Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920620050 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 8534000070 | Doc | 55.0% | CN | US | 2025-05-12 |

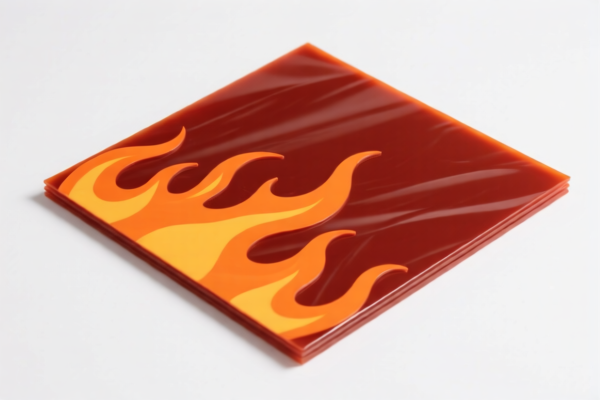

Here is the structured analysis and classification for the PET Plastic Flame Retardant Strip based on the provided HS codes and tariff details:

🔍 HS Code Classification Overview

1. HS CODE: 3920620090

- Product Description: PET Plastic Flame Retardant Sheet

- Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Notes:

- This code is suitable for PET-based flame retardant sheets.

- Ensure the product is not metalized or not classified under other categories like 3920.62.00.20.

2. HS CODE: 3920620050

- Product Description: PET Metalized Flame Retardant Film

- Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Notes:

- This code applies to metalized PET flame retardant films.

- Confirm the metalization process and material composition to avoid misclassification.

3. HS CODE: 3921905050

- Product Description: Flame Retardant Plastic Board

- Tariff Summary:

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Notes:

- This code is for general plastic flame retardant boards.

- Lower tax rate compared to other codes, but only applicable if the product is not PET-based or not classified under 3920.

4. HS CODE: 3920995000

- Product Description: Flame Retardant Plastic Sheet (Other)

- Tariff Summary:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Notes:

- This is a catch-all code for other plastic flame retardant sheets not covered by more specific codes.

- Use this only if the product does not match the description of 3920620090 or 3920620050.

5. HS CODE: 8534000070

- Product Description: Flame Retardant Plastic Board Used in Printed Circuit Boards (Non-Flexible)

- Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes:

- This code applies to flame retardant plastic boards used in circuit boards.

- Ensure the product is used in electronics and not a standalone material.

📌 Key Recommendations

- Verify Material Composition: Confirm whether the product is PET-based, metalized, or general plastic to choose the correct HS code.

- Check Unit Price and Certification: Some HS codes may require technical specifications or certifications (e.g., flame retardancy test reports).

- Watch for April 11, 2025 Tariff Changes: All listed codes will be subject to an additional 30% tariff after this date.

- Avoid Misclassification: Incorrect HS code selection may lead to customs delays, additional duties, or product seizure.

✅ Proactive Action Checklist

- [ ] Confirm the material type (PET, metalized, general plastic).

- [ ] Verify if the product is used in electronics or standalone.

- [ ] Check if flame retardancy certification is required.

- [ ] Review product specifications and technical documentation.

- [ ] Update tariff planning for the April 11, 2025 deadline.

Let me know if you need help with certification requirements or customs documentation. Here is the structured analysis and classification for the PET Plastic Flame Retardant Strip based on the provided HS codes and tariff details:

🔍 HS Code Classification Overview

1. HS CODE: 3920620090

- Product Description: PET Plastic Flame Retardant Sheet

- Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Notes:

- This code is suitable for PET-based flame retardant sheets.

- Ensure the product is not metalized or not classified under other categories like 3920.62.00.20.

2. HS CODE: 3920620050

- Product Description: PET Metalized Flame Retardant Film

- Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Notes:

- This code applies to metalized PET flame retardant films.

- Confirm the metalization process and material composition to avoid misclassification.

3. HS CODE: 3921905050

- Product Description: Flame Retardant Plastic Board

- Tariff Summary:

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Notes:

- This code is for general plastic flame retardant boards.

- Lower tax rate compared to other codes, but only applicable if the product is not PET-based or not classified under 3920.

4. HS CODE: 3920995000

- Product Description: Flame Retardant Plastic Sheet (Other)

- Tariff Summary:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Notes:

- This is a catch-all code for other plastic flame retardant sheets not covered by more specific codes.

- Use this only if the product does not match the description of 3920620090 or 3920620050.

5. HS CODE: 8534000070

- Product Description: Flame Retardant Plastic Board Used in Printed Circuit Boards (Non-Flexible)

- Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes:

- This code applies to flame retardant plastic boards used in circuit boards.

- Ensure the product is used in electronics and not a standalone material.

📌 Key Recommendations

- Verify Material Composition: Confirm whether the product is PET-based, metalized, or general plastic to choose the correct HS code.

- Check Unit Price and Certification: Some HS codes may require technical specifications or certifications (e.g., flame retardancy test reports).

- Watch for April 11, 2025 Tariff Changes: All listed codes will be subject to an additional 30% tariff after this date.

- Avoid Misclassification: Incorrect HS code selection may lead to customs delays, additional duties, or product seizure.

✅ Proactive Action Checklist

- [ ] Confirm the material type (PET, metalized, general plastic).

- [ ] Verify if the product is used in electronics or standalone.

- [ ] Check if flame retardancy certification is required.

- [ ] Review product specifications and technical documentation.

- [ ] Update tariff planning for the April 11, 2025 deadline.

Let me know if you need help with certification requirements or customs documentation.

Customer Reviews

No reviews yet.