| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

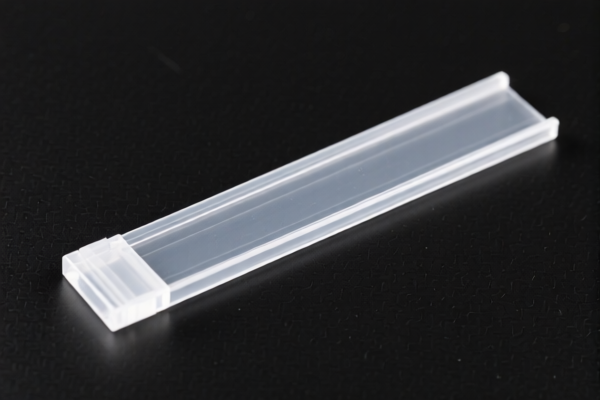

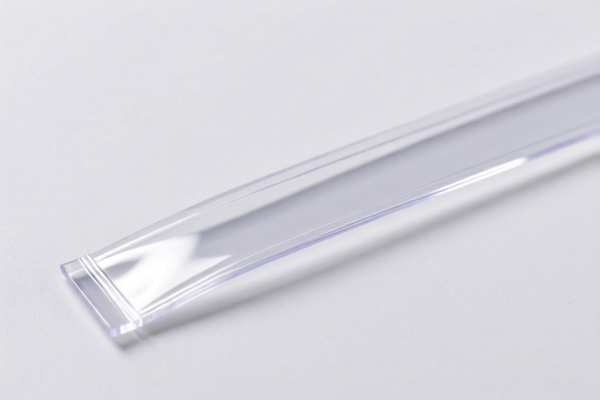

Here is the structured classification and tariff information for the PET Plastic Advertising Strip based on the provided HS codes and tax details:

✅ HS CODE: 3920620090

Product Description: PET Plastic Advertising Material, suitable for advertising use

Total Tax Rate: 59.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

✅ HS CODE: 3921905050

Product Description: Plastic Advertising Sign, suitable for advertising use

Total Tax Rate: 34.8%

Tax Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

✅ HS CODE: 3925900000

Product Description: Plastic Decorative Strip, suitable for building decoration

Total Tax Rate: 60.3%

Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

✅ HS CODE: 3921905050 (Duplicate Entry)

Product Description: Plastic Decorative Strip, suitable for decorative use

Total Tax Rate: 34.8%

Tax Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

✅ HS CODE: 3920620090 (Duplicate Entry)

Product Description: PET Plastic Label Material, suitable for label use

Total Tax Rate: 59.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all listed products after April 11, 2025. This is a time-sensitive policy and should be factored into cost planning.

-

Material Verification: Confirm the exact material composition (e.g., PET, PVC, etc.) and unit price to ensure correct classification and avoid misdeclaration penalties.

-

Certifications: Check if any customs certifications or product compliance documents are required for import (e.g., CE, RoHS, etc.).

-

Duplicate Entries: Be cautious of duplicate HS codes (e.g., 3921905050 and 3920620090 appear more than once). Ensure the product description aligns with the correct HS code to avoid classification errors.

If you have more details about the product (e.g., thickness, intended use, or country of origin), I can help refine the classification further. Here is the structured classification and tariff information for the PET Plastic Advertising Strip based on the provided HS codes and tax details:

✅ HS CODE: 3920620090

Product Description: PET Plastic Advertising Material, suitable for advertising use

Total Tax Rate: 59.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

✅ HS CODE: 3921905050

Product Description: Plastic Advertising Sign, suitable for advertising use

Total Tax Rate: 34.8%

Tax Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

✅ HS CODE: 3925900000

Product Description: Plastic Decorative Strip, suitable for building decoration

Total Tax Rate: 60.3%

Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

✅ HS CODE: 3921905050 (Duplicate Entry)

Product Description: Plastic Decorative Strip, suitable for decorative use

Total Tax Rate: 34.8%

Tax Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

✅ HS CODE: 3920620090 (Duplicate Entry)

Product Description: PET Plastic Label Material, suitable for label use

Total Tax Rate: 59.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all listed products after April 11, 2025. This is a time-sensitive policy and should be factored into cost planning.

-

Material Verification: Confirm the exact material composition (e.g., PET, PVC, etc.) and unit price to ensure correct classification and avoid misdeclaration penalties.

-

Certifications: Check if any customs certifications or product compliance documents are required for import (e.g., CE, RoHS, etc.).

-

Duplicate Entries: Be cautious of duplicate HS codes (e.g., 3921905050 and 3920620090 appear more than once). Ensure the product description aligns with the correct HS code to avoid classification errors.

If you have more details about the product (e.g., thickness, intended use, or country of origin), I can help refine the classification further.

Customer Reviews

No reviews yet.