| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920200020 | Doc | 59.2% | CN | US | 2025-05-12 |

| 6305390000 | Doc | 45.9% | CN | US | 2025-05-12 |

| 4819200040 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4811592000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3923900080 | Doc | 58.0% | CN | US | 2025-05-12 |

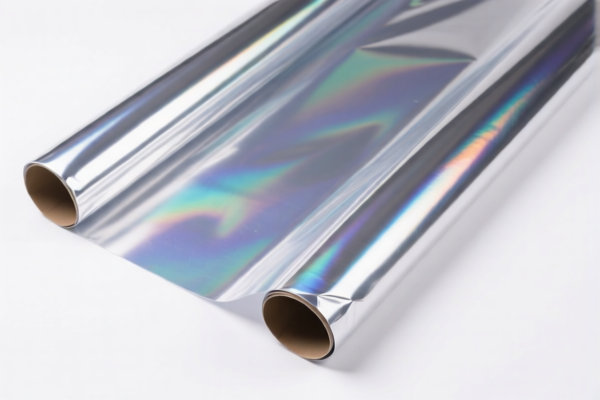

Here is the structured classification and tariff information for the PET Gift Wrap Film based on the provided HS codes and tax details:

✅ HS CODE: 3920200020

Product Description: Plastic packaging film made of polypropylene (e.g., PP plastic animal pattern packaging film)

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most relevant code for PET (Polyethylene Terephthalate) gift wrap film, assuming it is made of polypropylene or similar plastic.

✅ HS CODE: 6305390000

Product Description: Packaging bags made of man-made textile materials (e.g., pet food packaging bags, pet toy packaging bags)

Total Tax Rate: 45.9%

- Base Tariff Rate: 8.4%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to textile-based packaging, not plastic or paper-based materials.

✅ HS CODE: 4819200040

Product Description: Packaging containers made of paper or paperboard (e.g., pet food packaging boxes)

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for paper-based packaging, not suitable for plastic gift wrap.

✅ HS CODE: 4811592000

Product Description: Plastic-coated paper (e.g., plastic-coated pet food packaging paper)

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for plastic-coated paper, not pure plastic film.

✅ HS CODE: 3923900080

Product Description: Plastic packaging goods (e.g., plastic pet food boxes)

Total Tax Rate: 58.0%

- Base Tariff Rate: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for general plastic packaging goods, which may include PET film if it is used as a container or box.

📌 Proactive Advice:

- Verify Material: Confirm whether the product is made of PET, PP, or other plastics, as this will determine the correct HS code.

- Check Unit Price: High-value items may be subject to additional regulations or inspections.

- Certifications Required: Ensure compliance with any required certifications (e.g., food-grade, environmental standards).

- April 11, 2025 Deadline: Be aware of the special tariff increase after this date, which may significantly impact your import costs.

- Anti-Dumping Duties: Not applicable for this product category, but always verify for any specific anti-dumping measures on plastics.

Let me know if you need help determining the most accurate HS code for your specific product. Here is the structured classification and tariff information for the PET Gift Wrap Film based on the provided HS codes and tax details:

✅ HS CODE: 3920200020

Product Description: Plastic packaging film made of polypropylene (e.g., PP plastic animal pattern packaging film)

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most relevant code for PET (Polyethylene Terephthalate) gift wrap film, assuming it is made of polypropylene or similar plastic.

✅ HS CODE: 6305390000

Product Description: Packaging bags made of man-made textile materials (e.g., pet food packaging bags, pet toy packaging bags)

Total Tax Rate: 45.9%

- Base Tariff Rate: 8.4%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to textile-based packaging, not plastic or paper-based materials.

✅ HS CODE: 4819200040

Product Description: Packaging containers made of paper or paperboard (e.g., pet food packaging boxes)

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for paper-based packaging, not suitable for plastic gift wrap.

✅ HS CODE: 4811592000

Product Description: Plastic-coated paper (e.g., plastic-coated pet food packaging paper)

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for plastic-coated paper, not pure plastic film.

✅ HS CODE: 3923900080

Product Description: Plastic packaging goods (e.g., plastic pet food boxes)

Total Tax Rate: 58.0%

- Base Tariff Rate: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for general plastic packaging goods, which may include PET film if it is used as a container or box.

📌 Proactive Advice:

- Verify Material: Confirm whether the product is made of PET, PP, or other plastics, as this will determine the correct HS code.

- Check Unit Price: High-value items may be subject to additional regulations or inspections.

- Certifications Required: Ensure compliance with any required certifications (e.g., food-grade, environmental standards).

- April 11, 2025 Deadline: Be aware of the special tariff increase after this date, which may significantly impact your import costs.

- Anti-Dumping Duties: Not applicable for this product category, but always verify for any specific anti-dumping measures on plastics.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.