| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919101010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3919905010 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919905060 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919101050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3919905010 | Doc | 60.8% | CN | US | 2025-05-12 |

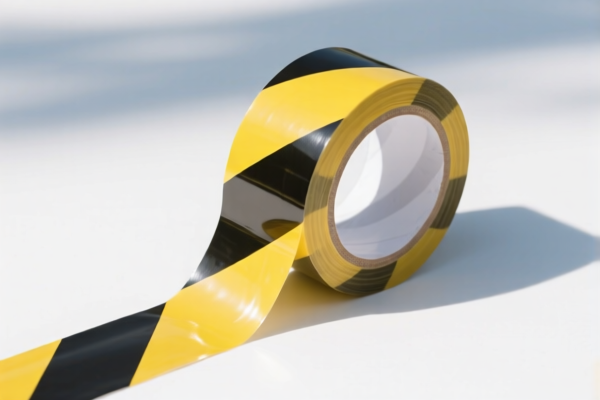

Product Classification: Outdoor Reflective Self-Adhesive Warning Tape

HS CODE: 3919.10.10.10, 3919.90.50.10, 3919.90.50.60, 3919.10.10.50, 3919.90.50.10 (multiple applicable codes based on product specifics)

Tariff Overview (as of current policy)

- Base Tariff Rate: 5.8% to 6.5% (varies by HS code)

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8% to 61.5% (varies by HS code)

Key Tax Rate Changes and Notes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all applicable HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for this product category (iron and aluminum are not relevant here).

Classification Considerations

- Material and Design:

The product is classified under Chapter 39 (Plastics and articles thereof), specifically under Heading 3919 (Self-adhesive plates, sheets, films, foils, tapes, strips, etc., of plastics, whether or not self-adhesive). - 3919.10.10 is for self-adhesive tapes with reflective surfaces made of glass beads.

-

3919.90.50 is for other self-adhesive reflective plastic products.

-

Width Matters:

Some codes (e.g., 3919.10.10.50) specify that the product must be no more than 20 cm in width. Ensure your product meets this requirement if using this code.

Proactive Advice for Importers

-

Verify Material and Unit Price:

Confirm the exact composition (e.g., whether it contains glass beads or other reflective materials) and unit price to ensure correct classification. -

Check Required Certifications:

Some products may require safety certifications or compliance with local standards (e.g., traffic safety regulations, fire resistance, etc.). -

Monitor Tariff Updates:

Keep track of the April 11, 2025 deadline for the special tariff. This could significantly impact your import costs. -

Consult Customs Broker:

For complex classifications or large volumes, consider engaging a customs broker or customs clearance expert to avoid misclassification penalties.

Summary of Applicable HS Codes and Tax Rates

| HS CODE | Description | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tax Rate |

|---|---|---|---|---|---|

| 3919.10.10.10 | Reflective self-adhesive road marking tape | 6.5% | 25.0% | 30.0% | 61.5% |

| 3919.90.50.10 | Reflective self-adhesive plastic tape | 5.8% | 25.0% | 30.0% | 60.8% |

| 3919.90.50.60 | Reflective self-adhesive plastic tape | 5.8% | 25.0% | 30.0% | 60.8% |

| 3919.10.10.50 | Reflective self-adhesive tape (≤20cm) | 6.5% | 25.0% | 30.0% | 61.5% |

If you provide more details about the product (e.g., width, material, use case), I can help you further narrow down the most accurate HS code.

Product Classification: Outdoor Reflective Self-Adhesive Warning Tape

HS CODE: 3919.10.10.10, 3919.90.50.10, 3919.90.50.60, 3919.10.10.50, 3919.90.50.10 (multiple applicable codes based on product specifics)

Tariff Overview (as of current policy)

- Base Tariff Rate: 5.8% to 6.5% (varies by HS code)

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8% to 61.5% (varies by HS code)

Key Tax Rate Changes and Notes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all applicable HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for this product category (iron and aluminum are not relevant here).

Classification Considerations

- Material and Design:

The product is classified under Chapter 39 (Plastics and articles thereof), specifically under Heading 3919 (Self-adhesive plates, sheets, films, foils, tapes, strips, etc., of plastics, whether or not self-adhesive). - 3919.10.10 is for self-adhesive tapes with reflective surfaces made of glass beads.

-

3919.90.50 is for other self-adhesive reflective plastic products.

-

Width Matters:

Some codes (e.g., 3919.10.10.50) specify that the product must be no more than 20 cm in width. Ensure your product meets this requirement if using this code.

Proactive Advice for Importers

-

Verify Material and Unit Price:

Confirm the exact composition (e.g., whether it contains glass beads or other reflective materials) and unit price to ensure correct classification. -

Check Required Certifications:

Some products may require safety certifications or compliance with local standards (e.g., traffic safety regulations, fire resistance, etc.). -

Monitor Tariff Updates:

Keep track of the April 11, 2025 deadline for the special tariff. This could significantly impact your import costs. -

Consult Customs Broker:

For complex classifications or large volumes, consider engaging a customs broker or customs clearance expert to avoid misclassification penalties.

Summary of Applicable HS Codes and Tax Rates

| HS CODE | Description | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tax Rate |

|---|---|---|---|---|---|

| 3919.10.10.10 | Reflective self-adhesive road marking tape | 6.5% | 25.0% | 30.0% | 61.5% |

| 3919.90.50.10 | Reflective self-adhesive plastic tape | 5.8% | 25.0% | 30.0% | 60.8% |

| 3919.90.50.60 | Reflective self-adhesive plastic tape | 5.8% | 25.0% | 30.0% | 60.8% |

| 3919.10.10.50 | Reflective self-adhesive tape (≤20cm) | 6.5% | 25.0% | 30.0% | 61.5% |

If you provide more details about the product (e.g., width, material, use case), I can help you further narrow down the most accurate HS code.

Customer Reviews

No reviews yet.