| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4601298000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3921901910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921901910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 6301400020 | Doc | 38.5% | CN | US | 2025-05-12 |

| 5702505900 | Doc | 57.7% | CN | US | 2025-05-12 |

| 4601990500 | Doc | 57.7% | CN | US | 2025-05-12 |

| 5515190020 | Doc | 67.0% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Outdoor Vegetable Fiber Woven Mats, based on the provided HS codes and tax details:

📦 Product Classification Overview: Outdoor Vegetable Fiber Woven Mats

✅ HS CODE: 4601298000

Product Description: Plant Fiber Mats (e.g., natural fiber ground mats)

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Note: This is the most likely code for natural vegetable fiber woven mats used outdoors.

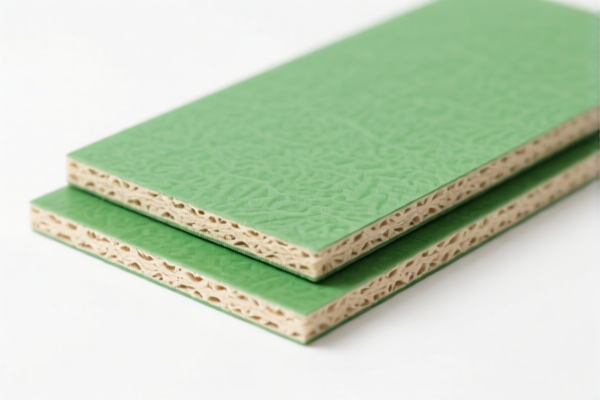

✅ HS CODE: 3921901910

Product Description: Plant Fiber Plastic Mats / Plant Fiber Plastic Table Mats

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Note: Applicable for plant fiber mats with plastic components or plastic-coated mats.

✅ HS CODE: 6301400020

Product Description: Outdoor Synthetic Fiber Blankets (e.g., picnic blankets)

- Base Tariff Rate: 8.5%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 38.5%

- Note: This code is for synthetic fiber blankets, not natural vegetable fiber. Use with caution if the product is 100% natural fiber.

✅ HS CODE: 5702505900

Product Description: Outdoor Woven Carpets (e.g., woven mats)

- Base Tariff Rate: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

- Note: This is for woven carpets, which may include vegetable fiber woven mats if they are used as floor coverings.

✅ HS CODE: 4601990500

Product Description: Polyethylene Woven Picnic Mats

- Base Tariff Rate: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

- Note: This is for polyethylene (plastic) woven mats, not vegetable fiber. Ensure the product is 100% vegetable fiber to avoid misclassification.

✅ HS CODE: 5515190020

Product Description: Polyester Fiber Picnic Mats

- Base Tariff Rate: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 67.0%

- Note: This is for polyester fiber mats, not vegetable fiber. Confirm the material is 100% vegetable fiber.

📌 Key Notes and Recommendations:

- Material Verification: Ensure the product is 100% vegetable fiber (e.g., jute, bamboo, hemp) and not mixed with synthetic fibers (e.g., polyethylene, polyester) or plastic components.

- Unit Price and Certification: Check if the product requires import certifications or environmental compliance documents, especially if it's for commercial use.

- April 11, 2025, Tariff Alert: All listed products will face an additional 30% tariff after this date. Plan accordingly for cost estimation.

- Avoid Misclassification: Be cautious with codes like 6301400020 (synthetic fiber blankets) or 3921901910 (plastic-coated mats), which may not apply to 100% natural vegetable fiber mats.

🛠️ Proactive Advice:

- Confirm Material Composition: Provide a material breakdown to customs to avoid misclassification.

- Check for Certifications: Some products may require eco-certifications or safety standards for import.

- Consult a Customs Broker: For high-value or complex products, consider professional customs clearance assistance.

Let me know if you need help determining the correct HS code based on a product description or image. Here is the structured classification and tariff information for Outdoor Vegetable Fiber Woven Mats, based on the provided HS codes and tax details:

📦 Product Classification Overview: Outdoor Vegetable Fiber Woven Mats

✅ HS CODE: 4601298000

Product Description: Plant Fiber Mats (e.g., natural fiber ground mats)

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Note: This is the most likely code for natural vegetable fiber woven mats used outdoors.

✅ HS CODE: 3921901910

Product Description: Plant Fiber Plastic Mats / Plant Fiber Plastic Table Mats

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Note: Applicable for plant fiber mats with plastic components or plastic-coated mats.

✅ HS CODE: 6301400020

Product Description: Outdoor Synthetic Fiber Blankets (e.g., picnic blankets)

- Base Tariff Rate: 8.5%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 38.5%

- Note: This code is for synthetic fiber blankets, not natural vegetable fiber. Use with caution if the product is 100% natural fiber.

✅ HS CODE: 5702505900

Product Description: Outdoor Woven Carpets (e.g., woven mats)

- Base Tariff Rate: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

- Note: This is for woven carpets, which may include vegetable fiber woven mats if they are used as floor coverings.

✅ HS CODE: 4601990500

Product Description: Polyethylene Woven Picnic Mats

- Base Tariff Rate: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

- Note: This is for polyethylene (plastic) woven mats, not vegetable fiber. Ensure the product is 100% vegetable fiber to avoid misclassification.

✅ HS CODE: 5515190020

Product Description: Polyester Fiber Picnic Mats

- Base Tariff Rate: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 67.0%

- Note: This is for polyester fiber mats, not vegetable fiber. Confirm the material is 100% vegetable fiber.

📌 Key Notes and Recommendations:

- Material Verification: Ensure the product is 100% vegetable fiber (e.g., jute, bamboo, hemp) and not mixed with synthetic fibers (e.g., polyethylene, polyester) or plastic components.

- Unit Price and Certification: Check if the product requires import certifications or environmental compliance documents, especially if it's for commercial use.

- April 11, 2025, Tariff Alert: All listed products will face an additional 30% tariff after this date. Plan accordingly for cost estimation.

- Avoid Misclassification: Be cautious with codes like 6301400020 (synthetic fiber blankets) or 3921901910 (plastic-coated mats), which may not apply to 100% natural vegetable fiber mats.

🛠️ Proactive Advice:

- Confirm Material Composition: Provide a material breakdown to customs to avoid misclassification.

- Check for Certifications: Some products may require eco-certifications or safety standards for import.

- Consult a Customs Broker: For high-value or complex products, consider professional customs clearance assistance.

Let me know if you need help determining the correct HS code based on a product description or image.

Customer Reviews

No reviews yet.