Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3926203000 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3926903500 | Doc | 44.0% | CN | US | 2025-05-12 |

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

Here is the structured classification and tax information for the declared product "Other supported plastic sheets" based on the provided HS codes and tariff details:

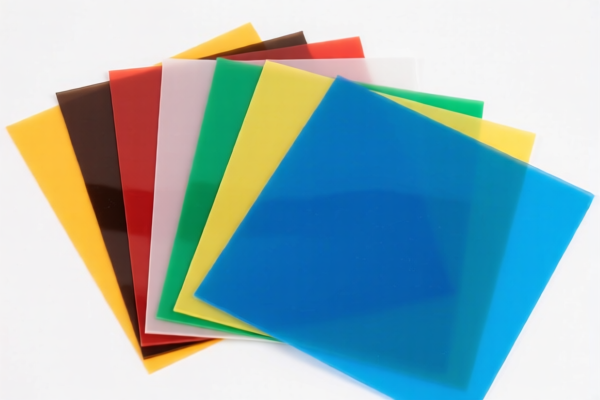

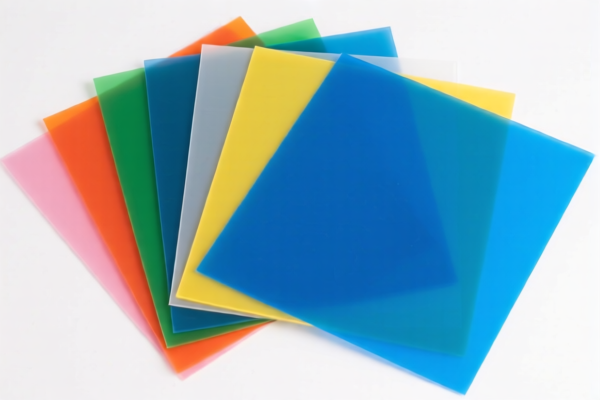

📦 Product Classification Overview: Other Supported Plastic Sheets

✅ HS CODE: 3921905050

- Description: Other plates, sheets, film, foil and strip, of plastics

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total after April 11, 2025: 34.8% (4.8% + 30.0%)

✅ HS CODE: 3921904010

- Description: Other plates, sheets, film, foil and strip, of plastics

- Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total after April 11, 2025: 34.2% (4.2% + 30.0%)

⚠️ Important Notes on Tariff Changes (April 11, 2025)

- A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025.

- This is a time-sensitive policy, so ensure your customs clearance is completed before this date if you want to avoid the extra cost.

📌 Proactive Advice for Importers

- Verify the material composition of the plastic sheets to ensure correct classification.

- Check the unit price and total value of the goods, as this may affect the application of anti-dumping duties or other trade measures.

- Confirm required certifications (e.g., RoHS, REACH, or other compliance standards) depending on the destination country.

- Consult a customs broker or expert if the product is close to the boundary of multiple HS codes.

📊 Summary of Tax Rates (April 11, 2025 onwards)

| HS Code | Base Tariff | Additional Tariff | Special Tariff (after April 11, 2025) | Total Tax Rate |

|---|---|---|---|---|

| 3921905050 | 4.8% | 0.0% | 30.0% | 34.8% |

| 3921904010 | 4.2% | 0.0% | 30.0% | 34.2% |

Let me know if you need help determining the most accurate HS code for your specific product or if you need assistance with customs documentation. Here is the structured classification and tax information for the declared product "Other supported plastic sheets" based on the provided HS codes and tariff details:

📦 Product Classification Overview: Other Supported Plastic Sheets

✅ HS CODE: 3921905050

- Description: Other plates, sheets, film, foil and strip, of plastics

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total after April 11, 2025: 34.8% (4.8% + 30.0%)

✅ HS CODE: 3921904010

- Description: Other plates, sheets, film, foil and strip, of plastics

- Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total after April 11, 2025: 34.2% (4.2% + 30.0%)

⚠️ Important Notes on Tariff Changes (April 11, 2025)

- A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025.

- This is a time-sensitive policy, so ensure your customs clearance is completed before this date if you want to avoid the extra cost.

📌 Proactive Advice for Importers

- Verify the material composition of the plastic sheets to ensure correct classification.

- Check the unit price and total value of the goods, as this may affect the application of anti-dumping duties or other trade measures.

- Confirm required certifications (e.g., RoHS, REACH, or other compliance standards) depending on the destination country.

- Consult a customs broker or expert if the product is close to the boundary of multiple HS codes.

📊 Summary of Tax Rates (April 11, 2025 onwards)

| HS Code | Base Tariff | Additional Tariff | Special Tariff (after April 11, 2025) | Total Tax Rate |

|---|---|---|---|---|

| 3921905050 | 4.8% | 0.0% | 30.0% | 34.8% |

| 3921904010 | 4.2% | 0.0% | 30.0% | 34.2% |

Let me know if you need help determining the most accurate HS code for your specific product or if you need assistance with customs documentation.

Customer Reviews

No reviews yet.