| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920620050 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920620050 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

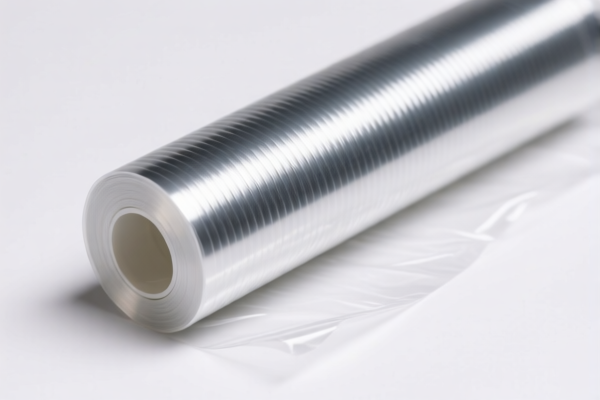

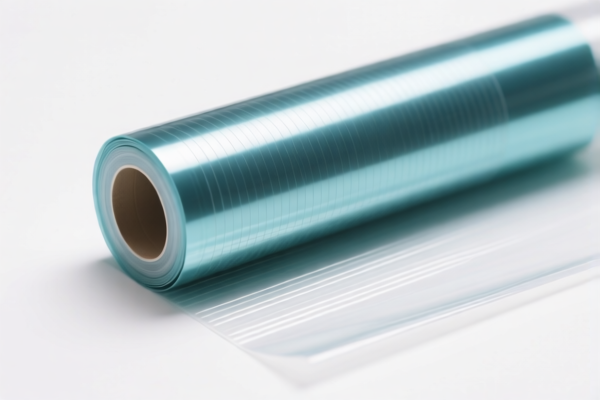

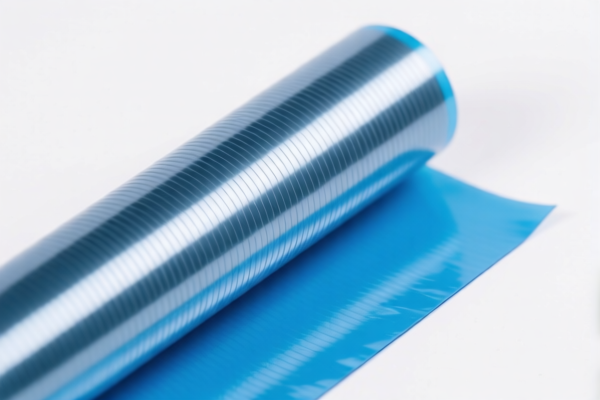

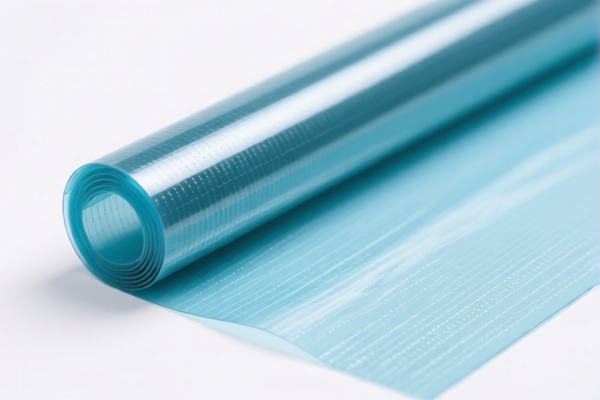

Product Classification: PET Plastic Conductive Film

HS CODE: 3920.62.00.90 or 3920.62.00.50 (depending on specific product type)

🔍 Classification Summary:

- 3920.62.00.90 applies to PET plastic conductive films that are laminated, supported, or combined with other materials (e.g., protective films, anti-static films, etc.).

- 3920.62.00.50 applies to metalized PET conductive films used for other purposes (e.g., metalized conductive protective films).

📊 Tariff Overview:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2% (4.2% + 25.0% + 30.0%)

⚠️ Note: The 30.0% additional tariff applies after April 11, 2025, and is likely related to anti-dumping or safeguard measures. Confirm with customs or a trade compliance expert for the exact reason.

📌 Key Considerations:

- Material Composition: Ensure the product is clearly defined as either metalized or non-metalized (e.g., conductive vs. anti-static).

- Usage Purpose: The classification may vary based on end-use (e.g., industrial, consumer electronics, packaging).

- Certifications: Check if any technical or safety certifications are required for import (e.g., RoHS, REACH, or specific industry standards).

- Unit Price: Verify the unit price and quantity to ensure correct classification and tax calculation.

✅ Proactive Advice:

- Confirm Product Description: Provide detailed product specifications (e.g., thickness, conductivity, metalization type) to customs.

- Check for Updates: Monitor any new trade policies or tariff adjustments after April 11, 2025.

- Consult Customs Broker: For complex or high-value shipments, consider engaging a customs broker or compliance expert.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Classification: PET Plastic Conductive Film

HS CODE: 3920.62.00.90 or 3920.62.00.50 (depending on specific product type)

🔍 Classification Summary:

- 3920.62.00.90 applies to PET plastic conductive films that are laminated, supported, or combined with other materials (e.g., protective films, anti-static films, etc.).

- 3920.62.00.50 applies to metalized PET conductive films used for other purposes (e.g., metalized conductive protective films).

📊 Tariff Overview:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2% (4.2% + 25.0% + 30.0%)

⚠️ Note: The 30.0% additional tariff applies after April 11, 2025, and is likely related to anti-dumping or safeguard measures. Confirm with customs or a trade compliance expert for the exact reason.

📌 Key Considerations:

- Material Composition: Ensure the product is clearly defined as either metalized or non-metalized (e.g., conductive vs. anti-static).

- Usage Purpose: The classification may vary based on end-use (e.g., industrial, consumer electronics, packaging).

- Certifications: Check if any technical or safety certifications are required for import (e.g., RoHS, REACH, or specific industry standards).

- Unit Price: Verify the unit price and quantity to ensure correct classification and tax calculation.

✅ Proactive Advice:

- Confirm Product Description: Provide detailed product specifications (e.g., thickness, conductivity, metalization type) to customs.

- Check for Updates: Monitor any new trade policies or tariff adjustments after April 11, 2025.

- Consult Customs Broker: For complex or high-value shipments, consider engaging a customs broker or compliance expert.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.