Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4421999400 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4418999195 | Doc | 58.2% | CN | US | 2025-05-12 |

| 4418890000 | Doc | 58.2% | CN | US | 2025-05-12 |

| 4418920000 | Doc | 58.2% | CN | US | 2025-05-12 |

| 6808000000 | Doc | 55.0% | CN | US | 2025-05-12 |

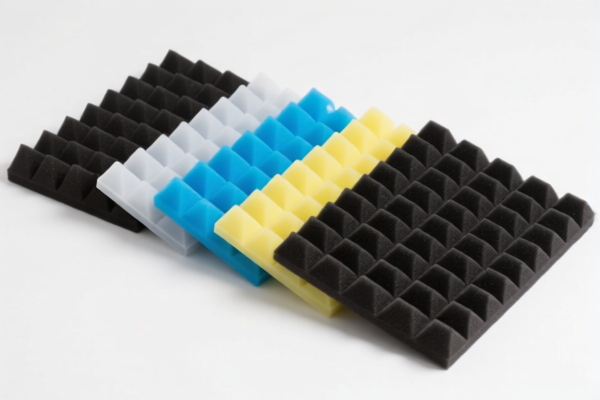

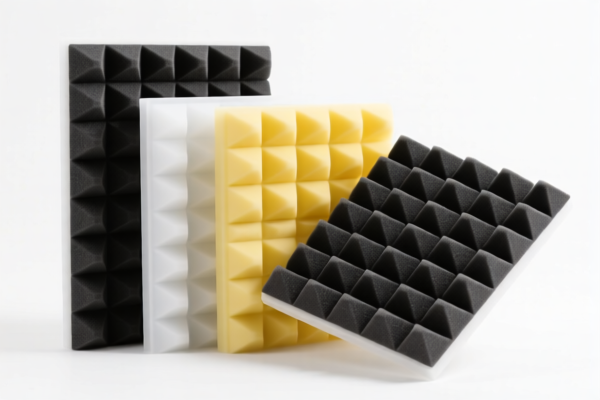

Product Classification: Other Wood Soundproofing Panels

HS CODE: 4421999400

🔍 Classification Summary

- Product Category: Other wooden articles, including edge-glued wood and wooden soundproofing panels.

- HS Code: 4421999400 (10-digit code).

- Tariff Summary: 55.0% total tax rate.

📊 Tariff Breakdown

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is wood-based, not metal).

⚠️ Time-Sensitive Policy Alert

- April 11, 2025 Special Tariff: If your product is imported after April 11, 2025, an additional 30.0% tariff will apply.

- This is a significant increase from the standard 25.0% additional tariff.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is wood-based and not made from composite materials (e.g., particle board or fiberboard), which may fall under a different HS code (e.g., 6808000000).

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., soundproofing standards, environmental compliance) are required for import.

- Review Documentation: Ensure proper product descriptions and technical specifications are included in customs declarations to avoid misclassification.

🔄 Alternative HS Codes for Reference

- 4418999195 – For general wooden carpentry and joinery products (not soundproofing-specific).

- 4418890000 – For engineered wood products like honeycomb panels or assembled floor boards.

- 6808000000 – For fiberboard or particle board made from wood waste and bonded with mineral adhesives (not suitable for soundproofing panels unless composite).

✅ Conclusion

For wooden soundproofing panels, the most accurate HS code is 4421999400, with a total tax rate of 55.0%. Be mindful of the April 11, 2025 tariff increase and ensure your product is correctly classified to avoid delays or penalties.

Product Classification: Other Wood Soundproofing Panels

HS CODE: 4421999400

🔍 Classification Summary

- Product Category: Other wooden articles, including edge-glued wood and wooden soundproofing panels.

- HS Code: 4421999400 (10-digit code).

- Tariff Summary: 55.0% total tax rate.

📊 Tariff Breakdown

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is wood-based, not metal).

⚠️ Time-Sensitive Policy Alert

- April 11, 2025 Special Tariff: If your product is imported after April 11, 2025, an additional 30.0% tariff will apply.

- This is a significant increase from the standard 25.0% additional tariff.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is wood-based and not made from composite materials (e.g., particle board or fiberboard), which may fall under a different HS code (e.g., 6808000000).

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., soundproofing standards, environmental compliance) are required for import.

- Review Documentation: Ensure proper product descriptions and technical specifications are included in customs declarations to avoid misclassification.

🔄 Alternative HS Codes for Reference

- 4418999195 – For general wooden carpentry and joinery products (not soundproofing-specific).

- 4418890000 – For engineered wood products like honeycomb panels or assembled floor boards.

- 6808000000 – For fiberboard or particle board made from wood waste and bonded with mineral adhesives (not suitable for soundproofing panels unless composite).

✅ Conclusion

For wooden soundproofing panels, the most accurate HS code is 4421999400, with a total tax rate of 55.0%. Be mindful of the April 11, 2025 tariff increase and ensure your product is correctly classified to avoid delays or penalties.

Customer Reviews

No reviews yet.