| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920620050 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920620020 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

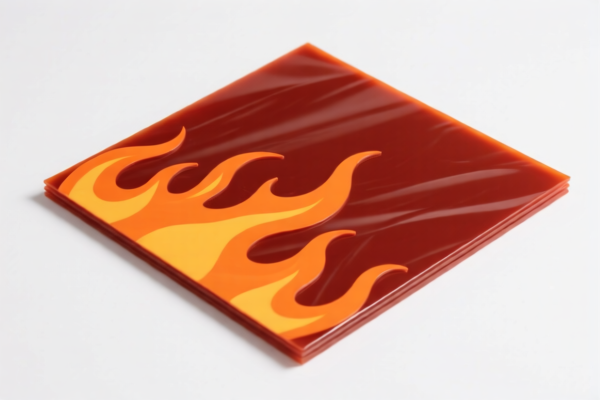

Product Classification and Customs Tariff Analysis for PET Plastic Flame Retardant Sheet

Based on the product description "PET Plastic Flame Retardant Sheet", the following HS codes and tariff details are relevant. Please note that the classification may vary depending on specific product attributes such as material composition, thickness, and intended use.

1. HS Code: 3920.62.00.90

Product Description:

- PET Plastic Flame Retardant Sheet

- PET Plastic UV-Resistant Sheet (as per the data)

Tariff Details:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

Notes: - This code is used for PET plastic sheets with flame retardant or UV-resistant properties. - Ensure the product is not metalized or not used for packaging (see other codes below).

2. HS Code: 3920.62.00.50

Product Description:

- PET Metalized Flame Retardant Film

Tariff Details:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

Notes: - This code applies to metalized PET films with flame retardant properties. - If your product is not metalized, this code is not applicable.

3. HS Code: 3921.90.50.50

Product Description:

- Plastic Flame Retardant Board

Tariff Details:

- Base Tariff Rate: 4.8%

- Additional Tariff (General): 0.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 34.8%

Notes: - This code is for plastic flame retardant boards, which are typically thicker and used in construction or industrial applications. - If your product is a sheet (thin), this code may not be applicable.

4. HS Code: 3920.62.00.20

Product Description:

- Metalized PET Film for Gift Packaging

Tariff Details:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

Notes: - This code is for metalized PET films used in gift packaging. - If your product is not for packaging, this code is not applicable.

Key Considerations and Recommendations:

- Verify Material and Unit Price: Confirm whether the product is metalized, used for packaging, or thicker (board vs. sheet).

- Check Certifications: Some products may require flame retardant certification or safety compliance documents.

- April 11, 2025, Special Tariff: Be aware that an additional 30% tariff will apply after this date for most of the above codes.

- Anti-Dumping Duties: Not applicable for plastic products, but always check for any anti-dumping or countervailing duties that may apply.

- Customs Declaration: Ensure the HS code matches the product description to avoid delays or penalties.

Proactive Advice:

- If in doubt, consult a customs broker or HS code classifier for confirmation.

- Keep product specifications and test reports ready for customs inspection.

- Monitor tariff updates after April 11, 2025, as they may affect your import costs significantly.

Product Classification and Customs Tariff Analysis for PET Plastic Flame Retardant Sheet

Based on the product description "PET Plastic Flame Retardant Sheet", the following HS codes and tariff details are relevant. Please note that the classification may vary depending on specific product attributes such as material composition, thickness, and intended use.

1. HS Code: 3920.62.00.90

Product Description:

- PET Plastic Flame Retardant Sheet

- PET Plastic UV-Resistant Sheet (as per the data)

Tariff Details:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

Notes: - This code is used for PET plastic sheets with flame retardant or UV-resistant properties. - Ensure the product is not metalized or not used for packaging (see other codes below).

2. HS Code: 3920.62.00.50

Product Description:

- PET Metalized Flame Retardant Film

Tariff Details:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

Notes: - This code applies to metalized PET films with flame retardant properties. - If your product is not metalized, this code is not applicable.

3. HS Code: 3921.90.50.50

Product Description:

- Plastic Flame Retardant Board

Tariff Details:

- Base Tariff Rate: 4.8%

- Additional Tariff (General): 0.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 34.8%

Notes: - This code is for plastic flame retardant boards, which are typically thicker and used in construction or industrial applications. - If your product is a sheet (thin), this code may not be applicable.

4. HS Code: 3920.62.00.20

Product Description:

- Metalized PET Film for Gift Packaging

Tariff Details:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

Notes: - This code is for metalized PET films used in gift packaging. - If your product is not for packaging, this code is not applicable.

Key Considerations and Recommendations:

- Verify Material and Unit Price: Confirm whether the product is metalized, used for packaging, or thicker (board vs. sheet).

- Check Certifications: Some products may require flame retardant certification or safety compliance documents.

- April 11, 2025, Special Tariff: Be aware that an additional 30% tariff will apply after this date for most of the above codes.

- Anti-Dumping Duties: Not applicable for plastic products, but always check for any anti-dumping or countervailing duties that may apply.

- Customs Declaration: Ensure the HS code matches the product description to avoid delays or penalties.

Proactive Advice:

- If in doubt, consult a customs broker or HS code classifier for confirmation.

- Keep product specifications and test reports ready for customs inspection.

- Monitor tariff updates after April 11, 2025, as they may affect your import costs significantly.

Customer Reviews

No reviews yet.