| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917400080 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917330000 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

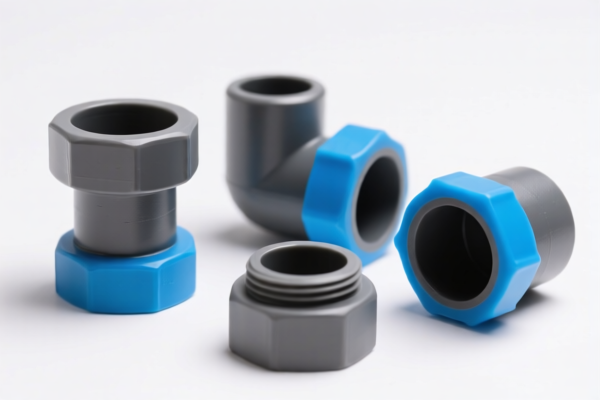

Product Name: PE Plastic Irrigation Pipe Fittings

Classification: Plastic pipe fittings and accessories

Here is the detailed HS code classification and tariff information for your product:

✅ HS CODE: 3917400080

Description: PE plastic irrigation pipe fittings, classified as other fittings.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3917400095

Description: Plastic pipe fittings, classified as other fittings.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3917390050

Description: Agricultural irrigation pipe fittings, classified as plastic pipe fittings.

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.1%

✅ HS CODE: 3917330000

Description: PE agricultural irrigation pipes, classified as non-reinforced or combined with other materials plastic pipes.

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.1%

✅ HS CODE: 3917320050

Description: Plastic irrigation pipes, classified as non-reinforced or combined with other materials plastic pipes.

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff is applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning.

- No Anti-Dumping Duties: No specific anti-dumping duties are mentioned for this product category.

- Material and Certification: Ensure the product is indeed made of PE (polyethylene) and confirm if any certifications (e.g., ISO, CE, or local standards) are required for import.

- Unit Price and Classification: Verify the exact product description and unit price to ensure correct HS code classification and avoid misclassification penalties.

📌 Proactive Advice:

- Confirm the material composition (e.g., PE, PVC, etc.) and intended use (e.g., agricultural, industrial) to ensure accurate HS code selection.

- Check with customs or a qualified customs broker to confirm the most up-to-date classification and tax rates.

- If importing in large quantities, consider pre-clearance or customs compliance audits to avoid delays or penalties.

Let me know if you need help with customs documentation or classification confirmation.

Product Name: PE Plastic Irrigation Pipe Fittings

Classification: Plastic pipe fittings and accessories

Here is the detailed HS code classification and tariff information for your product:

✅ HS CODE: 3917400080

Description: PE plastic irrigation pipe fittings, classified as other fittings.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3917400095

Description: Plastic pipe fittings, classified as other fittings.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3917390050

Description: Agricultural irrigation pipe fittings, classified as plastic pipe fittings.

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.1%

✅ HS CODE: 3917330000

Description: PE agricultural irrigation pipes, classified as non-reinforced or combined with other materials plastic pipes.

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.1%

✅ HS CODE: 3917320050

Description: Plastic irrigation pipes, classified as non-reinforced or combined with other materials plastic pipes.

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff is applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning.

- No Anti-Dumping Duties: No specific anti-dumping duties are mentioned for this product category.

- Material and Certification: Ensure the product is indeed made of PE (polyethylene) and confirm if any certifications (e.g., ISO, CE, or local standards) are required for import.

- Unit Price and Classification: Verify the exact product description and unit price to ensure correct HS code classification and avoid misclassification penalties.

📌 Proactive Advice:

- Confirm the material composition (e.g., PE, PVC, etc.) and intended use (e.g., agricultural, industrial) to ensure accurate HS code selection.

- Check with customs or a qualified customs broker to confirm the most up-to-date classification and tax rates.

- If importing in large quantities, consider pre-clearance or customs compliance audits to avoid delays or penalties.

Let me know if you need help with customs documentation or classification confirmation.

Customer Reviews

No reviews yet.