| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 4814200000 | Doc | 37.5% | CN | US | 2025-05-12 |

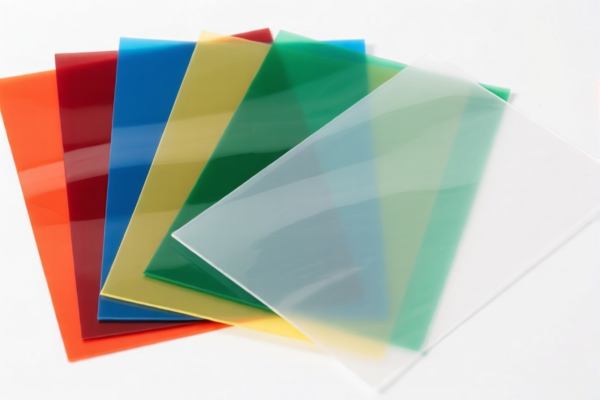

Product Classification and Tax Information for "Other Plastic Sheets (for Coating)"

Based on your input, the product "Other Plastic Sheets (for Coating)" may fall under the following HS codes and associated tax rates:

✅ HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils and strips

Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariffs: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is plastic, not metal)

✅ HS CODE: 4814200000

Description: Wallpapers and similar wall coverings consisting of paper coated with a plastic layer or covering

Total Tax Rate: 37.5%

- Base Tariff Rate: 0.0%

- Additional Tariffs: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is paper with plastic coating, not metal)

📌 Key Notes and Recommendations:

- Classification Clarification:

- If your product is pure plastic sheet (not paper with plastic coating), HS CODE 3921905050 is more likely to be correct.

-

If your product is paper with a plastic coating (e.g., for wall coverings), then HS CODE 4814200000 applies.

-

Time-sensitive Policy Alert:

-

After April 11, 2025, an additional 30% tariff will be applied to both HS codes. This is a critical date to note for import planning.

-

Proactive Actions Required:

- Verify the material composition (e.g., is it pure plastic or paper with plastic coating?).

- Check the unit price to ensure it aligns with the correct HS code.

- Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- Consult with customs brokers or local authorities for the most up-to-date classification and compliance requirements.

Let me know if you need help determining which HS code applies to your specific product. Product Classification and Tax Information for "Other Plastic Sheets (for Coating)"

Based on your input, the product "Other Plastic Sheets (for Coating)" may fall under the following HS codes and associated tax rates:

✅ HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils and strips

Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariffs: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is plastic, not metal)

✅ HS CODE: 4814200000

Description: Wallpapers and similar wall coverings consisting of paper coated with a plastic layer or covering

Total Tax Rate: 37.5%

- Base Tariff Rate: 0.0%

- Additional Tariffs: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is paper with plastic coating, not metal)

📌 Key Notes and Recommendations:

- Classification Clarification:

- If your product is pure plastic sheet (not paper with plastic coating), HS CODE 3921905050 is more likely to be correct.

-

If your product is paper with a plastic coating (e.g., for wall coverings), then HS CODE 4814200000 applies.

-

Time-sensitive Policy Alert:

-

After April 11, 2025, an additional 30% tariff will be applied to both HS codes. This is a critical date to note for import planning.

-

Proactive Actions Required:

- Verify the material composition (e.g., is it pure plastic or paper with plastic coating?).

- Check the unit price to ensure it aligns with the correct HS code.

- Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- Consult with customs brokers or local authorities for the most up-to-date classification and compliance requirements.

Let me know if you need help determining which HS code applies to your specific product.

Customer Reviews

No reviews yet.