| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907995010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

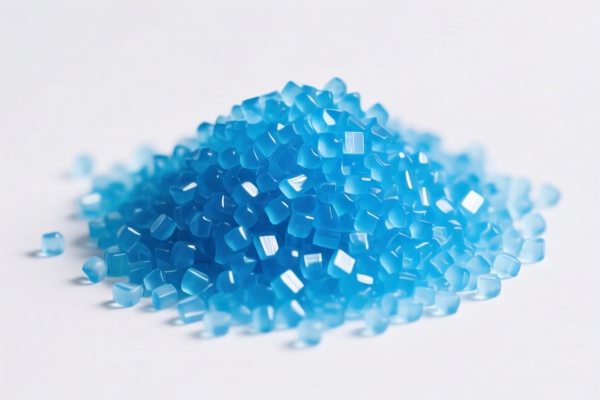

Product Classification: PBT Injection Molding Grade Raw Material

HS CODE:

- 3907995010 (PBT injection molding grade resin, specialized for injection molding)

- 3907995050 (PBT resin raw material, general polyester category)

🔍 Classification Summary

- PBT (Polybutylene Terephthalate) is a type of polyester used in injection molding applications.

- Both HS codes 3907995010 and 3907995050 fall under the broader category of polyester resins (HS Chapter 39, Heading 3907).

- The difference lies in the specific application (injection molding grade vs. general-purpose resin).

📊 Tariff Overview

Base Tariff Rate: 6.5%

Additional Tariff (General): 25.0%

Special Tariff (After April 11, 2025): 30.0%

Total Tax Rate: 61.5% (6.5% + 25.0% + 30.0%)

⏰ Time-Sensitive Policy Alert

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025.

- This is a critical date for customs clearance and cost estimation.

- Ensure your import timeline is aligned with this policy change.

🛑 Anti-Dumping Duties

- Not applicable for PBT resin (not an iron or aluminum product).

- No current anti-dumping duties are imposed on this product category.

📌 Proactive Advice for Importers

- Verify Material Specifications: Confirm that the product is indeed PBT resin and not a blend or modified version.

- Check Unit Price and Certification: Ensure proper documentation (e.g., material safety data sheet, technical specifications) is available for customs inspection.

- Consult Tariff Updates: Monitor any changes in HS code classifications or additional tariffs after April 11, 2025.

- Consider Alternative HS Codes: If the product is a blend or modified PBT, double-check for possible reclassification.

Let me know if you need help with customs documentation, certification requirements, or tariff calculation tools.

Product Classification: PBT Injection Molding Grade Raw Material

HS CODE:

- 3907995010 (PBT injection molding grade resin, specialized for injection molding)

- 3907995050 (PBT resin raw material, general polyester category)

🔍 Classification Summary

- PBT (Polybutylene Terephthalate) is a type of polyester used in injection molding applications.

- Both HS codes 3907995010 and 3907995050 fall under the broader category of polyester resins (HS Chapter 39, Heading 3907).

- The difference lies in the specific application (injection molding grade vs. general-purpose resin).

📊 Tariff Overview

Base Tariff Rate: 6.5%

Additional Tariff (General): 25.0%

Special Tariff (After April 11, 2025): 30.0%

Total Tax Rate: 61.5% (6.5% + 25.0% + 30.0%)

⏰ Time-Sensitive Policy Alert

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025.

- This is a critical date for customs clearance and cost estimation.

- Ensure your import timeline is aligned with this policy change.

🛑 Anti-Dumping Duties

- Not applicable for PBT resin (not an iron or aluminum product).

- No current anti-dumping duties are imposed on this product category.

📌 Proactive Advice for Importers

- Verify Material Specifications: Confirm that the product is indeed PBT resin and not a blend or modified version.

- Check Unit Price and Certification: Ensure proper documentation (e.g., material safety data sheet, technical specifications) is available for customs inspection.

- Consult Tariff Updates: Monitor any changes in HS code classifications or additional tariffs after April 11, 2025.

- Consider Alternative HS Codes: If the product is a blend or modified PBT, double-check for possible reclassification.

Let me know if you need help with customs documentation, certification requirements, or tariff calculation tools.

Customer Reviews

No reviews yet.