| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920620050 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

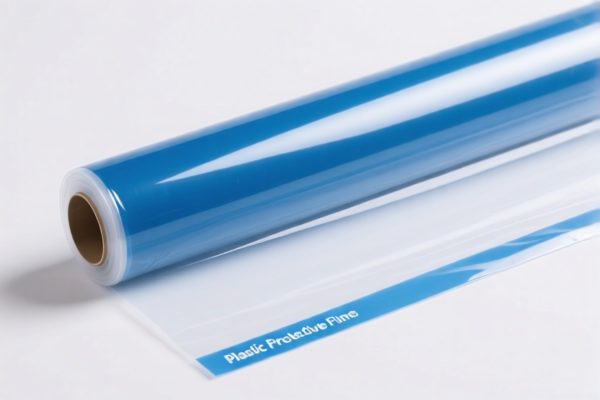

Here is the structured classification and tariff information for the PET Plastic Frosted Protective Film based on the provided HS codes:

✅ HS CODE: 3920620050

Product Description: PET metallized frosted film, for other uses (e.g., metallized PET films not used in packaging or electrical applications).

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is suitable if the product is metallized and used for non-packaging or non-electrical purposes.

✅ HS CODE: 3920620090

Product Description: PET plastic frosted sheets, protective films, screen protectors, etc., for laminated, supported, or combined with other materials.

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is suitable if the product is not metallized and is used as a protective film or combined with other materials (e.g., laminated with other films or substrates).

✅ HS CODE: 3921905050

Product Description: PET plastic protective film, for other plastic sheets, films, foils, and strips.

Total Tax Rate: 34.8%

Tariff Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is suitable if the product is a simple PET film used as a protective film without metallization or combination with other materials.

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All three codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm whether the product is metallized or non-metallized, and whether it is combined with other materials (e.g., laminated with glass or other films).

- Certifications: Check if any customs certifications or product compliance documents (e.g., material safety data sheets, technical specifications) are required for import.

- Unit Price: Verify the unit price and product description to ensure accurate classification and avoid misclassification penalties.

📌 Proactive Advice:

- If the product is not metallized and is used as a simple protective film, 3921905050 may offer a lower overall tax rate (34.8% vs. 59.2%).

- If the product is metallized or combined with other materials, use 3920620050 or 3920620090 accordingly.

- Always consult with customs authorities or a qualified customs broker for final confirmation, especially if the product has special features or custom specifications. Here is the structured classification and tariff information for the PET Plastic Frosted Protective Film based on the provided HS codes:

✅ HS CODE: 3920620050

Product Description: PET metallized frosted film, for other uses (e.g., metallized PET films not used in packaging or electrical applications).

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is suitable if the product is metallized and used for non-packaging or non-electrical purposes.

✅ HS CODE: 3920620090

Product Description: PET plastic frosted sheets, protective films, screen protectors, etc., for laminated, supported, or combined with other materials.

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is suitable if the product is not metallized and is used as a protective film or combined with other materials (e.g., laminated with other films or substrates).

✅ HS CODE: 3921905050

Product Description: PET plastic protective film, for other plastic sheets, films, foils, and strips.

Total Tax Rate: 34.8%

Tariff Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is suitable if the product is a simple PET film used as a protective film without metallization or combination with other materials.

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All three codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm whether the product is metallized or non-metallized, and whether it is combined with other materials (e.g., laminated with glass or other films).

- Certifications: Check if any customs certifications or product compliance documents (e.g., material safety data sheets, technical specifications) are required for import.

- Unit Price: Verify the unit price and product description to ensure accurate classification and avoid misclassification penalties.

📌 Proactive Advice:

- If the product is not metallized and is used as a simple protective film, 3921905050 may offer a lower overall tax rate (34.8% vs. 59.2%).

- If the product is metallized or combined with other materials, use 3920620050 or 3920620090 accordingly.

- Always consult with customs authorities or a qualified customs broker for final confirmation, especially if the product has special features or custom specifications.

Customer Reviews

No reviews yet.