| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920620050 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920620020 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920620020 | Doc | 59.2% | CN | US | 2025-05-12 |

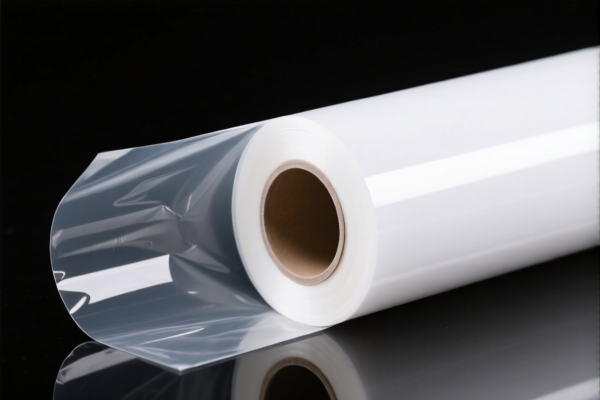

Product Classification: PET Industrial Packaging Film

HS CODEs and Tax Details (as of current regulations):

✅ HS CODE: 3920620090

Description: PET plastic industrial packaging film, non-cellular, non-reinforced, laminated or combined with other materials.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code applies to standard PET films that are not metallized or reinforced.

- Ensure the product is not classified under a more specific code (e.g., metallized films).

✅ HS CODE: 3920620050

Description: PET metallized industrial packaging film, non-cellular, non-reinforced, laminated or combined with other materials.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code is for metallized PET films used in industrial packaging.

- Confirm that the film is not classified under a different category (e.g., decorative or gift packaging).

✅ HS CODE: 3920620020

Description: PET film industrial packaging, matching the description "Of poly(ethylene terephthalate)".

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code is also used for metallized PET films (e.g., "metalized PET film: gift packaging film").

- Verify the exact product description and intended use to avoid misclassification.

✅ HS CODE: 3921905050

Description: Plastic industrial packaging film, other plastic sheets, plates, films, foils, and strips.

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Key Notes:

- This is a broader category for other types of plastic films not specifically classified under 3920.

- Lower tax rate compared to PET-specific codes.

- Ensure the product does not meet the criteria for more specific codes (e.g., PET-based films).

📌 Proactive Advice for Importers:

- Verify Material Composition: Confirm whether the film is PET-based, metallized, or made from other plastics.

- Check Unit Price and Specifications: Some HS codes may apply based on technical specifications or intended use.

- Review Certification Requirements: Some products may require specific certifications (e.g., RoHS, REACH) for compliance.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all listed codes, increasing the total tax rate by 30.0% for most products.

- Consult Customs Broker: For complex classifications, seek professional advice to avoid delays or penalties.

Let me know if you need help determining the most accurate HS code for your specific product.

Product Classification: PET Industrial Packaging Film

HS CODEs and Tax Details (as of current regulations):

✅ HS CODE: 3920620090

Description: PET plastic industrial packaging film, non-cellular, non-reinforced, laminated or combined with other materials.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code applies to standard PET films that are not metallized or reinforced.

- Ensure the product is not classified under a more specific code (e.g., metallized films).

✅ HS CODE: 3920620050

Description: PET metallized industrial packaging film, non-cellular, non-reinforced, laminated or combined with other materials.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code is for metallized PET films used in industrial packaging.

- Confirm that the film is not classified under a different category (e.g., decorative or gift packaging).

✅ HS CODE: 3920620020

Description: PET film industrial packaging, matching the description "Of poly(ethylene terephthalate)".

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code is also used for metallized PET films (e.g., "metalized PET film: gift packaging film").

- Verify the exact product description and intended use to avoid misclassification.

✅ HS CODE: 3921905050

Description: Plastic industrial packaging film, other plastic sheets, plates, films, foils, and strips.

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Key Notes:

- This is a broader category for other types of plastic films not specifically classified under 3920.

- Lower tax rate compared to PET-specific codes.

- Ensure the product does not meet the criteria for more specific codes (e.g., PET-based films).

📌 Proactive Advice for Importers:

- Verify Material Composition: Confirm whether the film is PET-based, metallized, or made from other plastics.

- Check Unit Price and Specifications: Some HS codes may apply based on technical specifications or intended use.

- Review Certification Requirements: Some products may require specific certifications (e.g., RoHS, REACH) for compliance.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all listed codes, increasing the total tax rate by 30.0% for most products.

- Consult Customs Broker: For complex classifications, seek professional advice to avoid delays or penalties.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.