| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3918905000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921901910 | Doc | 60.3% | CN | US | 2025-05-12 |

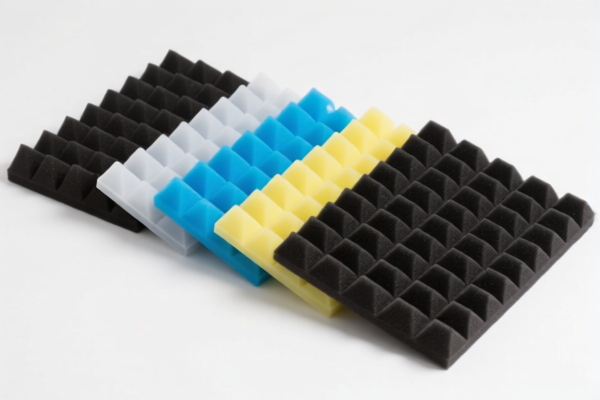

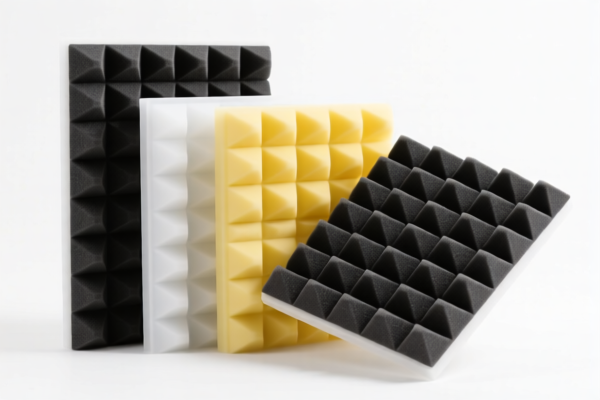

Here is the structured analysis and classification guidance for "Other plastic soundproof boards" based on the provided HS codes and tariff details:

✅ HS CODE: 3925900000

Product Description: Other plastic building hardware products

Total Tax Rate: 60.3%

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable if the soundproof board is considered a building hardware product.

✅ HS CODE: 3920995000

Product Description: Non-cellular plastics, not reinforced, sheets, etc., combined with other materials

Total Tax Rate: 60.8%

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies if the soundproof board is a sheet made of non-cellular plastic combined with other materials.

✅ HS CODE: 3918905000

Product Description: Other plastic floor, wall or ceiling coverings

Total Tax Rate: 59.2%

Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is appropriate if the soundproof board is used as a floor, wall, or ceiling covering.

✅ HS CODE: 3921902900

Product Description: Other plastic sheets, etc., combined with other materials, weight over 1.492 kg/m²

Total Tax Rate: 59.4%

Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies if the soundproof board is a plastic sheet combined with other materials, and the weight per square meter exceeds 1.492 kg.

✅ HS CODE: 3921901910

Product Description: Other plastic sheets, etc., combined with other materials, weight not over 1.492 kg/m²

Total Tax Rate: 60.3%

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies if the soundproof board is a plastic sheet combined with other materials, and the weight per square meter is less than or equal to 1.492 kg.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: All the above codes are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning.

- Anti-dumping duties: Not applicable for plastic products (not iron or aluminum).

- Certifications: Ensure the product meets any required import certifications (e.g., fire resistance, soundproofing standards, etc.).

- Material and Unit Price: Verify the material composition and unit price to ensure correct classification and avoid misdeclaration penalties.

📌 Proactive Advice:

- Confirm the exact composition of the soundproof board (e.g., plastic type, combined materials, weight per square meter).

- Check if the product is used for building hardware, flooring, or acoustic insulation to determine the most accurate HS code.

- If in doubt, consult a customs broker or classification expert for confirmation before import.

Let me know if you need help with a specific product description or customs documentation. Here is the structured analysis and classification guidance for "Other plastic soundproof boards" based on the provided HS codes and tariff details:

✅ HS CODE: 3925900000

Product Description: Other plastic building hardware products

Total Tax Rate: 60.3%

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable if the soundproof board is considered a building hardware product.

✅ HS CODE: 3920995000

Product Description: Non-cellular plastics, not reinforced, sheets, etc., combined with other materials

Total Tax Rate: 60.8%

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies if the soundproof board is a sheet made of non-cellular plastic combined with other materials.

✅ HS CODE: 3918905000

Product Description: Other plastic floor, wall or ceiling coverings

Total Tax Rate: 59.2%

Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is appropriate if the soundproof board is used as a floor, wall, or ceiling covering.

✅ HS CODE: 3921902900

Product Description: Other plastic sheets, etc., combined with other materials, weight over 1.492 kg/m²

Total Tax Rate: 59.4%

Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies if the soundproof board is a plastic sheet combined with other materials, and the weight per square meter exceeds 1.492 kg.

✅ HS CODE: 3921901910

Product Description: Other plastic sheets, etc., combined with other materials, weight not over 1.492 kg/m²

Total Tax Rate: 60.3%

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies if the soundproof board is a plastic sheet combined with other materials, and the weight per square meter is less than or equal to 1.492 kg.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: All the above codes are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning.

- Anti-dumping duties: Not applicable for plastic products (not iron or aluminum).

- Certifications: Ensure the product meets any required import certifications (e.g., fire resistance, soundproofing standards, etc.).

- Material and Unit Price: Verify the material composition and unit price to ensure correct classification and avoid misdeclaration penalties.

📌 Proactive Advice:

- Confirm the exact composition of the soundproof board (e.g., plastic type, combined materials, weight per square meter).

- Check if the product is used for building hardware, flooring, or acoustic insulation to determine the most accurate HS code.

- If in doubt, consult a customs broker or classification expert for confirmation before import.

Let me know if you need help with a specific product description or customs documentation.

Customer Reviews

No reviews yet.