Found 4 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3915900010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3920620050 | Doc | 59.2% | CN | US | 2025-05-12 |

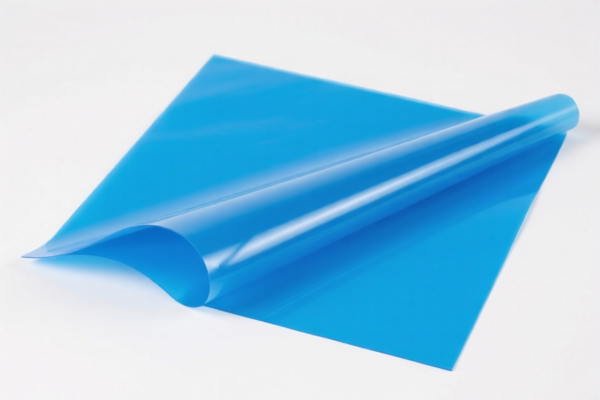

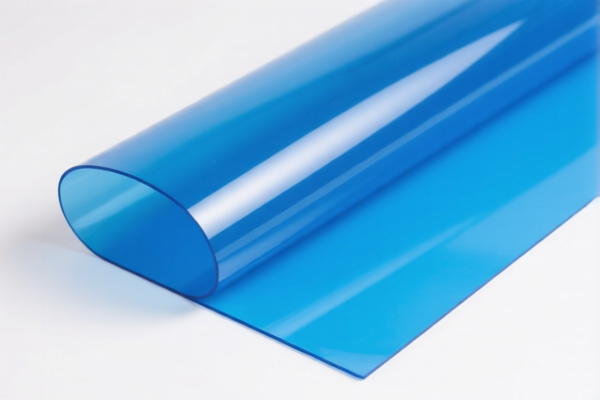

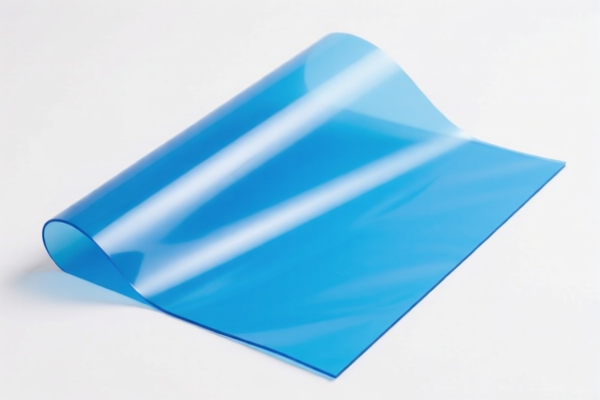

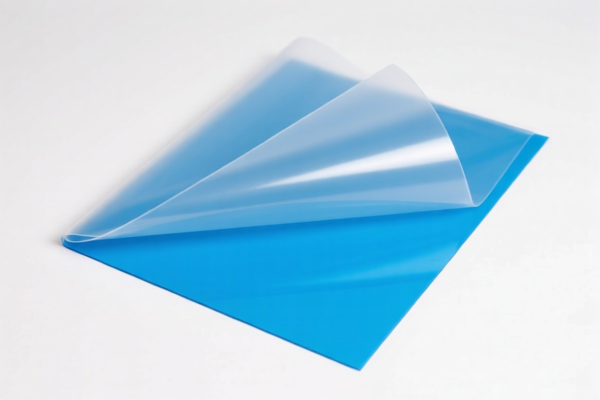

Product Name: PET Plastic Anti UV Sheet

Classification Analysis and Tax Information:

- HS CODE: 3920620090

- Description: PET plastic anti-UV sheets, PET plastic UV-resistant films, PET protective films, etc., all fall under HS code 3920.62.00.90. This code covers plastic sheets, plates, films, foils, and strips made of polyethylene terephthalate (PET), which are combined with other materials through lamination, support, or other methods. Anti-UV sheets are categorized under plastic sheets/films.

-

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921905050

- Description: PET plastic sheets fall under HS code 3921905050, which covers other plastic sheets, plates, films, foils, and strips.

-

Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3915900010

- Description: PET plastic sheets fall under HS code 3915900010, which is specifically for waste, scrap, and broken pieces of polyethylene terephthalate (PET) plastic.

-

Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920620050

- Description: PET metallized anti-UV film falls under HS code 3920.62.00.50, which covers metallized PET films with other purposes. Anti-UV is a property of the film and falls under the "other" category.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not applicable for this product category.

- Material and Certification: Verify the material composition and unit price to ensure correct classification. Check if certifications (e.g., UV resistance, safety standards) are required for import compliance.

-

Recommendation: If the product is for industrial or commercial use, ensure that the HS code matches the actual product description and usage. If in doubt, consult a customs broker or classification expert. Product Name: PET Plastic Anti UV Sheet

Classification Analysis and Tax Information: -

HS CODE: 3920620090

- Description: PET plastic anti-UV sheets, PET plastic UV-resistant films, PET protective films, etc., all fall under HS code 3920.62.00.90. This code covers plastic sheets, plates, films, foils, and strips made of polyethylene terephthalate (PET), which are combined with other materials through lamination, support, or other methods. Anti-UV sheets are categorized under plastic sheets/films.

-

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921905050

- Description: PET plastic sheets fall under HS code 3921905050, which covers other plastic sheets, plates, films, foils, and strips.

-

Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3915900010

- Description: PET plastic sheets fall under HS code 3915900010, which is specifically for waste, scrap, and broken pieces of polyethylene terephthalate (PET) plastic.

-

Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920620050

- Description: PET metallized anti-UV film falls under HS code 3920.62.00.50, which covers metallized PET films with other purposes. Anti-UV is a property of the film and falls under the "other" category.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not applicable for this product category.

- Material and Certification: Verify the material composition and unit price to ensure correct classification. Check if certifications (e.g., UV resistance, safety standards) are required for import compliance.

- Recommendation: If the product is for industrial or commercial use, ensure that the HS code matches the actual product description and usage. If in doubt, consult a customs broker or classification expert.

Customer Reviews

No reviews yet.