| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3915900010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

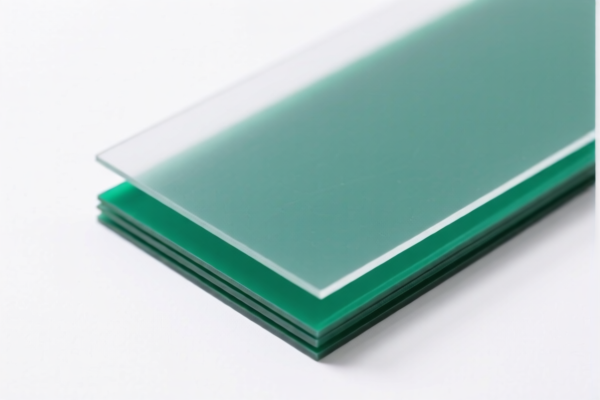

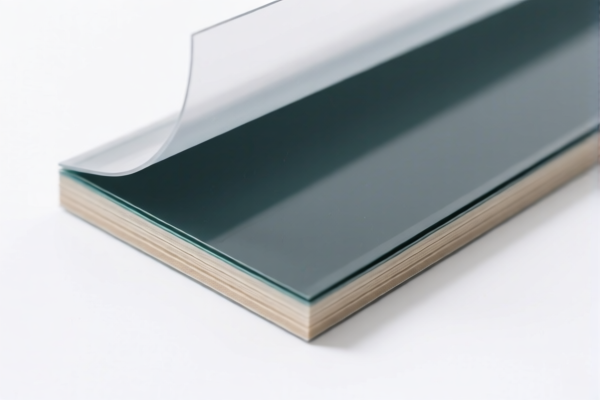

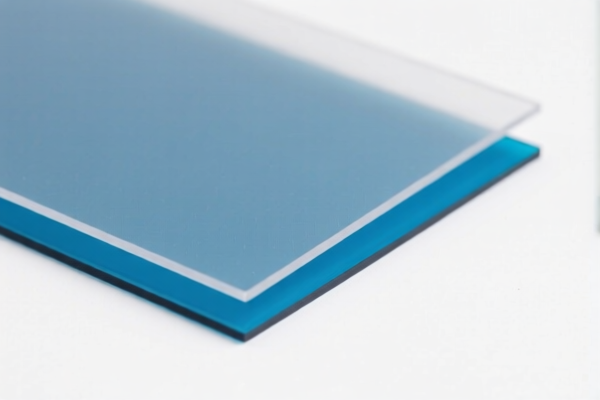

Product Name: PET Plastic Composite Sheet

Classification: Plastic composite materials, specifically PET (Polyethylene Terephthalate) composite sheets.

HS Code Analysis and Tax Overview:

✅ HS Code: 3920620090

Description: PET plastic composite film, classified as plastic sheets, films, foils, and strips made of PET, laminated, supported, or combined with other materials in a similar manner.

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This is the most likely classification for your PET composite sheet if it is laminated or combined with other materials.

- Be sure to confirm the exact composition and structure of the product to ensure correct classification.

📌 HS Code: 3915900010

Description: PET plastic composite waste, scrap, and offcuts, classified as waste and scrap of PET plastic.

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- This code applies to waste or scrap, not finished products.

- If your product is a finished composite sheet, this code is not applicable.

📌 HS Code: 3921905050

Description: Plastic composite sheets, classified as other plastic sheets, films, foils, and strips.

- Base Tariff Rate: 4.8%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Key Notes:

- This code is for general plastic composite sheets not covered by more specific categories.

- If your product is not laminated or combined with other materials, this may be a possible classification.

📌 HS Code: 3920100000

Description: Polyethylene composite sheets, classified as non-cellular, non-reinforced plastic sheets made of ethylene polymers, laminated or combined with other materials.

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code applies to polyethylene (PE) composite sheets, not PET.

- If your product is made of PE, this may be the correct classification.

📌 HS Code: 3920995000

Description: Composite plastic sheets, classified as non-cellular, non-reinforced plastic sheets laminated or combined with other materials.

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Key Notes:

- This is a general category for composite plastic sheets.

- If your product is not specifically PET or PE, this may be a fallback classification.

🚨 Important Alerts:

- April 11, 2025 Special Tariff: All the above codes are subject to an additional 30.0% tariff after April 11, 2025.

- Anti-dumping duties: Not applicable for plastic composite sheets unless specified by the importing country.

- Certifications: Ensure your product meets any required certifications (e.g., REACH, RoHS, or customs documentation).

✅ Proactive Advice:

- Verify Material Composition: Confirm whether your product is PET, PE, or another type of plastic.

- Check Unit Price and Structure: Laminated or combined materials may fall under different HS codes.

- Consult Customs Authority: For final classification, especially if the product is complex or has multiple layers.

- Plan for Tariff Increases: If importing after April 11, 2025, budget for the 30.0% additional tariff.

Let me know if you need help with customs documentation or classification confirmation.

Product Name: PET Plastic Composite Sheet

Classification: Plastic composite materials, specifically PET (Polyethylene Terephthalate) composite sheets.

HS Code Analysis and Tax Overview:

✅ HS Code: 3920620090

Description: PET plastic composite film, classified as plastic sheets, films, foils, and strips made of PET, laminated, supported, or combined with other materials in a similar manner.

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This is the most likely classification for your PET composite sheet if it is laminated or combined with other materials.

- Be sure to confirm the exact composition and structure of the product to ensure correct classification.

📌 HS Code: 3915900010

Description: PET plastic composite waste, scrap, and offcuts, classified as waste and scrap of PET plastic.

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- This code applies to waste or scrap, not finished products.

- If your product is a finished composite sheet, this code is not applicable.

📌 HS Code: 3921905050

Description: Plastic composite sheets, classified as other plastic sheets, films, foils, and strips.

- Base Tariff Rate: 4.8%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Key Notes:

- This code is for general plastic composite sheets not covered by more specific categories.

- If your product is not laminated or combined with other materials, this may be a possible classification.

📌 HS Code: 3920100000

Description: Polyethylene composite sheets, classified as non-cellular, non-reinforced plastic sheets made of ethylene polymers, laminated or combined with other materials.

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code applies to polyethylene (PE) composite sheets, not PET.

- If your product is made of PE, this may be the correct classification.

📌 HS Code: 3920995000

Description: Composite plastic sheets, classified as non-cellular, non-reinforced plastic sheets laminated or combined with other materials.

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Key Notes:

- This is a general category for composite plastic sheets.

- If your product is not specifically PET or PE, this may be a fallback classification.

🚨 Important Alerts:

- April 11, 2025 Special Tariff: All the above codes are subject to an additional 30.0% tariff after April 11, 2025.

- Anti-dumping duties: Not applicable for plastic composite sheets unless specified by the importing country.

- Certifications: Ensure your product meets any required certifications (e.g., REACH, RoHS, or customs documentation).

✅ Proactive Advice:

- Verify Material Composition: Confirm whether your product is PET, PE, or another type of plastic.

- Check Unit Price and Structure: Laminated or combined materials may fall under different HS codes.

- Consult Customs Authority: For final classification, especially if the product is complex or has multiple layers.

- Plan for Tariff Increases: If importing after April 11, 2025, budget for the 30.0% additional tariff.

Let me know if you need help with customs documentation or classification confirmation.

Customer Reviews

No reviews yet.