| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3916905000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

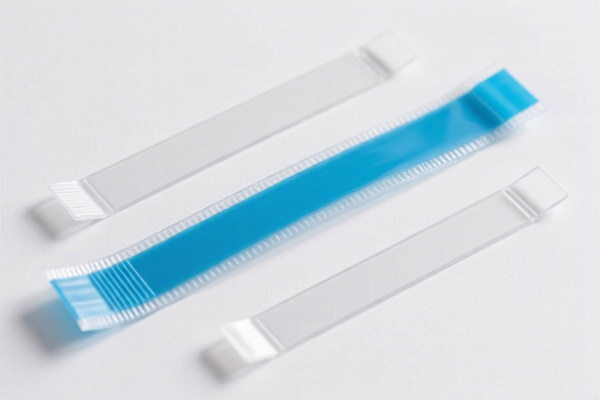

Here is the structured analysis and classification for the product "Other plastic strip For medical use" based on the provided HS codes and tax details:

✅ HS CODE: 3921905050

Product Description: Other plastic strip for medical use

Total Tax Rate: 34.8%

Breakdown:

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Key Notes: - This is the lowest tax rate among the listed HS codes. - No additional tariffs are currently applied. - Be aware of the 30% special tariff that will be imposed after April 11, 2025.

✅ HS CODE: 3916905000

Product Description: Other plastic strip for medical use

Total Tax Rate: 60.8%

Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Key Notes: - This code has the highest total tax rate. - Includes a 25% additional tariff. - 30% special tariff applies after April 11, 2025.

✅ HS CODE: 3920690000

Product Description: Other plastic strip for medical use

Total Tax Rate: 59.2%

Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Key Notes: - A 25% additional tariff is applied. - 30% special tariff applies after April 11, 2025.

✅ HS CODE: 3920100000

Product Description: Other plastic strip for medical use

Total Tax Rate: 59.2%

Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Key Notes: - Same total tax rate as 3920690000. - 25% additional tariff is included. - 30% special tariff applies after April 11, 2025.

✅ HS CODE: 3925900000

Product Description: Other plastic strip for medical use

Total Tax Rate: 60.3%

Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Key Notes: - 25% additional tariff is included. - 30% special tariff applies after April 11, 2025.

📌 Proactive Advice for Users:

- Verify the material composition of the plastic strip to ensure correct classification.

- Check the unit price to determine if any preferential tariff rates apply.

- Confirm if the product requires any certifications (e.g., medical device certification, CE marking, etc.).

- Monitor the April 11, 2025, deadline for the special tariff increase.

- Consult with customs or a compliance expert if the product is part of a larger kit or bundled with other items.

Let me know if you need help determining the most appropriate HS code for your specific product. Here is the structured analysis and classification for the product "Other plastic strip For medical use" based on the provided HS codes and tax details:

✅ HS CODE: 3921905050

Product Description: Other plastic strip for medical use

Total Tax Rate: 34.8%

Breakdown:

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Key Notes: - This is the lowest tax rate among the listed HS codes. - No additional tariffs are currently applied. - Be aware of the 30% special tariff that will be imposed after April 11, 2025.

✅ HS CODE: 3916905000

Product Description: Other plastic strip for medical use

Total Tax Rate: 60.8%

Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Key Notes: - This code has the highest total tax rate. - Includes a 25% additional tariff. - 30% special tariff applies after April 11, 2025.

✅ HS CODE: 3920690000

Product Description: Other plastic strip for medical use

Total Tax Rate: 59.2%

Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Key Notes: - A 25% additional tariff is applied. - 30% special tariff applies after April 11, 2025.

✅ HS CODE: 3920100000

Product Description: Other plastic strip for medical use

Total Tax Rate: 59.2%

Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Key Notes: - Same total tax rate as 3920690000. - 25% additional tariff is included. - 30% special tariff applies after April 11, 2025.

✅ HS CODE: 3925900000

Product Description: Other plastic strip for medical use

Total Tax Rate: 60.3%

Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

Key Notes: - 25% additional tariff is included. - 30% special tariff applies after April 11, 2025.

📌 Proactive Advice for Users:

- Verify the material composition of the plastic strip to ensure correct classification.

- Check the unit price to determine if any preferential tariff rates apply.

- Confirm if the product requires any certifications (e.g., medical device certification, CE marking, etc.).

- Monitor the April 11, 2025, deadline for the special tariff increase.

- Consult with customs or a compliance expert if the product is part of a larger kit or bundled with other items.

Let me know if you need help determining the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.