Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917320020 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917400080 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for PE plastic tubes based on the provided HS codes and tax details:

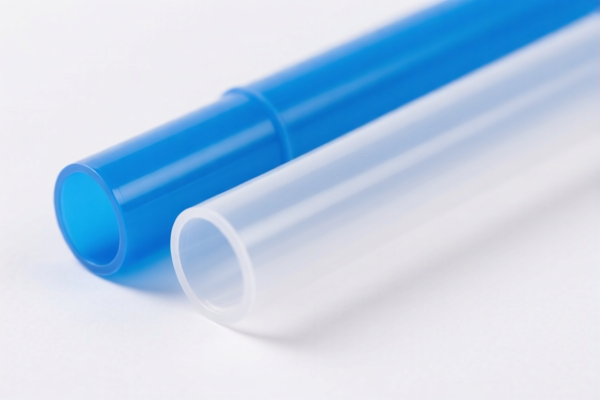

✅ Product Classification: PE Plastic Tubes

🔢 HS CODE: 3917320020

- Description: Polyethylene plastic tubes and fittings

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: This code is highly relevant for general PE plastic tubes and fittings.

🔢 HS CODE: 3917320050

- Description: Plastic tubes (general category)

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: Suitable for general-purpose plastic tubes, including PE.

🔢 HS CODE: 3917210000

- Description: Polyethylene plastic tubes

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: Specifically for polyethylene tubes, ideal for PE products.

🔢 HS CODE: 3917400080

- Description: Plastic pipe fittings (e.g., connectors)

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: Higher base tariff applies to fittings, which may be relevant if your product includes connectors or joints.

🔢 HS CODE: 3917390050

- Description: General plastic tubes (not otherwise specified)

- Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: Lower total tax rate due to no additional tariffs, but still subject to the April 11 special tariff.

📌 Key Observations:

- April 11 Special Tariff: Applies to all listed codes after April 11, 2025, increasing the total tax by 30.0%.

- Anti-dumping duties: Not explicitly mentioned in the data, but always verify if your product is subject to such duties based on the origin and material.

- Material and Certification: Confirm the exact material (e.g., HDPE, LDPE) and unit price to ensure correct classification. Some codes may require certifications (e.g., RoHS, REACH) for compliance.

🛑 Proactive Advice:

- Verify the exact product description (e.g., whether it's a tube, fitting, or both).

- Check the origin of the product to determine if additional tariffs or anti-dumping duties apply.

- Consult customs authorities or a compliance expert if the product is used in sensitive industries (e.g., construction, water supply).

- Keep records of product specifications and documentation to support customs declarations.

Let me know if you need help selecting the most appropriate HS code for your specific product. Here is the structured classification and tariff information for PE plastic tubes based on the provided HS codes and tax details:

✅ Product Classification: PE Plastic Tubes

🔢 HS CODE: 3917320020

- Description: Polyethylene plastic tubes and fittings

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: This code is highly relevant for general PE plastic tubes and fittings.

🔢 HS CODE: 3917320050

- Description: Plastic tubes (general category)

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: Suitable for general-purpose plastic tubes, including PE.

🔢 HS CODE: 3917210000

- Description: Polyethylene plastic tubes

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: Specifically for polyethylene tubes, ideal for PE products.

🔢 HS CODE: 3917400080

- Description: Plastic pipe fittings (e.g., connectors)

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: Higher base tariff applies to fittings, which may be relevant if your product includes connectors or joints.

🔢 HS CODE: 3917390050

- Description: General plastic tubes (not otherwise specified)

- Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Note: Lower total tax rate due to no additional tariffs, but still subject to the April 11 special tariff.

📌 Key Observations:

- April 11 Special Tariff: Applies to all listed codes after April 11, 2025, increasing the total tax by 30.0%.

- Anti-dumping duties: Not explicitly mentioned in the data, but always verify if your product is subject to such duties based on the origin and material.

- Material and Certification: Confirm the exact material (e.g., HDPE, LDPE) and unit price to ensure correct classification. Some codes may require certifications (e.g., RoHS, REACH) for compliance.

🛑 Proactive Advice:

- Verify the exact product description (e.g., whether it's a tube, fitting, or both).

- Check the origin of the product to determine if additional tariffs or anti-dumping duties apply.

- Consult customs authorities or a compliance expert if the product is used in sensitive industries (e.g., construction, water supply).

- Keep records of product specifications and documentation to support customs declarations.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.