Tax Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- April 11 Special Tariff: 30.0% (applies after April 11, 2025)

Key Notes:

- This code is for 3D printing parts made from plastic or rubber.

- If your product is a component for 3D printing, this may be the correct classification.

- The 30% additional tariff will apply after April 11, 2025.

✅ HS CODE: 3920992000

Description: Other plastic-made plates, sheets, film, foil and strip

Total Tax Rate: 59.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- April 11 Special Tariff: 30.0% (applies after April 11, 2025)

Key Notes:

- This is a more specific code for plastic sheets that are not covered under 3921904010.

- The 30% additional tariff will apply after April 11, 2025.

✅ HS CODE: 3920690000

Description: Other polyester plastic foil

Total Tax Rate: 59.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- April 11 Special Tariff: 30.0% (applies after April 11, 2025)

Key Notes:

- This code is for polyester plastic foil, which is a specific type of plastic sheet.

- If your product is polyester-based, this may be the correct classification.

- The 30% additional tariff will apply after April 11, 2025.

📌 Proactive Advice for Users:

- Verify the material composition of the plastic sheet (e.g., is it polyester, polyethylene, etc.) to ensure correct classification.

- Check the unit price to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Confirm the intended use (e.g., general-purpose vs. electronics-specific) to select the most accurate HS code.

- Review required certifications (e.g., RoHS, REACH, or other compliance standards) for electronics industry products.

- Plan for the April 11, 2025, tariff increase to avoid unexpected costs during customs clearance.

Let me know if you need help with a specific product description or customs documentation.

Customer Reviews

No reviews yet.