| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920991000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3920991000 | Doc | 61.0% | CN | US | 2025-05-12 |

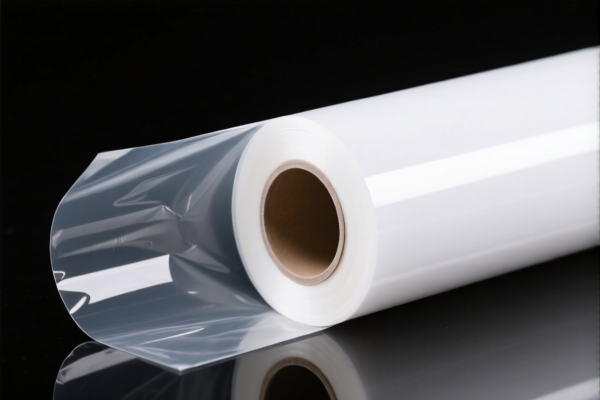

Product Name: PET Pharmaceutical Packaging Film

Classification: Plastic Films for Pharmaceutical Packaging

HS Code Classification and Tax Details:

- HS CODE: 3920991000

- Description: Medicinal packaging film, classified under HS code 3920, falls under the category of other plastic sheets, plates, films, foils, and strips.

- Total Tax Rate: 61.0%

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is also used for food packaging films, so ensure the product is clearly classified as pharmaceutical.

-

HS CODE: 3920992000

- Description: Plastic film for medicinal packaging, classified under HS code 3920, falls under the category of other plastic sheets, plates, films, foils, and strips.

- Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Lower base tariff compared to 3920991000, but still subject to the same additional and special tariffs.

-

HS CODE: 3921905050

- Description: Plastic film for packaging, classified under HS code 3921905050, falls under the category of other plastic sheets, plates, films, foils, and strips.

- Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: No additional tariff, but still subject to the special tariff after April 11, 2025.

-

HS CODE: 3921904090

- Description: Plastic film for packaging, classified under HS code 3921, falls under the category of other plastic sheets, plates, films, foils, and strips.

- Total Tax Rate: 34.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lower base tariff and no additional tariff, but still subject to the special tariff after April 11, 2025.

Key Tax Rate Changes (April 11, 2025 onwards):

- All listed HS codes will be subject to an additional 30.0% special tariff after April 11, 2025.

- This is a time-sensitive policy, so ensure your customs clearance is completed before this date if possible.

Proactive Advice:

- Verify Material and Unit Price: Confirm the exact composition of the PET film (e.g., whether it contains additives or is coated) to ensure correct classification.

- Check Required Certifications: Some HS codes may require specific documentation (e.g., medical device certification, food-grade certification, etc.).

- Consult with Customs Broker: For accurate classification and to avoid delays, it is recommended to work with a customs broker or consult the local customs authority for the most up-to-date information.

Let me know if you need help with HS code selection or customs documentation.

Product Name: PET Pharmaceutical Packaging Film

Classification: Plastic Films for Pharmaceutical Packaging

HS Code Classification and Tax Details:

- HS CODE: 3920991000

- Description: Medicinal packaging film, classified under HS code 3920, falls under the category of other plastic sheets, plates, films, foils, and strips.

- Total Tax Rate: 61.0%

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is also used for food packaging films, so ensure the product is clearly classified as pharmaceutical.

-

HS CODE: 3920992000

- Description: Plastic film for medicinal packaging, classified under HS code 3920, falls under the category of other plastic sheets, plates, films, foils, and strips.

- Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Lower base tariff compared to 3920991000, but still subject to the same additional and special tariffs.

-

HS CODE: 3921905050

- Description: Plastic film for packaging, classified under HS code 3921905050, falls under the category of other plastic sheets, plates, films, foils, and strips.

- Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: No additional tariff, but still subject to the special tariff after April 11, 2025.

-

HS CODE: 3921904090

- Description: Plastic film for packaging, classified under HS code 3921, falls under the category of other plastic sheets, plates, films, foils, and strips.

- Total Tax Rate: 34.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lower base tariff and no additional tariff, but still subject to the special tariff after April 11, 2025.

Key Tax Rate Changes (April 11, 2025 onwards):

- All listed HS codes will be subject to an additional 30.0% special tariff after April 11, 2025.

- This is a time-sensitive policy, so ensure your customs clearance is completed before this date if possible.

Proactive Advice:

- Verify Material and Unit Price: Confirm the exact composition of the PET film (e.g., whether it contains additives or is coated) to ensure correct classification.

- Check Required Certifications: Some HS codes may require specific documentation (e.g., medical device certification, food-grade certification, etc.).

- Consult with Customs Broker: For accurate classification and to avoid delays, it is recommended to work with a customs broker or consult the local customs authority for the most up-to-date information.

Let me know if you need help with HS code selection or customs documentation.

Customer Reviews

No reviews yet.