Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921190010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3919905030 | Doc | 60.8% | CN | US | 2025-05-12 |

| 6307907200 | Doc | 42.0% | CN | US | 2025-05-12 |

| 3921190010 | Doc | 61.5% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for PE Microporous Film and related products, based on the provided HS codes and tax details:

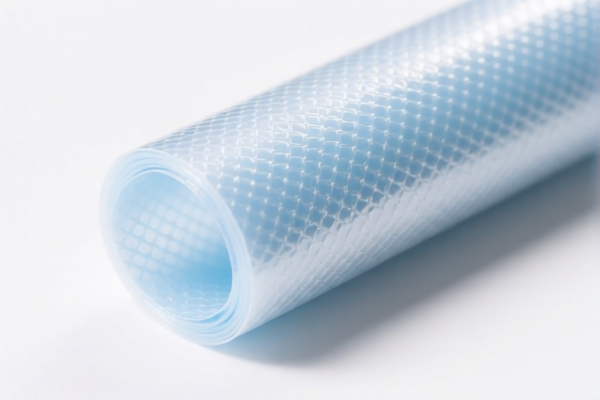

✅ Product Classification Overview: PE Microporous Film and Related Products

1. HS Code: 3921190010

- Product Name: Polyethylene Microporous Film / Polyethylene Microporous Packaging Film

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code applies to both "Polyethylene Microporous Film" and "Polyethylene Microporous Packaging Film."

2. HS Code: 3921905050

- Product Name: PE Plastic Film

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code is for general-purpose PE plastic film, not specifically microporous.

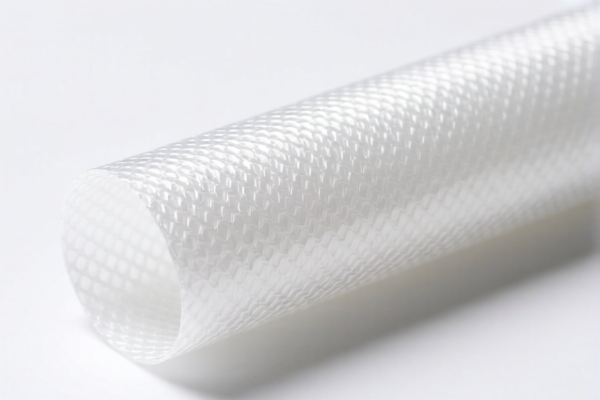

3. HS Code: 3919905030

- Product Name: PE Protective Film

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code is for PE protective films, which may be used in various industries (e.g., electronics, construction).

4. HS Code: 6307907200

- Product Name: PE Surgical Film

- Total Tax Rate: 42.0%

- Base Tariff: 4.5%

- Additional Tariff: 7.5%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code is for medical-grade PE surgical films, which may be subject to different regulations.

📌 Key Tax Rate Changes (April 2, 2025 onwards)

- All products listed above will be subject to an additional 30.0% tariff starting April 2, 2025.

- This is a time-sensitive policy, and the tax rate will increase significantly after this date.

⚠️ Important Considerations

- Verify the exact product description and specifications (e.g., whether it is microporous, used for packaging, or medical use) to ensure correct HS code classification.

- Check the unit of measurement (e.g., kg, m²) as this can affect the final tax calculation.

- Confirm if any certifications are required (e.g., medical device certification for surgical films).

- Review the origin of the product (e.g., whether it is from China or other countries), as this may affect the applicable tariffs.

📌 Proactive Advice

- Double-check the product name and technical specifications to avoid misclassification.

- Consult with customs brokers or tax consultants if the product is used in regulated industries (e.g., medical or electronics).

- Plan for the increased tariffs after April 2, 2025, and consider adjusting pricing or sourcing strategies accordingly.

Let me know if you need help with HS code verification or customs documentation. Here is the structured classification and tariff information for PE Microporous Film and related products, based on the provided HS codes and tax details:

✅ Product Classification Overview: PE Microporous Film and Related Products

1. HS Code: 3921190010

- Product Name: Polyethylene Microporous Film / Polyethylene Microporous Packaging Film

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code applies to both "Polyethylene Microporous Film" and "Polyethylene Microporous Packaging Film."

2. HS Code: 3921905050

- Product Name: PE Plastic Film

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code is for general-purpose PE plastic film, not specifically microporous.

3. HS Code: 3919905030

- Product Name: PE Protective Film

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code is for PE protective films, which may be used in various industries (e.g., electronics, construction).

4. HS Code: 6307907200

- Product Name: PE Surgical Film

- Total Tax Rate: 42.0%

- Base Tariff: 4.5%

- Additional Tariff: 7.5%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code is for medical-grade PE surgical films, which may be subject to different regulations.

📌 Key Tax Rate Changes (April 2, 2025 onwards)

- All products listed above will be subject to an additional 30.0% tariff starting April 2, 2025.

- This is a time-sensitive policy, and the tax rate will increase significantly after this date.

⚠️ Important Considerations

- Verify the exact product description and specifications (e.g., whether it is microporous, used for packaging, or medical use) to ensure correct HS code classification.

- Check the unit of measurement (e.g., kg, m²) as this can affect the final tax calculation.

- Confirm if any certifications are required (e.g., medical device certification for surgical films).

- Review the origin of the product (e.g., whether it is from China or other countries), as this may affect the applicable tariffs.

📌 Proactive Advice

- Double-check the product name and technical specifications to avoid misclassification.

- Consult with customs brokers or tax consultants if the product is used in regulated industries (e.g., medical or electronics).

- Plan for the increased tariffs after April 2, 2025, and consider adjusting pricing or sourcing strategies accordingly.

Let me know if you need help with HS code verification or customs documentation.

Customer Reviews

No reviews yet.