| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 4811592000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3923210095 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3923900080 | Doc | 58.0% | CN | US | 2025-05-12 |

| 6305390000 | Doc | 45.9% | CN | US | 2025-05-12 |

Here is the structured analysis and customs compliance information for the PET Food Packaging Film and related products, based on the provided HS codes and tax details:

📦 Product Classification Overview

Below are the HS codes and associated customs duties for various types of PET food packaging films and related products:

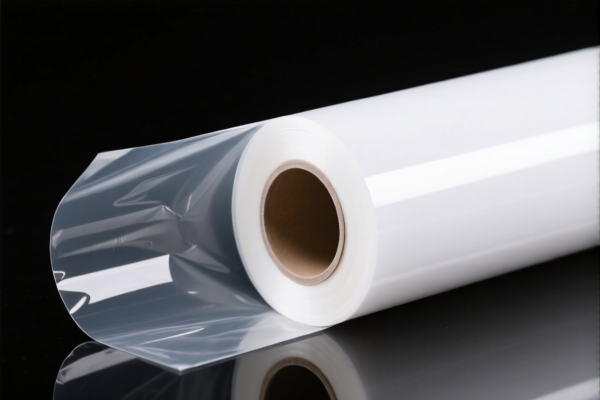

🔢 HS Code: 3921905050 - Plastic Food Packaging Film

- Description: Plastic food packaging film

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Key Notes:

- No anti-dumping duties on iron or aluminum (not applicable here).

- This code is for general plastic food packaging film, not specific to pet food.

📦 HS Code: 4811592000 - Plastic-Coated Pet Food Packaging Paper

- Description: Plastic-coated pet food packaging paper

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Key Notes:

- This is a paper product with a plastic coating, used for pet food packaging.

- High tax burden due to the additional tariff and the 2025 special tariff.

📦 HS Code: 3923210095 - Polyethylene Pet Food Packaging Bags

- Description: Polyethylene pet food packaging bags

- Total Tax Rate: 58.0%

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Key Notes:

- This is a specific type of plastic bag used for pet food.

- The high tax rate is due to the combination of base, additional, and special tariffs.

📦 HS Code: 3923900080 - Plastic Pet Food Boxes

- Description: Plastic pet food boxes

- Total Tax Rate: 58.0%

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Key Notes:

- This is a container or box made of plastic for pet food.

- Similar to the packaging bags, it is subject to the same high tax rate.

📦 HS Code: 6305390000 - Pet Food Packaging Bags

- Description: Pet food packaging bags

- Total Tax Rate: 45.9%

- Base Tariff: 8.4%

- Additional Tariff: 7.5%

- April 11, 2025 Special Tariff: 30.0%

- Key Notes:

- This is a general category for pet food packaging bags.

- The base and additional tariffs are relatively higher than some plastic-specific codes.

⚠️ Important Reminders for Importers:

- Verify Material and Unit Price: Ensure the product is correctly classified based on its material (e.g., polyethylene, plastic-coated paper, etc.) and unit price.

- Check Required Certifications: Some products may require specific certifications (e.g., food-grade, safety standards).

- Monitor April 11, 2025 Tariff Changes: The 30% additional tariff applies after this date, so plan accordingly for import costs.

- Consider Alternative HS Codes: If the product can be classified under a different HS code with lower tariffs, consult a customs expert for optimization.

📌 Proactive Advice:

- If you are importing PET food packaging film, consider whether it can be classified under 3921905050 or a more specific code.

- For plastic-coated paper, ensure the coating is clearly defined in the product description to avoid misclassification.

- Always confirm with customs or a qualified customs broker to ensure compliance and avoid delays or penalties.

Let me know if you need help with classification based on product specifications or documentation. Here is the structured analysis and customs compliance information for the PET Food Packaging Film and related products, based on the provided HS codes and tax details:

📦 Product Classification Overview

Below are the HS codes and associated customs duties for various types of PET food packaging films and related products:

🔢 HS Code: 3921905050 - Plastic Food Packaging Film

- Description: Plastic food packaging film

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Key Notes:

- No anti-dumping duties on iron or aluminum (not applicable here).

- This code is for general plastic food packaging film, not specific to pet food.

📦 HS Code: 4811592000 - Plastic-Coated Pet Food Packaging Paper

- Description: Plastic-coated pet food packaging paper

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Key Notes:

- This is a paper product with a plastic coating, used for pet food packaging.

- High tax burden due to the additional tariff and the 2025 special tariff.

📦 HS Code: 3923210095 - Polyethylene Pet Food Packaging Bags

- Description: Polyethylene pet food packaging bags

- Total Tax Rate: 58.0%

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Key Notes:

- This is a specific type of plastic bag used for pet food.

- The high tax rate is due to the combination of base, additional, and special tariffs.

📦 HS Code: 3923900080 - Plastic Pet Food Boxes

- Description: Plastic pet food boxes

- Total Tax Rate: 58.0%

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Key Notes:

- This is a container or box made of plastic for pet food.

- Similar to the packaging bags, it is subject to the same high tax rate.

📦 HS Code: 6305390000 - Pet Food Packaging Bags

- Description: Pet food packaging bags

- Total Tax Rate: 45.9%

- Base Tariff: 8.4%

- Additional Tariff: 7.5%

- April 11, 2025 Special Tariff: 30.0%

- Key Notes:

- This is a general category for pet food packaging bags.

- The base and additional tariffs are relatively higher than some plastic-specific codes.

⚠️ Important Reminders for Importers:

- Verify Material and Unit Price: Ensure the product is correctly classified based on its material (e.g., polyethylene, plastic-coated paper, etc.) and unit price.

- Check Required Certifications: Some products may require specific certifications (e.g., food-grade, safety standards).

- Monitor April 11, 2025 Tariff Changes: The 30% additional tariff applies after this date, so plan accordingly for import costs.

- Consider Alternative HS Codes: If the product can be classified under a different HS code with lower tariffs, consult a customs expert for optimization.

📌 Proactive Advice:

- If you are importing PET food packaging film, consider whether it can be classified under 3921905050 or a more specific code.

- For plastic-coated paper, ensure the coating is clearly defined in the product description to avoid misclassification.

- Always confirm with customs or a qualified customs broker to ensure compliance and avoid delays or penalties.

Let me know if you need help with classification based on product specifications or documentation.

Customer Reviews

No reviews yet.