Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

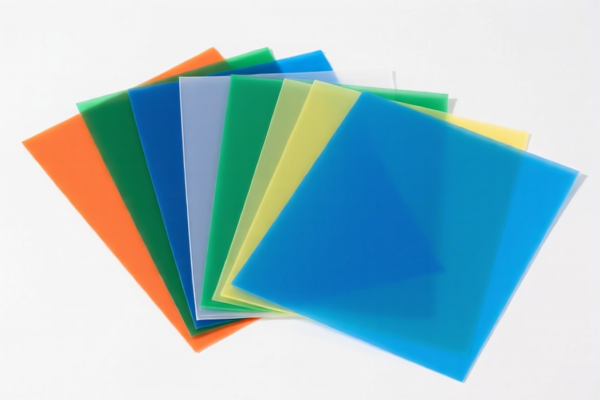

Here is the structured classification and tariff information for the declared product: "Other plastic sheets (Exterior decoration use)".

✅ HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils and strips

Total Tax Rate: 34.8%

🔍 Tariff Breakdown:

- Base Tariff Rate: 4.8%

- Additional Tariff (Currently): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a significant increase and will apply to all imports after this date.

⚠️ Important Notes:

- No anti-dumping duties are currently applicable for this product category.

- No specific additional tariffs are currently in place (other than the 30% after April 11, 2025).

- This product is not classified under 3918901000 (plastic wall or ceiling coverings), which has a much higher total tax rate of 60.3%. Ensure the product is not used for interior decoration or wall/ceiling coverings, as that would change the classification.

📌 Proactive Advice:

- Verify the material composition of the plastic sheets (e.g., PVC, PE, etc.) to ensure correct classification.

- Check the unit price and quantity to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Confirm the intended use (exterior vs. interior) to avoid misclassification.

- Review any required certifications (e.g., safety, environmental compliance) for import into the destination country.

- Plan for the 30% additional tariff after April 11, 2025, which could significantly impact your cost structure.

Let me know if you need help with certification requirements or customs documentation for this product. Here is the structured classification and tariff information for the declared product: "Other plastic sheets (Exterior decoration use)".

✅ HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils and strips

Total Tax Rate: 34.8%

🔍 Tariff Breakdown:

- Base Tariff Rate: 4.8%

- Additional Tariff (Currently): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a significant increase and will apply to all imports after this date.

⚠️ Important Notes:

- No anti-dumping duties are currently applicable for this product category.

- No specific additional tariffs are currently in place (other than the 30% after April 11, 2025).

- This product is not classified under 3918901000 (plastic wall or ceiling coverings), which has a much higher total tax rate of 60.3%. Ensure the product is not used for interior decoration or wall/ceiling coverings, as that would change the classification.

📌 Proactive Advice:

- Verify the material composition of the plastic sheets (e.g., PVC, PE, etc.) to ensure correct classification.

- Check the unit price and quantity to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Confirm the intended use (exterior vs. interior) to avoid misclassification.

- Review any required certifications (e.g., safety, environmental compliance) for import into the destination country.

- Plan for the 30% additional tariff after April 11, 2025, which could significantly impact your cost structure.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.