| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920620050 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3919102055 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

Here is the structured analysis and customs compliance guidance for the PET Film for Electronic Products based on the provided HS codes and tax details:

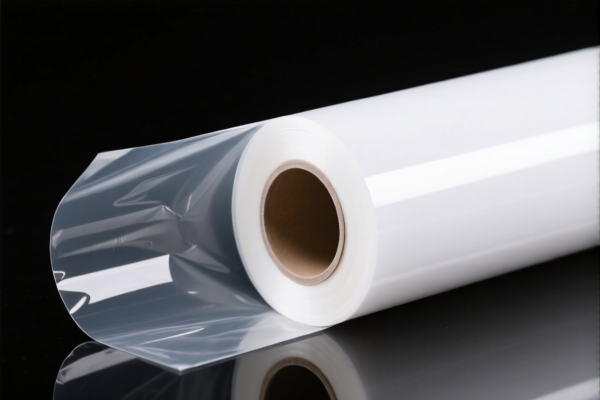

📦 Product Overview: PET Film for Electronic Products

- Usage: Packaging and protection of electronic products (e.g., screens, devices).

- Material: Polyethylene terephthalate (PET), a type of plastic film.

- Classification: Plastic films, sheets, or foils, with specific applications in electronics.

📊 HS Code Classification & Tax Details

1. HS Code: 3920620050

- Description: PET metallized electronic product packaging film.

- Tariff Summary:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code applies to metallized PET films used for electronic packaging.

- Time-sensitive: Additional tariffs increase to 30% after April 11, 2025.

2. HS Code: 3920620090

- Description: PET plastic display screen protection film.

- Tariff Summary:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code is for non-metallized PET films used as screen protectors.

- Same tax structure as 3920620050.

3. HS Code: 3921905050

- Description: PET plastic protection film (other uses).

- Tariff Summary:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 34.8%

- Key Notes:

- Lower base tariff compared to other codes.

- No additional tariffs (except the 2025 special tariff).

- Suitable for general-purpose PET films not specifically for electronics.

4. HS Code: 3919102055

- Description: Electronic product packaging film (narrow width).

- Tariff Summary:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 60.8%

- Key Notes:

- Applies to narrow-width (≤20 cm) packaging films.

- Highest total tax rate among the listed codes.

5. HS Code: 3920995000

- Description: Electronic screen protection film (other).

- Tariff Summary:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 60.8%

- Key Notes:

- For other types of screen protection films not covered by more specific codes.

- Same tax structure as 3919102055.

⚠️ Important Alerts & Compliance Actions

- April 11, 2025 Special Tariff:

- All listed codes will see an additional 30% tariff after this date.

-

Plan ahead for increased costs if importing after this date.

-

Anti-dumping duties:

-

Not applicable for PET films in the provided HS codes (no mention of anti-dumping duties on iron/aluminum).

-

Certifications & Documentation:

- Verify material composition (e.g., metallized vs. non-metallized).

- Confirm unit price and product specifications for accurate classification.

- Ensure customs documentation includes product use (e.g., packaging vs. screen protection).

- Check if certifications (e.g., RoHS, REACH) are required for import.

✅ Proactive Advice

- Double-check HS code based on material type (metallized, non-metallized, width, use).

- Monitor tax changes after April 11, 2025 to avoid unexpected costs.

- Consult customs brokers or trade compliance experts for complex or high-value shipments.

- Maintain product documentation (specifications, certificates, invoices) for customs audits.

Let me know if you need help selecting the most appropriate HS code for your specific product. Here is the structured analysis and customs compliance guidance for the PET Film for Electronic Products based on the provided HS codes and tax details:

📦 Product Overview: PET Film for Electronic Products

- Usage: Packaging and protection of electronic products (e.g., screens, devices).

- Material: Polyethylene terephthalate (PET), a type of plastic film.

- Classification: Plastic films, sheets, or foils, with specific applications in electronics.

📊 HS Code Classification & Tax Details

1. HS Code: 3920620050

- Description: PET metallized electronic product packaging film.

- Tariff Summary:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code applies to metallized PET films used for electronic packaging.

- Time-sensitive: Additional tariffs increase to 30% after April 11, 2025.

2. HS Code: 3920620090

- Description: PET plastic display screen protection film.

- Tariff Summary:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code is for non-metallized PET films used as screen protectors.

- Same tax structure as 3920620050.

3. HS Code: 3921905050

- Description: PET plastic protection film (other uses).

- Tariff Summary:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 34.8%

- Key Notes:

- Lower base tariff compared to other codes.

- No additional tariffs (except the 2025 special tariff).

- Suitable for general-purpose PET films not specifically for electronics.

4. HS Code: 3919102055

- Description: Electronic product packaging film (narrow width).

- Tariff Summary:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 60.8%

- Key Notes:

- Applies to narrow-width (≤20 cm) packaging films.

- Highest total tax rate among the listed codes.

5. HS Code: 3920995000

- Description: Electronic screen protection film (other).

- Tariff Summary:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 60.8%

- Key Notes:

- For other types of screen protection films not covered by more specific codes.

- Same tax structure as 3919102055.

⚠️ Important Alerts & Compliance Actions

- April 11, 2025 Special Tariff:

- All listed codes will see an additional 30% tariff after this date.

-

Plan ahead for increased costs if importing after this date.

-

Anti-dumping duties:

-

Not applicable for PET films in the provided HS codes (no mention of anti-dumping duties on iron/aluminum).

-

Certifications & Documentation:

- Verify material composition (e.g., metallized vs. non-metallized).

- Confirm unit price and product specifications for accurate classification.

- Ensure customs documentation includes product use (e.g., packaging vs. screen protection).

- Check if certifications (e.g., RoHS, REACH) are required for import.

✅ Proactive Advice

- Double-check HS code based on material type (metallized, non-metallized, width, use).

- Monitor tax changes after April 11, 2025 to avoid unexpected costs.

- Consult customs brokers or trade compliance experts for complex or high-value shipments.

- Maintain product documentation (specifications, certificates, invoices) for customs audits.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.