| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920620020 | Doc | 59.2% | CN | US | 2025-05-12 |

| 8532250060 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8532250010 | Doc | 55.0% | CN | US | 2025-05-12 |

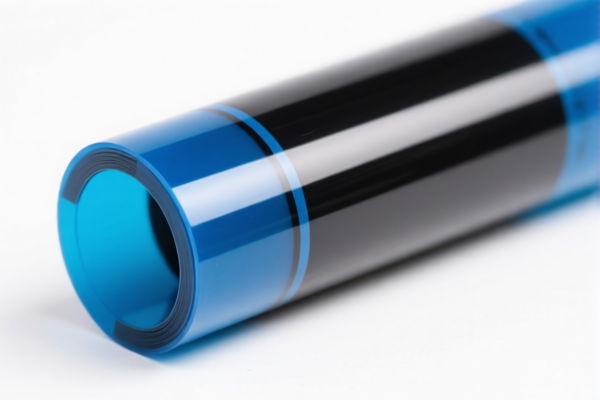

Product Name: PET Plastic Capacitor Film

Classification Analysis and Tax Information:

- HS CODE 3920620020

- Description: PET (Polyester) film used for capacitor electrodes, protective films, composite capacitor films, and packaging films.

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

-

Notes: This code applies to raw or semi-finished PET films used in capacitor manufacturing, not finished capacitors.

-

HS CODE 8532250060

- Description: Fixed capacitors with plastic (including polyester) dielectric materials, including AC capacitors for low-voltage applications.

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

-

Notes: This code applies to finished capacitors, not raw materials like PET film.

-

HS CODE 8532250010

- Description: Fixed capacitors with plastic dielectric, specifically for AC power with voltage less than 300V.

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes: This code is more specific to AC capacitors with voltage limitations.

✅ Proactive Advice:

- Verify Product Type: Confirm whether your product is raw PET film (HS 3920620020) or a finished capacitor (HS 8532250060 or 8532250010).

- Check Material Specifications: Ensure the PET film is not mixed with other materials, as this may affect classification.

- Review Voltage and Usage: For capacitors, confirm if they are AC or DC, and the voltage rating, as this determines the correct HS code.

- Check Required Certifications: Some products may require CE, RoHS, or other compliance certifications for import.

- Monitor Tariff Changes: The additional tariffs after April 11, 2025, will increase the total tax burden significantly. Plan accordingly.

Let me know if you need help determining the correct HS code based on your product specifications.

Product Name: PET Plastic Capacitor Film

Classification Analysis and Tax Information:

- HS CODE 3920620020

- Description: PET (Polyester) film used for capacitor electrodes, protective films, composite capacitor films, and packaging films.

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

-

Notes: This code applies to raw or semi-finished PET films used in capacitor manufacturing, not finished capacitors.

-

HS CODE 8532250060

- Description: Fixed capacitors with plastic (including polyester) dielectric materials, including AC capacitors for low-voltage applications.

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

-

Notes: This code applies to finished capacitors, not raw materials like PET film.

-

HS CODE 8532250010

- Description: Fixed capacitors with plastic dielectric, specifically for AC power with voltage less than 300V.

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes: This code is more specific to AC capacitors with voltage limitations.

✅ Proactive Advice:

- Verify Product Type: Confirm whether your product is raw PET film (HS 3920620020) or a finished capacitor (HS 8532250060 or 8532250010).

- Check Material Specifications: Ensure the PET film is not mixed with other materials, as this may affect classification.

- Review Voltage and Usage: For capacitors, confirm if they are AC or DC, and the voltage rating, as this determines the correct HS code.

- Check Required Certifications: Some products may require CE, RoHS, or other compliance certifications for import.

- Monitor Tariff Changes: The additional tariffs after April 11, 2025, will increase the total tax burden significantly. Plan accordingly.

Let me know if you need help determining the correct HS code based on your product specifications.

Customer Reviews

No reviews yet.