| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 4202291000 | Doc | 60.3% | CN | US | 2025-05-12 |

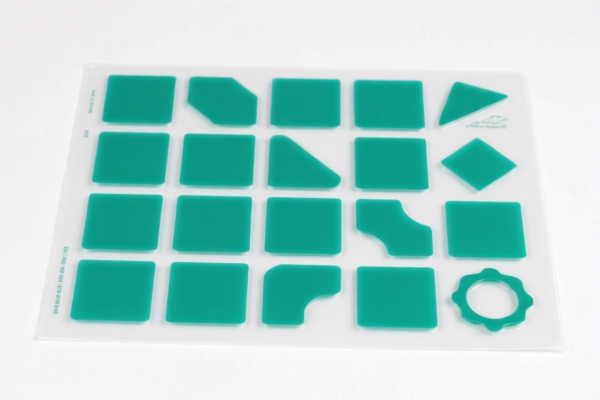

Here is the structured classification and tariff information for the PET Plastic Handicraft Packaging Sheet, based on the provided HS codes and tax details:

✅ HS CODE: 3920620090

Product Description: PET Plastic Handicraft Packaging Film

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Key Notes: - This code applies to PET (Polyethylene Terephthalate) films that are laminated, supported, or combined with other materials. - Applicable for: Packaging films used in handicrafts, with layered or composite structures. - Alert: The 30.0% additional tariff applies after April 11, 2025 — ensure compliance with updated regulations.

✅ HS CODE: 3921904090

Product Description: Plastic Handicraft Packaging Film

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

Key Notes: - This code covers plastic sheets, films, and foils used for packaging, including but not limited to handicrafts. - Applicable for: General-purpose plastic packaging films, not specifically layered or combined with other materials. - Alert: The 30.0% additional tariff applies after April 11, 2025 — ensure compliance with updated regulations.

✅ HS CODE: 4202291000

Product Description: Plastic Handbag Packaging Bag

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Key Notes: - This code applies to plastic handbags that are completely or mainly covered with plastic sheets, not made of leather, synthetic leather, or textiles. - Applicable for: Handbags used for packaging or carrying handicraft items. - Alert: The 30.0% additional tariff applies after April 11, 2025 — ensure compliance with updated regulations.

📌 Proactive Advice for Users:

- Verify Material Composition: Confirm whether the product is pure PET, layered, or combined with other materials, as this determines the correct HS code.

- Check Unit Price and Packaging: If the product is sold as a handbag, it may fall under 4202291000 rather than a film or sheet.

- Certifications Required: Ensure compliance with customs documentation, product standards, and import permits if applicable.

- Monitor Tariff Changes: The 30.0% additional tariff after April 11, 2025 is time-sensitive — plan accordingly for cost estimation and compliance.

Let me know if you need help determining the most accurate HS code based on your product specifications. Here is the structured classification and tariff information for the PET Plastic Handicraft Packaging Sheet, based on the provided HS codes and tax details:

✅ HS CODE: 3920620090

Product Description: PET Plastic Handicraft Packaging Film

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Key Notes: - This code applies to PET (Polyethylene Terephthalate) films that are laminated, supported, or combined with other materials. - Applicable for: Packaging films used in handicrafts, with layered or composite structures. - Alert: The 30.0% additional tariff applies after April 11, 2025 — ensure compliance with updated regulations.

✅ HS CODE: 3921904090

Product Description: Plastic Handicraft Packaging Film

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

Key Notes: - This code covers plastic sheets, films, and foils used for packaging, including but not limited to handicrafts. - Applicable for: General-purpose plastic packaging films, not specifically layered or combined with other materials. - Alert: The 30.0% additional tariff applies after April 11, 2025 — ensure compliance with updated regulations.

✅ HS CODE: 4202291000

Product Description: Plastic Handbag Packaging Bag

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Key Notes: - This code applies to plastic handbags that are completely or mainly covered with plastic sheets, not made of leather, synthetic leather, or textiles. - Applicable for: Handbags used for packaging or carrying handicraft items. - Alert: The 30.0% additional tariff applies after April 11, 2025 — ensure compliance with updated regulations.

📌 Proactive Advice for Users:

- Verify Material Composition: Confirm whether the product is pure PET, layered, or combined with other materials, as this determines the correct HS code.

- Check Unit Price and Packaging: If the product is sold as a handbag, it may fall under 4202291000 rather than a film or sheet.

- Certifications Required: Ensure compliance with customs documentation, product standards, and import permits if applicable.

- Monitor Tariff Changes: The 30.0% additional tariff after April 11, 2025 is time-sensitive — plan accordingly for cost estimation and compliance.

Let me know if you need help determining the most accurate HS code based on your product specifications.

Customer Reviews

No reviews yet.