| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 7607113000 | Doc | 35.8% | CN | US | 2025-05-12 |

| 7607116010 | Doc | 35.3% | CN | US | 2025-05-12 |

| 7616910000 | Doc | 57.5% | CN | US | 2025-05-12 |

| 7616991000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 3919905060 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919905040 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 8307906000 | Doc | 58.8% | CN | US | 2025-05-12 |

| 8307903000 | Doc | 58.8% | CN | US | 2025-05-12 |

| 8311900000 | Doc | 55.0% | CN | US | 2025-05-12 |

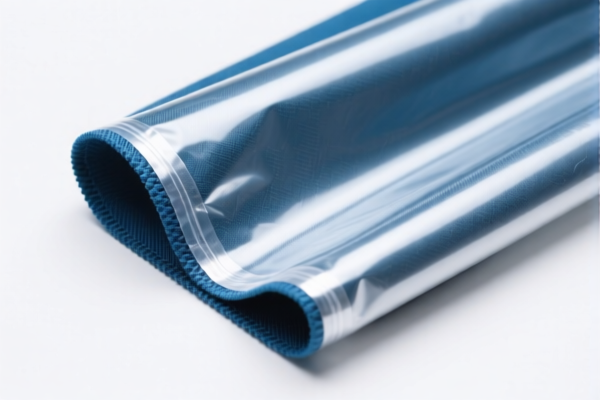

Here's a classification of "PACKAGING TIN FOIL" based on the provided reference data, presented in a structured format:

-

7607.11.30.00 – Aluminum foil (whether or not printed, or backed with paper, paperboard, plastics or similar backing materials) of a thickness (excluding any backing) not exceeding 0.2 mm: Not backed: Rolled but not further worked: Of a thickness not exceeding 0.15 mm.

- 76 – Aluminum and aluminum articles.

- 07 – Aluminum foil.

- 11 – Not backed.

- 30 – Rolled but not further worked, thickness ≤ 0.15mm.

- Note: This HS code is suitable if the foil is not backed with any material (paper, plastic, etc.) and has a thickness of 0.15mm or less.

-

7607.11.60.10 – Aluminum foil (whether or not printed, or backed with paper, paperboard, plastics or similar backing materials) of a thickness (excluding any backing) not exceeding 0.2 mm: Not backed: Rolled but not further worked: Of a thickness exceeding 0.01 mm: Boxed aluminum foil weighing not more than 11.3 kg.

- 76 – Aluminum and aluminum articles.

- 07 – Aluminum foil.

- 11 – Not backed.

- 60 – Rolled but not further worked, thickness > 0.01mm, boxed ≤ 11.3kg.

- Note: This applies if the foil is not backed, has a thickness greater than 0.01mm, and is packaged in boxes weighing 11.3 kg or less.

Important Considerations & Recommendations:

- Backing Material: The presence or absence of a backing material (paper, plastic, etc.) is crucial for correct classification. Carefully verify the composition of the packaging tin foil.

- Thickness: Accurate measurement of the foil's thickness is essential. Use a precise measuring instrument.

- Weight: If the foil is boxed, confirm the net weight of each box.

- Further Processing: If the foil has undergone any further processing (e.g., cutting, shaping), it may fall under a different HS code.

- Tax Rate: The total tax rate for both HS codes is currently 35.8% and 35.3% respectively, but this is subject to change, especially after April 2, 2025, when additional tariffs may apply.

- Certification: Depending on the intended use of the packaging tin foil (e.g., food contact), specific certifications may be required.

- Material Composition: Confirm the exact alloy composition of the aluminum foil. This can affect classification and potential tariff implications.

Customer Reviews

I was looking for the right HS code for my aluminum foil packaging, and this page provided all the necessary details. Highly recommend it!

The information is good, but I found it a bit overwhelming with so many HS codes. I had to do extra research to narrow it down.

The tariff rates and detailed explanations helped me understand the tax implications for exporting aluminum foil to the US. Very helpful!

Great breakdown of the HS codes for aluminum foil. The 7607.11.30.00 code was exactly what I needed for my packaging project.