| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 84798965 | Doc | Error | CN | US | 2025-05-12 |

| 8304000000 | Doc | 33.9% | CN | US | 2025-05-12 |

Okay, here's a breakdown of the HS codes provided for your "PAPER SHREDDER" declaration, along with relevant customs information. I'll aim to be clear, structured, and provide helpful advice.

Understanding the HS Codes

Let's analyze each code individually:

1. HS Code: 8479.89.65 – Machines and mechanical appliances having individual functions, not specified or included elsewhere in this chapter; parts thereof

- 84: Chapter 84 covers "Nuclear reactors, boilers, machinery and mechanical appliances; parts thereof." This is a broad category for many types of machines.

- 8479: Specifically, this narrows down to "Machines and mechanical appliances having individual functions; parts thereof." This means the item isn't a complete, complex system, but performs a specific task.

- 8479.89: Further refined to "Other machines and mechanical appliances." This indicates it doesn't fit into more specific categories within 8479.

- 8479.89.65: This is the most detailed level, specifying "Electromechanical appliances with self-contained electric motor: Other". This is likely the correct code for a standard electric paper shredder.

Tax Information:

- Tax Detail: "Failed to retrieve tax information" – This is concerning. It means the system couldn't automatically determine the applicable tax rate. You must manually verify this.

- Total Tax: "Error" – Confirms the tax calculation couldn't be completed.

Important Considerations for 8479.89.65:

- Motor Specification: The description highlights "self-contained electric motor." Ensure the shredder does have its own integrated motor. If it relies on an external power source in a unique way, this code might be incorrect.

- Functionality: Confirm the shredder's primary function is solely shredding paper. If it has additional features (e.g., binding, stapling), it might fall under a different HS code.

- Material: The material composition of the shredder (metal, plastic, etc.) can sometimes influence classification.

2. HS Code: 8304.00.00.00 – Desk-top filing or card-index cabinets, paper trays, paper rests, pen trays, office-stamp stands and similar office or desk equipment and parts thereof, of base metal, other than office furniture of heading 9403

- 83: Chapter 83 covers "Miscellaneous articles of base metal."

- 8304: Specifically, this covers "Articles of base metal, other than those of heading 8301, 8302, 8305 or 8306; parts thereof."

- 8304.00: This narrows it down to "Desk-top filing or card-index cabinets, paper trays, paper rests, pen trays, office-stamp stands and similar office or desk equipment and parts thereof, of base metal, other than office furniture of heading 9403."

- 8304.00.00.00: This is the most detailed level.

Tax Information:

- 基础关税 (Basic Tariff): 3.9%

- 加征关税 (Additional Tariff): 0.0% (currently)

- 2025.4.2后加征关税 (Additional Tariff after April 2, 2025): 30% – This is a critical date to be aware of! The tariff rate will significantly increase after this date.

- Total Tax: 33.9% (current rate)

Important Considerations for 8304.00.00.00:

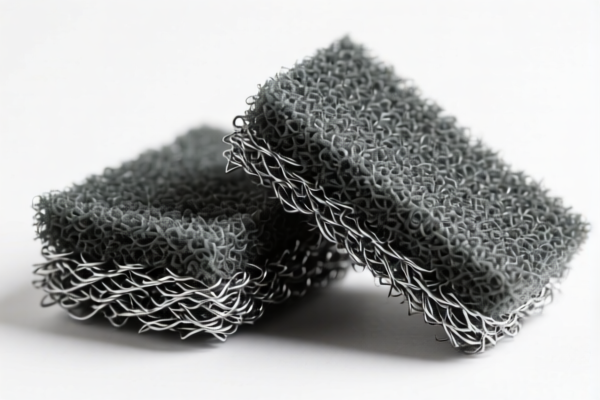

- Base Metal: The item must be made of base metal (e.g., steel, aluminum, iron). If it's primarily plastic, this code is incorrect.

- Office Equipment: It needs to be clearly classified as office or desk equipment.

- Not Furniture: It cannot be considered office furniture as defined under heading 9403.

Recommendations & Next Steps:

- Verify Tax Rates (Crucial): For 8479.89.65, you must manually confirm the applicable tax rate with your local customs authority or a customs broker. The "Failed to retrieve tax information" error is a red flag.

- Material Confirmation: Double-check the primary material composition of the paper shredder. This is vital for both HS codes.

- Functionality Review: Ensure the shredder's primary function aligns with the HS code descriptions.

- Date Awareness: If importing after April 2, 2025, factor in the 30% additional tariff for 8304.00.00.00.

- Consider a Binding Ruling: If you're unsure about the correct classification, especially for 8479.89.65, consider applying for a binding ruling from your customs authority. This provides legal certainty.

- Invoice Details: Ensure your commercial invoice clearly describes the paper shredder, its materials, and its function.

Disclaimer: I am an AI and cannot provide definitive customs advice. This information is for guidance only. Always consult with a qualified customs broker or your local customs authority for accurate and up-to-date regulations.

Customer Reviews

The detailed breakdown of the HS Code classification for the paper shredder was extremely helpful. I now understand how to determine the right code based on material and function.

The page had some good info, but I was confused about why two HS codes are listed for the same product. It would have been clearer if there was a brief explanation of why there are multiple options.

I found the information about the 33.9% tariff for HS Code 8304.00.00.00 very useful, especially the note about the tariff increasing after April 2, 2025. Great job on the warning.

The detailed breakdown of HS Code 8479.89.65 was exactly what I needed for my paper shredder exports. The explanation of the tariff error was very helpful.