| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907995010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902300000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901905501 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907995010 | Doc | 61.5% | CN | US | 2025-05-12 |

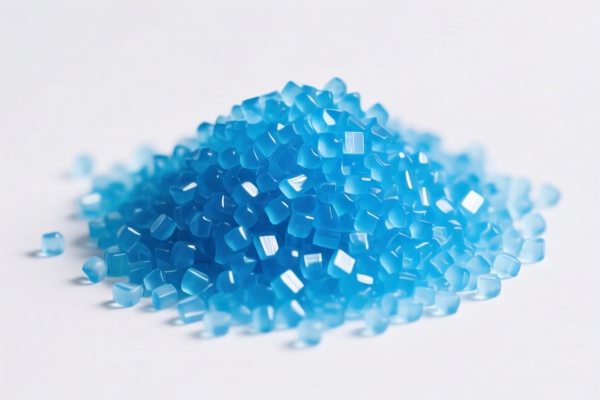

Product Classification: PBT Fiber Grade Raw Material

HS CODEs and Tax Information Summary:

- HS CODE: 3907995010

- Description: PBT fiber (Polybutylene terephthalate) falls under the category of polybutylene terephthalate, matching the description of HS CODE 3907.99.50.10.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to both general PBT fiber and food-grade PBT resin.

-

HS CODE: 3907995050

- Description: PBT resin (Polybutylene terephthalate) is a type of polyester, matching the description of HS CODE 3907.99.50.50.

- Total Tax Rate: 61.5%

-

Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3902300000

- Description: Polypropylene fiber-grade raw material fits the description of HS CODE 3902.30.00.00.

- Total Tax Rate: 61.5%

-

Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3901905501

- Description: Polyethylene copolymer fiber-grade raw material fits the description of HS CODE 3901.90.55.01.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

-

Tariff Changes After April 11, 2025:

A 30.0% additional tariff will be applied to all the above HS codes. Ensure your customs declarations are updated accordingly. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for PBT fiber-grade raw materials in the provided data. However, always verify with the latest customs notices or consult a customs broker for confirmation. -

Certifications and Documentation:

- Confirm the material specifications (e.g., whether it is food-grade or industrial-grade PBT).

- Ensure certifications (e.g., RoHS, REACH, or other relevant standards) are in place if exporting to regulated markets.

-

Verify the unit price and product description to avoid misclassification.

-

Proactive Action Required:

- Double-check the HS CODE based on the exact product composition and intended use.

- If the product is imported from a country under trade restrictions, additional duties may apply.

- Consider customs clearance services or consultation with a customs expert to avoid delays or penalties.

Let me know if you need help with HS CODE verification or customs documentation.

Product Classification: PBT Fiber Grade Raw Material

HS CODEs and Tax Information Summary:

- HS CODE: 3907995010

- Description: PBT fiber (Polybutylene terephthalate) falls under the category of polybutylene terephthalate, matching the description of HS CODE 3907.99.50.10.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to both general PBT fiber and food-grade PBT resin.

-

HS CODE: 3907995050

- Description: PBT resin (Polybutylene terephthalate) is a type of polyester, matching the description of HS CODE 3907.99.50.50.

- Total Tax Rate: 61.5%

-

Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3902300000

- Description: Polypropylene fiber-grade raw material fits the description of HS CODE 3902.30.00.00.

- Total Tax Rate: 61.5%

-

Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3901905501

- Description: Polyethylene copolymer fiber-grade raw material fits the description of HS CODE 3901.90.55.01.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

-

Tariff Changes After April 11, 2025:

A 30.0% additional tariff will be applied to all the above HS codes. Ensure your customs declarations are updated accordingly. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for PBT fiber-grade raw materials in the provided data. However, always verify with the latest customs notices or consult a customs broker for confirmation. -

Certifications and Documentation:

- Confirm the material specifications (e.g., whether it is food-grade or industrial-grade PBT).

- Ensure certifications (e.g., RoHS, REACH, or other relevant standards) are in place if exporting to regulated markets.

-

Verify the unit price and product description to avoid misclassification.

-

Proactive Action Required:

- Double-check the HS CODE based on the exact product composition and intended use.

- If the product is imported from a country under trade restrictions, additional duties may apply.

- Consider customs clearance services or consultation with a customs expert to avoid delays or penalties.

Let me know if you need help with HS CODE verification or customs documentation.

Customer Reviews

No reviews yet.