| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

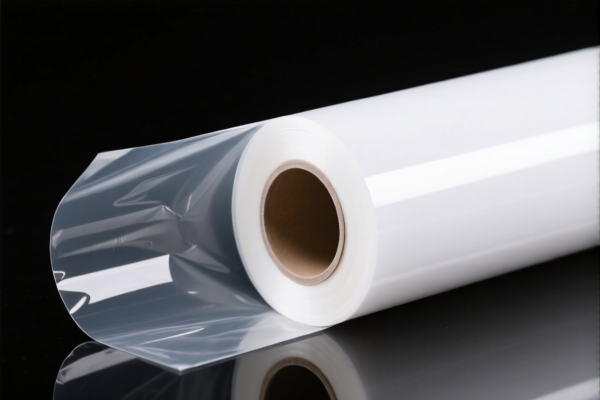

Product Name: PET Plastic Label Film

Classification HS Code:

- 3920.62.00.90 (for PET plastic label materials, food packaging films, printed films, protective films, etc., that are laminated, supported, or combined with other materials)

- 3920.99.20.00 (for non-cellular, non-reinforced, non-laminated plastic sheets, films, foils, and strips, not otherwise specified)

🔍 Key Classification Notes:

- 3920.62.00.90 applies to PET films that are combined with other materials (e.g., laminated, supported, or layered).

- 3920.99.20.00 applies to PET films that are not combined with other materials (i.e., standalone, non-laminated, non-reinforced).

📊 Tariff Overview (as of now):

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2% (4.2% + 25.0% + 30.0%)

⚠️ Important Policy Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a time-sensitive policy and may significantly increase the total import cost.

- No Anti-dumping duties currently reported for this product category.

- No specific anti-dumping duties on iron or aluminum are applicable here, as this is a plastic product.

📌 Proactive Advice for Importers:

- Verify the material composition of the PET film (e.g., whether it is laminated or standalone) to ensure correct HS code classification.

- Check the unit price and total value of the goods, as this may affect the applicability of certain tariffs or exemptions.

- Confirm required certifications (e.g., food-grade, environmental compliance, etc.) if the product is intended for food packaging or sensitive applications.

- Monitor policy updates after April 11, 2025, as the special tariff will take effect and may require adjustments in pricing or sourcing strategies.

Let me know if you need help with customs documentation or further classification details.

Product Name: PET Plastic Label Film

Classification HS Code:

- 3920.62.00.90 (for PET plastic label materials, food packaging films, printed films, protective films, etc., that are laminated, supported, or combined with other materials)

- 3920.99.20.00 (for non-cellular, non-reinforced, non-laminated plastic sheets, films, foils, and strips, not otherwise specified)

🔍 Key Classification Notes:

- 3920.62.00.90 applies to PET films that are combined with other materials (e.g., laminated, supported, or layered).

- 3920.99.20.00 applies to PET films that are not combined with other materials (i.e., standalone, non-laminated, non-reinforced).

📊 Tariff Overview (as of now):

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2% (4.2% + 25.0% + 30.0%)

⚠️ Important Policy Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a time-sensitive policy and may significantly increase the total import cost.

- No Anti-dumping duties currently reported for this product category.

- No specific anti-dumping duties on iron or aluminum are applicable here, as this is a plastic product.

📌 Proactive Advice for Importers:

- Verify the material composition of the PET film (e.g., whether it is laminated or standalone) to ensure correct HS code classification.

- Check the unit price and total value of the goods, as this may affect the applicability of certain tariffs or exemptions.

- Confirm required certifications (e.g., food-grade, environmental compliance, etc.) if the product is intended for food packaging or sensitive applications.

- Monitor policy updates after April 11, 2025, as the special tariff will take effect and may require adjustments in pricing or sourcing strategies.

Let me know if you need help with customs documentation or further classification details.

Customer Reviews

No reviews yet.