Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917400080 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400080 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400080 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400080 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400080 | Doc | 60.3% | CN | US | 2025-05-12 |

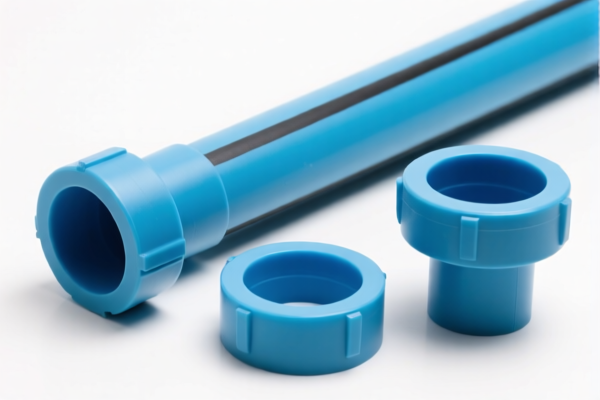

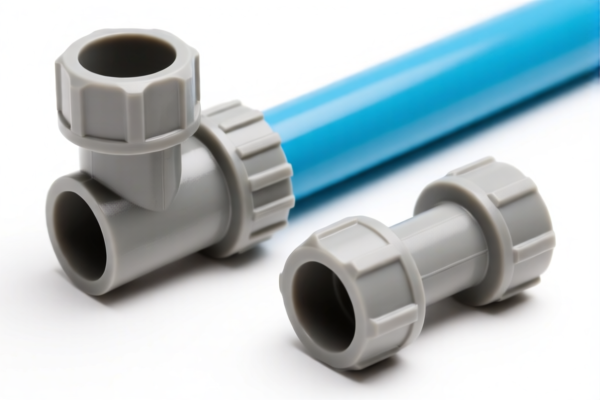

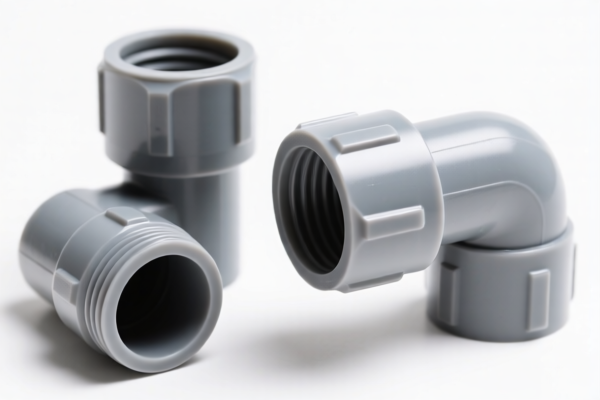

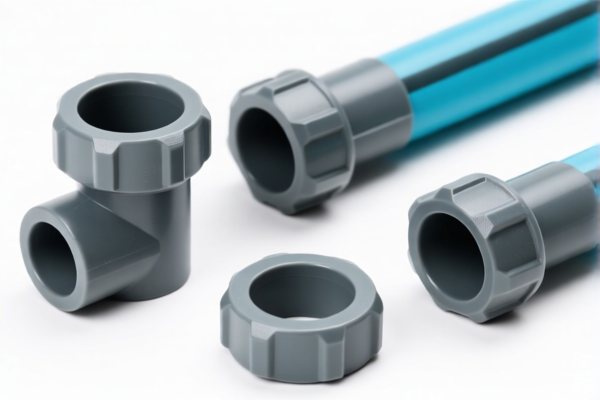

Product Classification: PE RT Plastic Pipe Fittings

HS CODE: 3917400080

🔍 Classification Summary

- Product Type: Plastic pipe fittings and accessories (e.g., PE-RT, PPR, PP-R, PE irrigation pipe fittings)

- HS Code: 3917400080

- Tariff Summary: 60.3% total tax rate

📊 Tariff Breakdown

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.

⚠️ Important Policy Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after this date.

- Anti-dumping duties: Not applicable for this product category (plastic pipe fittings).

- No specific anti-dumping duties on iron/aluminum: This product is made of plastic, so these duties do not apply.

📌 Proactive Advice for Importers

- Verify Material: Confirm the exact material (e.g., PE-RT, PPR, PP-R) to ensure correct HS code classification.

- Check Unit Price: Tariff calculations depend on the declared value, so ensure accurate pricing.

- Certifications Required: Some countries may require certifications (e.g., ISO, CE, or local standards) for plastic pipe fittings.

- Stay Updated: Monitor any changes in tariff policies, especially after April 11, 2025.

🧾 Summary Table

| Tariff Type | Rate | Notes |

|---|---|---|

| Base Tariff | 5.3% | Standard rate |

| General Additional Tariff | 25.0% | Applies to all imports |

| Special Tariff (after 2025.4.11) | 30.0% | Time-sensitive, apply after April 11, 2025 |

| Anti-dumping duties | N/A | Not applicable for this product |

If you need further assistance with customs documentation or compliance, feel free to ask.

Product Classification: PE RT Plastic Pipe Fittings

HS CODE: 3917400080

🔍 Classification Summary

- Product Type: Plastic pipe fittings and accessories (e.g., PE-RT, PPR, PP-R, PE irrigation pipe fittings)

- HS Code: 3917400080

- Tariff Summary: 60.3% total tax rate

📊 Tariff Breakdown

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.

⚠️ Important Policy Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after this date.

- Anti-dumping duties: Not applicable for this product category (plastic pipe fittings).

- No specific anti-dumping duties on iron/aluminum: This product is made of plastic, so these duties do not apply.

📌 Proactive Advice for Importers

- Verify Material: Confirm the exact material (e.g., PE-RT, PPR, PP-R) to ensure correct HS code classification.

- Check Unit Price: Tariff calculations depend on the declared value, so ensure accurate pricing.

- Certifications Required: Some countries may require certifications (e.g., ISO, CE, or local standards) for plastic pipe fittings.

- Stay Updated: Monitor any changes in tariff policies, especially after April 11, 2025.

🧾 Summary Table

| Tariff Type | Rate | Notes |

|---|---|---|

| Base Tariff | 5.3% | Standard rate |

| General Additional Tariff | 25.0% | Applies to all imports |

| Special Tariff (after 2025.4.11) | 30.0% | Time-sensitive, apply after April 11, 2025 |

| Anti-dumping duties | N/A | Not applicable for this product |

If you need further assistance with customs documentation or compliance, feel free to ask.

Customer Reviews

No reviews yet.