| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3915900010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920620050 | Doc | 59.2% | CN | US | 2025-05-12 |

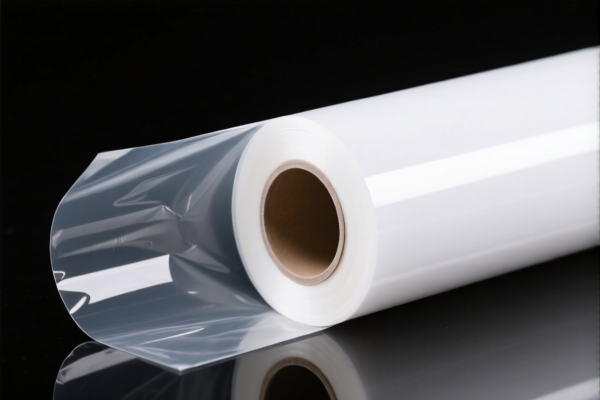

Product Name: PET Plastic Laminating Film

Classification HS Codes and Tax Details:

✅ HS CODE: 3920620090

Description: PET plastic composite film, protective film, reflective film, etc., laminated, supported, or combined with other materials in a similar manner.

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code is suitable for PET films that are laminated or combined with other materials.

- High total tax rate due to both base and additional tariffs.

- Proactive Advice: Confirm the product's exact composition and whether it is laminated with other materials (e.g., metal, paper, etc.).

✅ HS CODE: 3915900010

Description: PET plastic waste, scrap, and碎料, classified as polyethylene terephthalate (PET) plastic.

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- This code applies to waste or scrap of PET plastic, not finished products.

- No base tariff, but high additional tariffs apply.

- Proactive Advice: Ensure the product is not a finished film or composite product, but actual waste or scrap.

✅ HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils, and strips, for use in PET plastic protective films, etc.

- Base Tariff Rate: 4.8%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Key Notes:

- This code is for other plastics used in protective films, not specifically PET.

- Lower total tax rate due to no general additional tariff.

- Proactive Advice: Confirm the material is not PET and is used for protective film applications.

✅ HS CODE: 3920620050

Description: PET metallized composite film, classified as metallized polyethylene terephthalate (PET) film.

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code is for metallized PET film, which is a specific type of composite film.

- High total tax rate due to base and additional tariffs.

- Proactive Advice: Confirm if the film is metallized (e.g., with aluminum layer) and its intended use.

📌 Important Reminders:

- April 11, 2025 Special Tariff: All four codes are subject to an additional 30.0% tariff after April 11, 2025.

- Anti-dumping duties: Not applicable for this product category.

- Certifications: Ensure proper documentation (e.g., material composition, origin, and product use) to avoid misclassification.

- Unit Price: Verify the unit price and product description to match the correct HS code.

Let me know if you need help with customs documentation or classification confirmation.

Product Name: PET Plastic Laminating Film

Classification HS Codes and Tax Details:

✅ HS CODE: 3920620090

Description: PET plastic composite film, protective film, reflective film, etc., laminated, supported, or combined with other materials in a similar manner.

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code is suitable for PET films that are laminated or combined with other materials.

- High total tax rate due to both base and additional tariffs.

- Proactive Advice: Confirm the product's exact composition and whether it is laminated with other materials (e.g., metal, paper, etc.).

✅ HS CODE: 3915900010

Description: PET plastic waste, scrap, and碎料, classified as polyethylene terephthalate (PET) plastic.

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- This code applies to waste or scrap of PET plastic, not finished products.

- No base tariff, but high additional tariffs apply.

- Proactive Advice: Ensure the product is not a finished film or composite product, but actual waste or scrap.

✅ HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils, and strips, for use in PET plastic protective films, etc.

- Base Tariff Rate: 4.8%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Key Notes:

- This code is for other plastics used in protective films, not specifically PET.

- Lower total tax rate due to no general additional tariff.

- Proactive Advice: Confirm the material is not PET and is used for protective film applications.

✅ HS CODE: 3920620050

Description: PET metallized composite film, classified as metallized polyethylene terephthalate (PET) film.

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code is for metallized PET film, which is a specific type of composite film.

- High total tax rate due to base and additional tariffs.

- Proactive Advice: Confirm if the film is metallized (e.g., with aluminum layer) and its intended use.

📌 Important Reminders:

- April 11, 2025 Special Tariff: All four codes are subject to an additional 30.0% tariff after April 11, 2025.

- Anti-dumping duties: Not applicable for this product category.

- Certifications: Ensure proper documentation (e.g., material composition, origin, and product use) to avoid misclassification.

- Unit Price: Verify the unit price and product description to match the correct HS code.

Let me know if you need help with customs documentation or classification confirmation.

Customer Reviews

No reviews yet.