| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920620050 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920200020 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

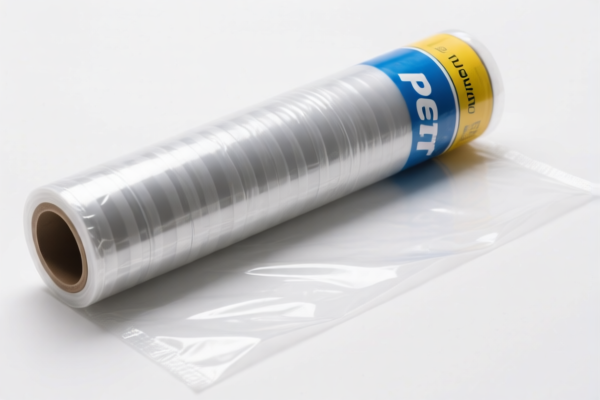

Product Classification and Tax Information for PET Plastic Heat Shrink Packaging Film

Below is the detailed classification and tariff information for the declared product PET Plastic Heat Shrink Packaging Film, based on the provided HS codes and tax details:

HS CODE: 3920.62.00.90

Product Description:

- PET Plastic Heat Shrink Packaging Film (for general use, food, or industrial applications)

- Includes: PET plastic food packaging film, PET plastic industrial packaging film, and general-purpose PET heat shrink film

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

HS CODE: 3920.62.00.50

Product Description:

- PET Metalized Heat Shrink Film (used for specialized packaging applications)

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

HS CODE: 3920.20.00.20

Product Description:

- PP Plastic Heat Shrink Packaging Film (polypropylene-based)

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

Key Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for this product category. However, it is advisable to verify if any anti-dumping measures are currently in effect for PET or PP-based packaging films. -

Material and Certification Requirements:

- Confirm the material composition (e.g., PET, PP, metalized) and intended use (food, industrial, etc.) to ensure correct HS code classification.

-

Check if certifications (e.g., food-grade, safety standards) are required for export or import, depending on the destination country.

-

Unit Price and Tax Calculation:

- Verify the unit price and quantity for accurate tax calculation.

- Be aware that the total tax rate of 59.2% applies to all the listed HS codes, but the base rate is only 4.2%, with the rest being additional tariffs.

Proactive Advice:

- Double-check the product description to ensure it matches the HS code used.

- Consult with customs brokers or import/export agents for the most up-to-date tariff information and compliance requirements.

- Monitor policy updates after April 11, 2025, as the special tariff may change or be extended.

Let me know if you need help with HS code verification or customs documentation.

Product Classification and Tax Information for PET Plastic Heat Shrink Packaging Film

Below is the detailed classification and tariff information for the declared product PET Plastic Heat Shrink Packaging Film, based on the provided HS codes and tax details:

HS CODE: 3920.62.00.90

Product Description:

- PET Plastic Heat Shrink Packaging Film (for general use, food, or industrial applications)

- Includes: PET plastic food packaging film, PET plastic industrial packaging film, and general-purpose PET heat shrink film

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

HS CODE: 3920.62.00.50

Product Description:

- PET Metalized Heat Shrink Film (used for specialized packaging applications)

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

HS CODE: 3920.20.00.20

Product Description:

- PP Plastic Heat Shrink Packaging Film (polypropylene-based)

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

Key Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for this product category. However, it is advisable to verify if any anti-dumping measures are currently in effect for PET or PP-based packaging films. -

Material and Certification Requirements:

- Confirm the material composition (e.g., PET, PP, metalized) and intended use (food, industrial, etc.) to ensure correct HS code classification.

-

Check if certifications (e.g., food-grade, safety standards) are required for export or import, depending on the destination country.

-

Unit Price and Tax Calculation:

- Verify the unit price and quantity for accurate tax calculation.

- Be aware that the total tax rate of 59.2% applies to all the listed HS codes, but the base rate is only 4.2%, with the rest being additional tariffs.

Proactive Advice:

- Double-check the product description to ensure it matches the HS code used.

- Consult with customs brokers or import/export agents for the most up-to-date tariff information and compliance requirements.

- Monitor policy updates after April 11, 2025, as the special tariff may change or be extended.

Let me know if you need help with HS code verification or customs documentation.

Customer Reviews

No reviews yet.