| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907995010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902900050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907995010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907995010 | Doc | 61.5% | CN | US | 2025-05-12 |

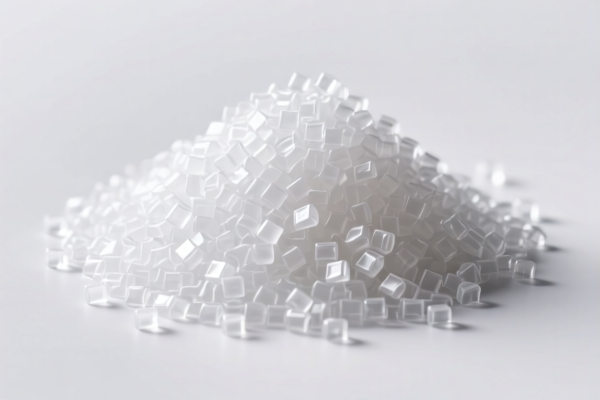

Product Classification: PBT Modified Plastic Raw Material

HS CODEs and Tax Information Summary:

- HS CODE: 3907995010

- Product Description: PBT modified plastic raw material, PBT reinforced modified resin, PBT injection molding raw material (all fall under the category of polyester).

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is used for multiple product types, including PBT modified plastics, reinforced resins, and injection molding materials.

-

HS CODE: 3907995050

- Product Description: PBT resin raw material (polyester category).

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3902900050

- Product Description: PP modified plastic (polypropylene polymer).

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Tax Rate Changes (April 11, 2025 onwards):

- All listed HS codes will face an additional 30.0% tariff after April 11, 2025.

- This is a time-sensitive policy, and the increase may significantly impact import costs.

🛑 Anti-Dumping Duties (if applicable):

- Not specified in the data, but if the product is imported from countries under anti-dumping investigations (e.g., certain countries in Asia), additional duties may apply.

- Recommendation: Confirm the country of origin and check for any anti-dumping or countervailing duties applicable to the product.

📌 Proactive Advice:

- Verify the exact material composition (e.g., PBT, PP, or other polymers) to ensure correct HS code classification.

- Check the unit price and total value for potential impact from the 30% special tariff.

- Confirm required certifications (e.g., REACH, RoHS, or customs documentation) for compliance.

- Consult a customs broker or tax expert for accurate tariff calculation and documentation preparation.

Let me know if you need help with HS code verification or customs documentation.

Product Classification: PBT Modified Plastic Raw Material

HS CODEs and Tax Information Summary:

- HS CODE: 3907995010

- Product Description: PBT modified plastic raw material, PBT reinforced modified resin, PBT injection molding raw material (all fall under the category of polyester).

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is used for multiple product types, including PBT modified plastics, reinforced resins, and injection molding materials.

-

HS CODE: 3907995050

- Product Description: PBT resin raw material (polyester category).

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3902900050

- Product Description: PP modified plastic (polypropylene polymer).

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Tax Rate Changes (April 11, 2025 onwards):

- All listed HS codes will face an additional 30.0% tariff after April 11, 2025.

- This is a time-sensitive policy, and the increase may significantly impact import costs.

🛑 Anti-Dumping Duties (if applicable):

- Not specified in the data, but if the product is imported from countries under anti-dumping investigations (e.g., certain countries in Asia), additional duties may apply.

- Recommendation: Confirm the country of origin and check for any anti-dumping or countervailing duties applicable to the product.

📌 Proactive Advice:

- Verify the exact material composition (e.g., PBT, PP, or other polymers) to ensure correct HS code classification.

- Check the unit price and total value for potential impact from the 30% special tariff.

- Confirm required certifications (e.g., REACH, RoHS, or customs documentation) for compliance.

- Consult a customs broker or tax expert for accurate tariff calculation and documentation preparation.

Let me know if you need help with HS code verification or customs documentation.

Customer Reviews

No reviews yet.