Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907995010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902300000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3908902000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3903905000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3908907000 | Doc | 61.5% | CN | US | 2025-05-12 |

Here is the structured and professional breakdown of the HS codes and associated tariff information for PBT extrusion grade raw materials and related products:

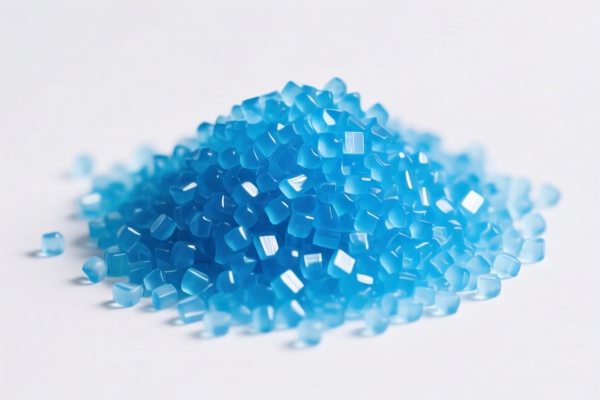

✅ Product Classification Overview: PBT Extrusion Grade Raw Material

HS CODE: 3907995010

- Product Description: PBT extrusion raw material, PBT extrusion specialty material, PBT extrusion-grade resin, PBT injection molding raw material, etc.

- Tariff Summary: 61.5%

- Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most relevant HS code for PBT extrusion-grade raw materials.

📌 Other Related HS Codes for Comparison

HS CODE: 3902300000

- Product Description: Polypropylene extrusion-grade raw material (primary form of polypropylene).

- Tariff Summary: 61.5%

- Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

HS CODE: 3908902000

- Product Description: Polyamide extrusion-grade raw material (primary form of polyamide).

- Tariff Summary: 55.0%

- Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

HS CODE: 3903905000

- Product Description: Polystyrene (PS) extrusion-grade raw material (primary form of styrene polymer).

- Tariff Summary: 61.5%

- Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

HS CODE: 3908907000

- Product Description: Polyamide extrusion-grade material (primary form of polyamide).

- Tariff Summary: 61.5%

- Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes and Recommendations

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and should be factored into cost planning.

- Anti-Dumping Duties: Not explicitly mentioned in the data, but be aware that anti-dumping duties on iron and aluminum may apply to related products. Confirm with customs or a compliance expert if applicable.

- Certifications Required: Ensure that the product meets all customs and import certification requirements, such as material specifications, origin documentation, and compliance with local regulations.

- Verify Material and Unit Price: Confirm the exact material composition and unit price to ensure correct classification and avoid misdeclaration penalties.

✅ Proactive Advice

- Double-check the HS code based on the exact chemical composition and intended use of the material.

- Consult with customs brokers or legal advisors if the product is close to the boundary of multiple HS codes.

- Monitor policy updates regarding the April 11, 2025 tariff change and any potential anti-dumping duties.

Let me know if you need help with customs documentation or tariff calculation tools. Here is the structured and professional breakdown of the HS codes and associated tariff information for PBT extrusion grade raw materials and related products:

✅ Product Classification Overview: PBT Extrusion Grade Raw Material

HS CODE: 3907995010

- Product Description: PBT extrusion raw material, PBT extrusion specialty material, PBT extrusion-grade resin, PBT injection molding raw material, etc.

- Tariff Summary: 61.5%

- Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most relevant HS code for PBT extrusion-grade raw materials.

📌 Other Related HS Codes for Comparison

HS CODE: 3902300000

- Product Description: Polypropylene extrusion-grade raw material (primary form of polypropylene).

- Tariff Summary: 61.5%

- Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

HS CODE: 3908902000

- Product Description: Polyamide extrusion-grade raw material (primary form of polyamide).

- Tariff Summary: 55.0%

- Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

HS CODE: 3903905000

- Product Description: Polystyrene (PS) extrusion-grade raw material (primary form of styrene polymer).

- Tariff Summary: 61.5%

- Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

HS CODE: 3908907000

- Product Description: Polyamide extrusion-grade material (primary form of polyamide).

- Tariff Summary: 61.5%

- Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes and Recommendations

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and should be factored into cost planning.

- Anti-Dumping Duties: Not explicitly mentioned in the data, but be aware that anti-dumping duties on iron and aluminum may apply to related products. Confirm with customs or a compliance expert if applicable.

- Certifications Required: Ensure that the product meets all customs and import certification requirements, such as material specifications, origin documentation, and compliance with local regulations.

- Verify Material and Unit Price: Confirm the exact material composition and unit price to ensure correct classification and avoid misdeclaration penalties.

✅ Proactive Advice

- Double-check the HS code based on the exact chemical composition and intended use of the material.

- Consult with customs brokers or legal advisors if the product is close to the boundary of multiple HS codes.

- Monitor policy updates regarding the April 11, 2025 tariff change and any potential anti-dumping duties.

Let me know if you need help with customs documentation or tariff calculation tools.

Customer Reviews

No reviews yet.