| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3919905010 | Doc | 60.8% | CN | US | 2025-05-12 |

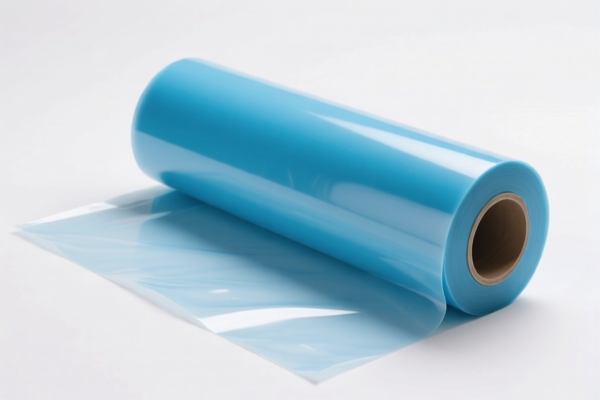

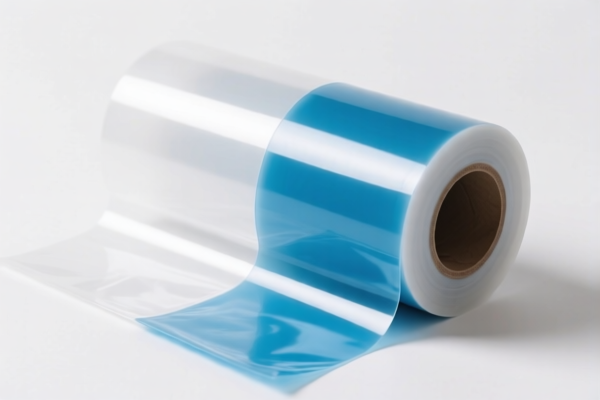

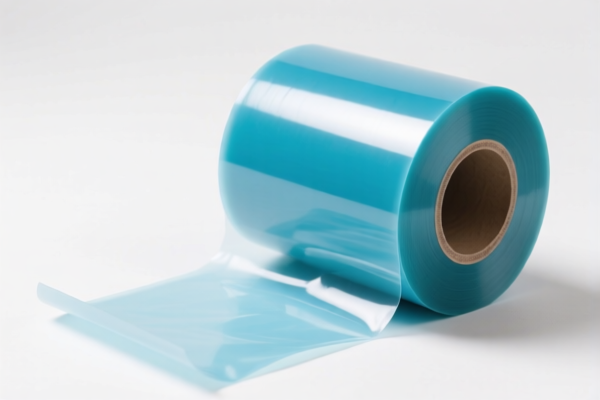

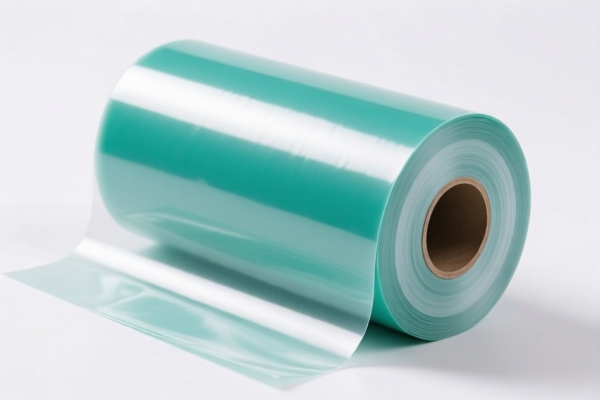

Here is the structured classification and tariff information for the declared product "Other plastic sheet roll" based on the provided HS codes and tax details:

📦 Product Classification Overview: Other Plastic Sheet Roll

🔍 HS CODE: 3920992000

- Description: Plastic film rolls (general category)

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most general category for plastic film rolls.

🔍 HS CODE: 3920690000

- Description: Polyester plastic rolls or polyester plastic foil

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Applies to both "polyester plastic rolls" and "other polyester plastic foil."

🔍 HS CODE: 3920591000

- Description: Acrylic plastic rolls

- Total Tax Rate: 61.0%

- Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Higher base tariff due to material type (acrylic).

🔍 HS CODE: 3919905010

- Description: Reflective plastic rolls

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Reflective materials may have specific customs attention due to their specialized use.

⚠️ Important Notes and Alerts:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning. -

Anti-dumping duties:

Not explicitly mentioned in the data, but be cautious if the product is made of iron or aluminum (not applicable here, but good to note for similar products).

📌 Proactive Advice for Importers:

-

Verify Material and Unit Price:

Ensure the product is correctly classified based on material (e.g., polyester, acrylic, reflective) to avoid misclassification penalties. -

Check Required Certifications:

Some plastic sheet rolls may require safety, environmental, or quality certifications depending on the end-use (e.g., construction, signage, packaging). -

Monitor Tariff Updates:

Keep track of any changes in tariff rates or policies, especially after April 11, 2025, to avoid unexpected costs. -

Consult a Customs Broker:

For complex or high-value shipments, consider professional customs brokerage services to ensure compliance and optimize tax planning.

Let me know if you need help determining the most accurate HS code for your specific product. Here is the structured classification and tariff information for the declared product "Other plastic sheet roll" based on the provided HS codes and tax details:

📦 Product Classification Overview: Other Plastic Sheet Roll

🔍 HS CODE: 3920992000

- Description: Plastic film rolls (general category)

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most general category for plastic film rolls.

🔍 HS CODE: 3920690000

- Description: Polyester plastic rolls or polyester plastic foil

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Applies to both "polyester plastic rolls" and "other polyester plastic foil."

🔍 HS CODE: 3920591000

- Description: Acrylic plastic rolls

- Total Tax Rate: 61.0%

- Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Higher base tariff due to material type (acrylic).

🔍 HS CODE: 3919905010

- Description: Reflective plastic rolls

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Reflective materials may have specific customs attention due to their specialized use.

⚠️ Important Notes and Alerts:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning. -

Anti-dumping duties:

Not explicitly mentioned in the data, but be cautious if the product is made of iron or aluminum (not applicable here, but good to note for similar products).

📌 Proactive Advice for Importers:

-

Verify Material and Unit Price:

Ensure the product is correctly classified based on material (e.g., polyester, acrylic, reflective) to avoid misclassification penalties. -

Check Required Certifications:

Some plastic sheet rolls may require safety, environmental, or quality certifications depending on the end-use (e.g., construction, signage, packaging). -

Monitor Tariff Updates:

Keep track of any changes in tariff rates or policies, especially after April 11, 2025, to avoid unexpected costs. -

Consult a Customs Broker:

For complex or high-value shipments, consider professional customs brokerage services to ensure compliance and optimize tax planning.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.