Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907995010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907995010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907995010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907995010 | Doc | 61.5% | CN | US | 2025-05-12 |

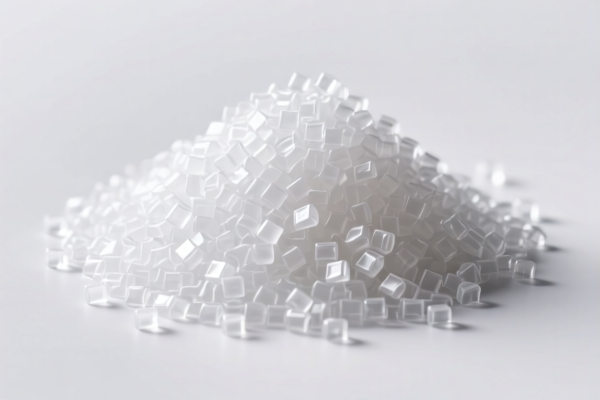

Product Classification: PBT Engineering Plastic Raw Material

HS CODE: 3907995010 (multiple entries under this code)

🔍 HS Code Interpretation and Classification

- HS CODE: 3907.99.50.10

- Description: This code specifically applies to PBT (Polybutylene Terephthalate), a type of polyester. It includes various forms of PBT such as raw materials, resins, modified plastics, and alloys.

- Applicable Products:

- PBT engineering plastic raw material

- PBT resin

- PBT modified engineering plastic

- PBT alloy material

- PBT injection molding raw material

📊 Tariff Structure and Rates

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 61.5% (6.5% + 25.0% + 30.0%)

⚠️ Important Note: The 30.0% additional tariff applies only after April 11, 2025. Ensure your import timeline aligns with this policy to avoid unexpected costs.

🛑 Anti-Dumping and Countervailing Duties

- No specific anti-dumping or countervailing duties are currently listed for PBT engineering plastic raw materials under this HS code.

- However, always verify with customs or a compliance expert if your product is subject to any specific anti-dumping duties on iron or aluminum (not applicable here, but good to be aware).

📌 Proactive Compliance Advice

- Verify Material Specifications: Confirm that your product is indeed PBT (Polybutylene Terephthalate) and not a different type of polyester or polymer.

- Check Unit Price and Packaging: Tariff rates may vary based on product form (e.g., pellets vs. powder) or packaging.

- Certifications Required: Some countries may require material safety data sheets (MSDS) or customs declarations for imported plastics.

- Monitor Policy Updates: Be aware of any new trade policies or tariff adjustments after April 11, 2025.

✅ Summary of Key Points

- HS CODE: 3907995010

- Tariff Breakdown:

- Base: 6.5%

- Additional: 25.0%

- Special (after April 11, 2025): 30.0%

- Total: 61.5%

- No Anti-Dumping Duties currently applicable

- Action Required: Confirm product composition and compliance documents before import.

Product Classification: PBT Engineering Plastic Raw Material

HS CODE: 3907995010 (multiple entries under this code)

🔍 HS Code Interpretation and Classification

- HS CODE: 3907.99.50.10

- Description: This code specifically applies to PBT (Polybutylene Terephthalate), a type of polyester. It includes various forms of PBT such as raw materials, resins, modified plastics, and alloys.

- Applicable Products:

- PBT engineering plastic raw material

- PBT resin

- PBT modified engineering plastic

- PBT alloy material

- PBT injection molding raw material

📊 Tariff Structure and Rates

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 61.5% (6.5% + 25.0% + 30.0%)

⚠️ Important Note: The 30.0% additional tariff applies only after April 11, 2025. Ensure your import timeline aligns with this policy to avoid unexpected costs.

🛑 Anti-Dumping and Countervailing Duties

- No specific anti-dumping or countervailing duties are currently listed for PBT engineering plastic raw materials under this HS code.

- However, always verify with customs or a compliance expert if your product is subject to any specific anti-dumping duties on iron or aluminum (not applicable here, but good to be aware).

📌 Proactive Compliance Advice

- Verify Material Specifications: Confirm that your product is indeed PBT (Polybutylene Terephthalate) and not a different type of polyester or polymer.

- Check Unit Price and Packaging: Tariff rates may vary based on product form (e.g., pellets vs. powder) or packaging.

- Certifications Required: Some countries may require material safety data sheets (MSDS) or customs declarations for imported plastics.

- Monitor Policy Updates: Be aware of any new trade policies or tariff adjustments after April 11, 2025.

✅ Summary of Key Points

- HS CODE: 3907995010

- Tariff Breakdown:

- Base: 6.5%

- Additional: 25.0%

- Special (after April 11, 2025): 30.0%

- Total: 61.5%

- No Anti-Dumping Duties currently applicable

- Action Required: Confirm product composition and compliance documents before import.

Customer Reviews

No reviews yet.