| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8487900080 | Doc | 83.9% | CN | US | 2025-05-12 |

| 8487900040 | Doc | 58.9% | CN | US | 2025-05-12 |

| 8537109170 | Doc | 57.7% | CN | US | 2025-05-12 |

| 8537109150 | Doc | 57.7% | CN | US | 2025-05-12 |

| 8534000070 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8534000095 | Doc | 55.0% | CN | US | 2025-05-12 |

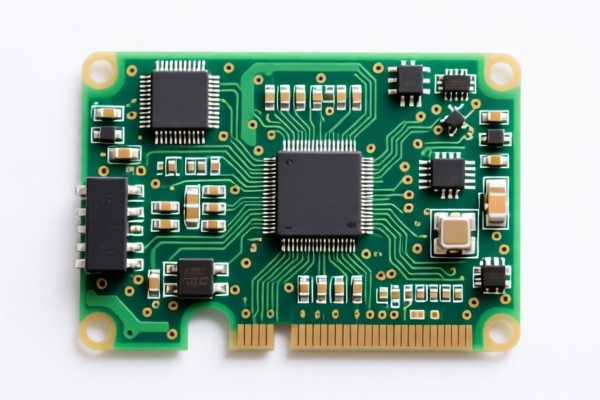

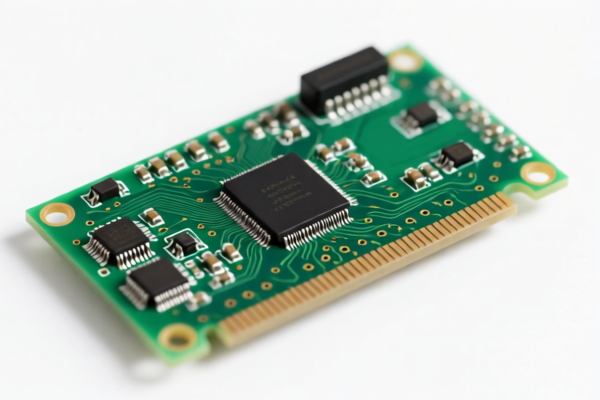

PCB BOARD KIT HS Code Classification

Based on the provided reference data and the user input "PCB BOARD KIT", here's a breakdown of potential HS code classifications. Given the broad nature of "PCB BOARD KIT", multiple codes may apply depending on the kit's specific components and characteristics.

Important Note: A "kit" classification is often complex. The final determination depends on the predominant component and the kit's purpose. The following assumes different compositions of the kit.

1. Printed Circuits - Plastics Impregnated, Not Flexible Type (8534000070)

- HS Code:

8534000070 - Breakdown:

85: Electrical machinery and equipment, their parts; sound recording or reproducing apparatus, television-image multiplier tubes.34: Printed circuits.00: Further specifies the type of printed circuit.00: Details the specific type - plastics impregnated, not flexible.

- Description: This code applies if the kit primarily consists of pre-fabricated, plastics-impregnated printed circuit boards that are not flexible. This is common for many hobbyist or prototyping kits.

- Tax Rate: 55.0% (Base Tariff: 0.0%, Additional Tariff: 25.0%, Post-April 2, 2025: 30.0%)

- Considerations: If the boards are flexible, this code is incorrect.

2. Printed Circuits - Other (8534000095)

- HS Code:

8534000095 - Breakdown: Same as above, except

000095indicates "other" printed circuits. - Description: This code applies if the kit contains printed circuits that don't fall into the more specific categories (e.g., metal-based, single-sided, double-sided, multilayer). This is a broader category.

- Tax Rate: 55.0% (Base Tariff: 0.0%, Additional Tariff: 25.0%, Post-April 2, 2025: 30.0%)

- Considerations: If a more specific code applies (e.1ofrayoukitof=ofofofofofofofofofofofofofofofofofofofofofofofofofofofofofofof

Customer Reviews

The information on HS Code 8487900080 and the associated tariff rate of 83.9% was helpful. The page is a bit dense, but it's well-structured and easy to follow once you get into it.

I was looking for HS code 8534000095 for a PCB kit I'm exporting. This page gave me all the details I needed, including the tariff rate and the breakdown of the code. Great resource!

The page provided a good explanation of the different HS codes for PCB boards. I wish there were more examples of kits that fall under each category, but it's still very helpful.

The detailed breakdown of HS Code 8534000070 was exactly what I needed for my PCB kit exports. The tariff rates and classifications are clear and accurate.

Perfect resource for understanding HS code 3925 and the associated tariffs. Highly recommend this page to anyone exporting plastic doors.